Quantum-readiness for the financial system: a roadmap

The ability of quantum computers to break today’s cryptographic algorithms represents an imminent threat to the financial system. This requires urgent action. Due to the long-term sensitivity of financial data, vulnerable cryptography must be replaced by new, quantum-safe solutions well before quantum computers reach maturity.

Quantum computers may in the future break today’s widely used encryption. This paper provides a framework to support the financial system in the transition to quantum-safe cryptographic infrastructures. It emphasises the need to start the transition today – with broad awareness and cryptographic inventory as critical foundations.

„While post-quantum cryptography offers a viable near-term solution, implementation challenges – including performance trade-offs and system integration – require coordinated planning. We caution against regarding this change as simple algorithm replacement.” – explained the authors of the report.

Ensuring the continued security and resilience of the global financial system may involve cryptographic agility, defence in depth, hybrid models and phased migration. Quantum key distribution may hold long-term potential, but several national security agencies note that it still faces infrastructure challenges that limit its immediate applicability.

Quantum computers may offer opportunities for innovation as they can solve certain classes of problems better than classical computers. At the same time, they pose a significant threat to the global financial system due to their expected ability to break some of the encryption methods that are widely used in today’s financial systems.

While small-scale quantum computers exist today, the timeline for the appearance of a cryptographically relevant quantum computer (CRQC), ie a computer capable of compromising current public key cryptography, remains uncertain.

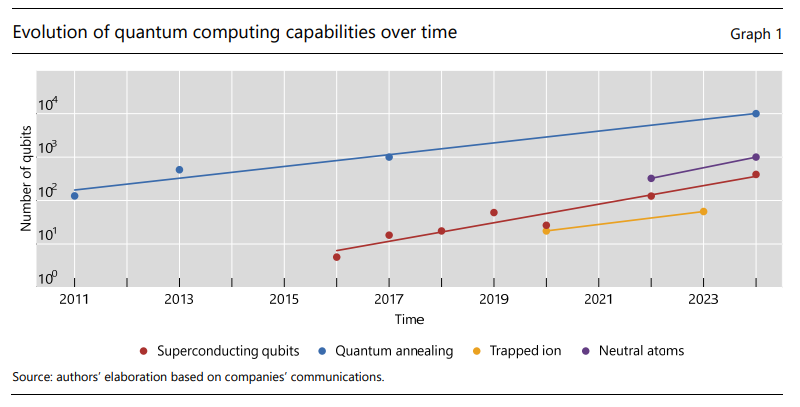

However, if current trends continue, a CRQC may be realised as soon as in the next decade (Graph 1). Each year, the Global Risk Institute releases the Quantum threat timeline report, which synthesises the insights of leading experts on the current state of quantum computing and the threat it poses for cyber security. The 2024 report indicates that 27% of experts expect the emergence of a CRQC to take place within 10 years and 50% expect it within the next 15 years.

What authors said: „We note that the dangers posed by quantum computers are more imminent than their development horizon. Risks to data confidentiality, integrity and authentication extend to data harvested today, intended to be decrypted later – a scenario termed “harvest now, decrypt later”. Given this uncertainty and the complexity involved in migrating cryptographic infrastructures, organisations must urgently initiate preparations today. Cyber incidents within the financial system can threaten global stability, making cybersecurity a critical concern for central banks and financial institutions.”

Quantum-readiness roadmap

Step 1 – Awareness

Step 2 – Planning

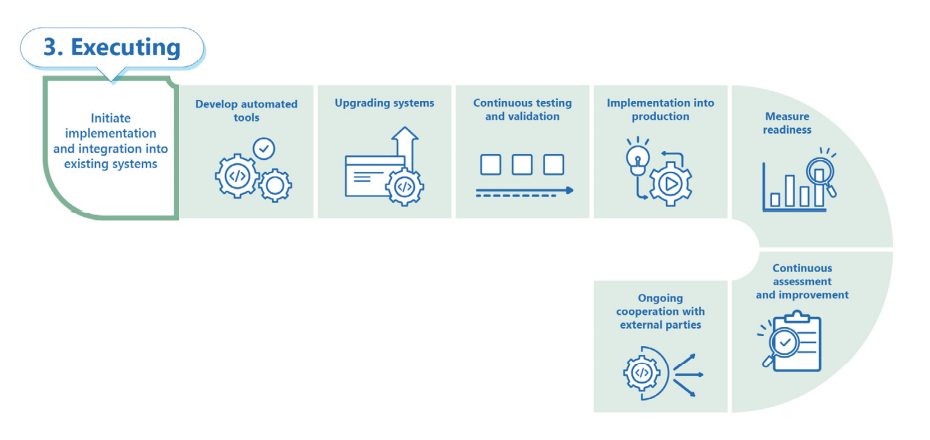

Step 3 – Executing

More details here:

BIS Papers No 158, Quantum-readiness for the financial system: a roadmap

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: