Juniper Research to announces the launch of the Consumer Payments Tech Horizon 2025.

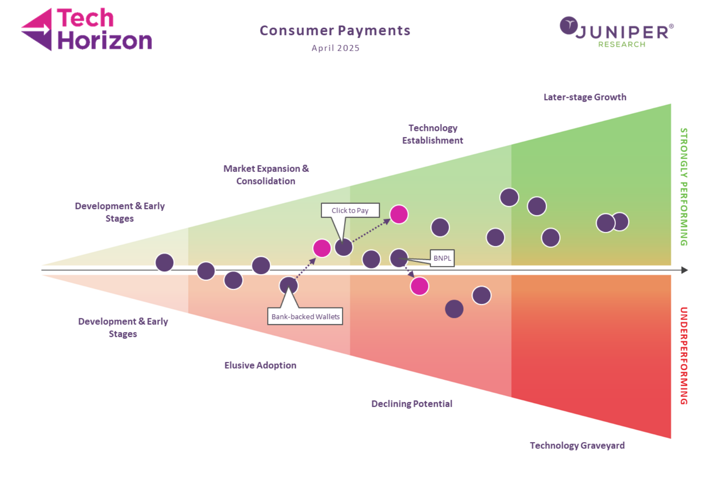

This free resource independently assesses how 17 consumer payments technologies, from Click to Pay to Biometric-equipped Terminals, are evolving; providing the industry with an invaluable guide to their long-term market prospects. Juniper Research positions each technology as either ‘above the line’ or ‘below the line’, dependent on whether their analysts believe it is meeting or failing expectations.

„From the evolution of digital wallets, the endurance of cards, to the emergence of CBDCs, the way consumers pay is shifting rapidly around the world. Our subscription goes beyond the headlines to decode what’s changing, why it matters, and where the next wave of opportunity lies.” – said the authors of the report.

Rising and Falling Stars of Consumer Payments

As part of the report, Juniper expert analysts have identified three ‘Major Movers’ in the consumer payments market; ranked by their anticipated change in market performance this year. These are:

These technologies are projected to experience considerable change in market position over the next year; Bank-backed wallets and Click to Pay are expected to significantly challenge incumbent digital wallets, whereas BNPL will underperform.

Click to Pay, an eCommerce one-click checkout solution launched by EMVCo in 2019, is expected to be established quickly in the consumer payments market. By the end of 2025, all deadlines for issuer implementation of Click to Pay will have passed and the technology will be widely seen at checkouts. By fast-tracking issuer adoption, card networks have already overcome a key hurdle for digital wallets attempting to launch; priming it for success.

Lorien Carter – Research Analyst at Juniper Research remarked: “Although BNPL is currently positioned above the line, market saturation and regulatory pressures will drive BNPL below the line over the next year. In response, smaller BNPL providers may exit the market or be acquired. To remain competitive, Juniper Research recommends that larger players proactively engage regulators as consumer protection laws expand to cover the sector.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: