Users of the YouBRD mobile application are up 19%, YoY at the end of March 2025. At the same time, the BRD branch network is down by more than 8%.

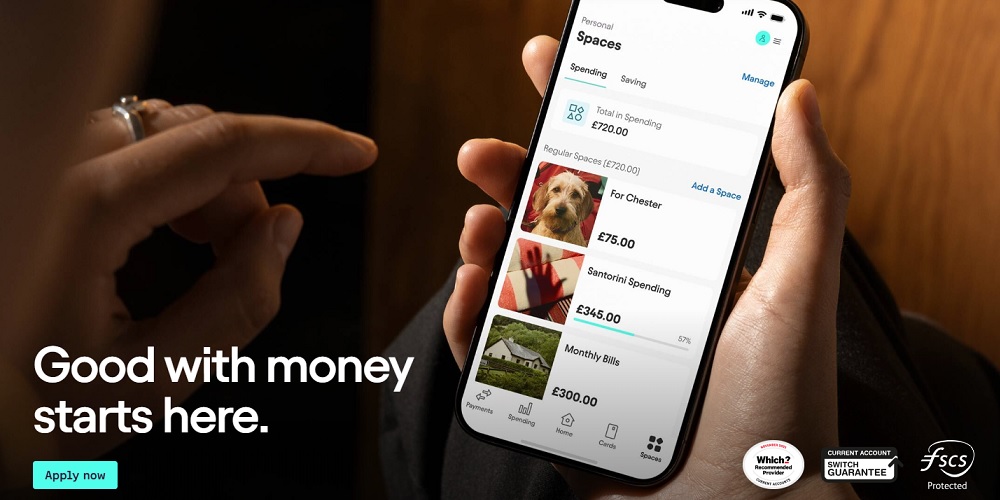

BRD reports that the clients’ digital interaction continues to rise, as reflected by the growing number of YouBRD mobile application users and higher number of transactions done through the application.

„YouBRD, our mobile banking application is growing both in the number of users (1.76 million, +19% YoY) and transactions (8.6 million, +20% YoY).” – said Maria ROUSSEVA – CEO of BRD Groupe Société Générale.

Also, the functionalities of YouBRD are constantly enriched. Providing extended range of products available for visualization for authorized natural (including now, deposits, savings and current accounts, lending products) and increased transfer limit for both individuals and authorized natural persons customers segments, „YouBRD is offering greater flexibility and convenience in managing financial transactions” – the bank said.

The cashback loyalty program available in YouBRD introduced in June 2024, enjoys a higher penetration rate, with almost 750K clients enrolled in the program as of March 2025 end and RON 2.3 million granted in cashback to BRD customers since launch.

Also, BRD ensures the availability of its products and services through a mix of on-site and remote presence. As at March 31, 2025, the Bank’s network reached 358 branches (vs. 391 as of March 31, 2024) and an increasing number of 24/7 self service areas, covering more than 60% of its network (217 vs. 201 as of March 31, 2024).

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: