The valuation gap between 🇪🇺 Europe and the 🇺🇸 US across public fintech markets is huge and very visible, according to a Multiples analysis. When it cames to global market capitalization of the fintech companies that are acting in different sectors, US dominates Europe at every segment except one: lead generation / brokers.

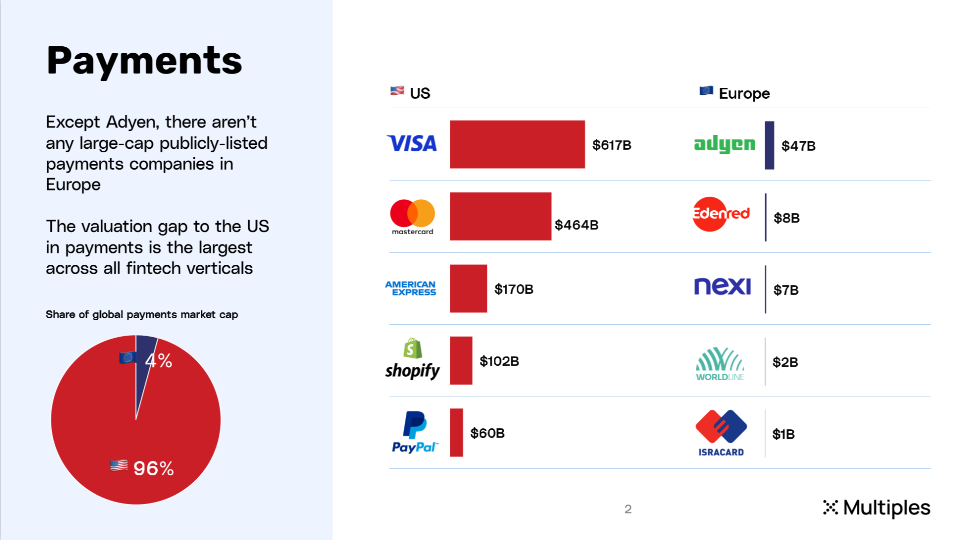

Payments: 96% (!) of all market cap is based in the US, mostly due to card networks (🇺🇸 Visa, 🇺🇸 Mastercard) and big platforms like 🇺🇸 PayPal or 🇨🇦🇺🇸 Shopify. Europe has only one (but a great one!) large-cap payment company 🇳🇱 Adyen

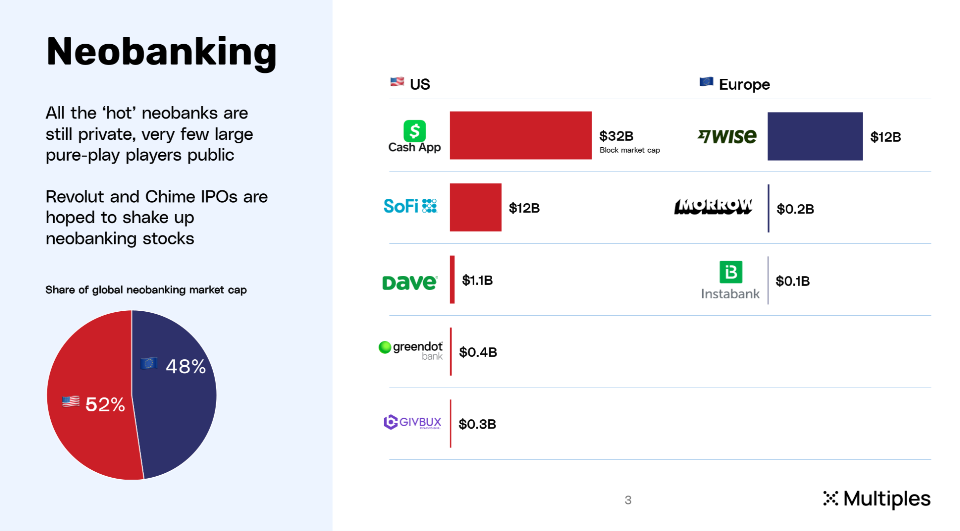

🏛️ Neobanking: very few publicly listed neobanking stocks, 🇬🇧 Wise being the only large pure-play digital bank. The world is waiting for 🇬🇧 Revolut and 🇺🇸 Chime IPOs!

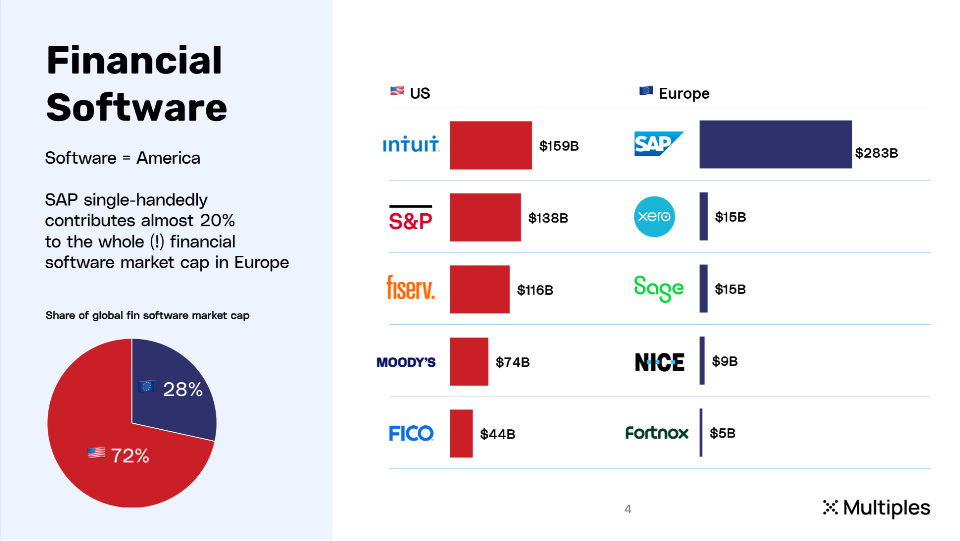

🖥️ Software: 🇩🇪 SAP (worth nearly $300B) carries Europe’s financial software industry that otherwise massively lags behind the US (72% vs. 28% market cap share)

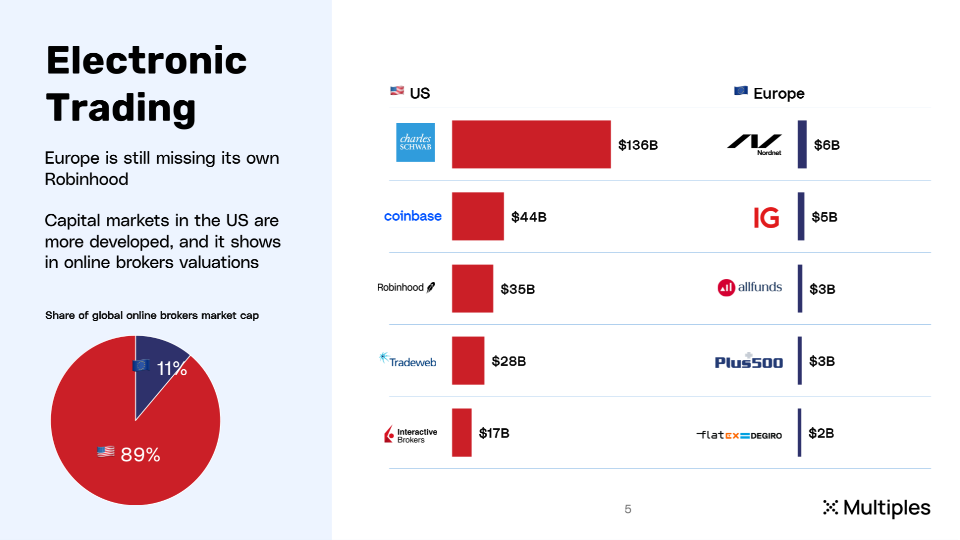

📊 Trading: all leading online brokers like 🇺🇸 Charles Schwab, 🇺🇸 Robinhood, 🇺🇸 Coinbase or 🇺🇸 Interactive Brokers are based in the US and there are no comparable peers (size-wise) in Europe – only mid-cap players like 🇸🇪 Nordnet Bank AB, 🇬🇧 IG, 🇬🇧 Allfunds or 🇬🇧 Plus500™

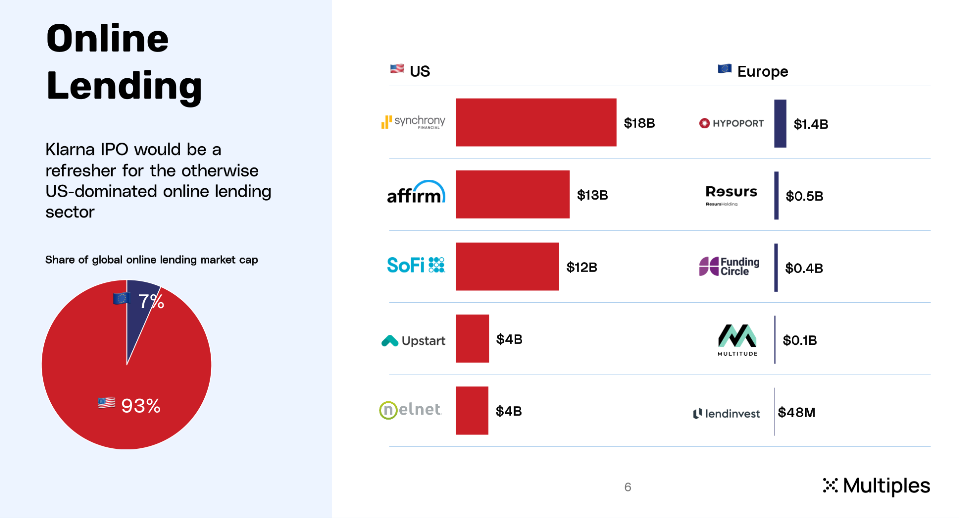

💰 Lending: fully dominated by America (93% market cap) but Europe is waiting for the 🇸🇪 Klarna IPO to rival US-based 🇺🇸 Affirm

📑 Lead Generation / Brokers: here Europe shines (64% market cap), plenty of great mid-cap platforms (🇮🇹 Moltiply Group, 🇩🇪 Hypoport SE, 🇸🇪 CDON, 🇫🇮 Multitude), with the overall market significantly bigger than in the US.

Multiples is a valuation data platform, built for VCs, PEs and other financial services professionals.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: