bunq completes first phase of US banking license filing as it reports its second consecutive year of profits

Breaking into the US: bunq has filed for a broker-dealer license, fast-tracking its much-anticipated entry into the US market. This move marks the first step in a two-phase strategy, with bunq set to refile for a full banking license later this year.

65% surge in profits: As revealed in its annual accounts filed today, bunq’s net profit soared to €85.3 million in 2024 (a 65% jump from €51.6 million in 2023), marking its second consecutive year of profitability.

17 million users and growing: bunq’s rapid international expansion has propelled it to 17 million users across Europe – and now, it’s setting its sights across the Atlantic.

bunq, the second largest neobank in Europe, is moving forward with its US banking license process. „The company has filed for a broker-dealer license as part of a two-phase strategy to enter the US market. This step will enable bunq to gather operational insights and user feedback before reapplying for a full banking license later this year.” – according to the press release.

As bunq expands into the US, it is bringing its proven, user-centric model to a community of nearly 5 million digital nomads, expats, international entrepreneurs, and remote professionals—EU or US citizens with deep ties on both sides of the Atlantic. This mobile, location-independent audience has driven bunq’s growth in Europe to 17 million users and fueled two consecutive years of profits. Today, in its annual accounts, the company reports 2024 profits of €85.3 million, which will be reinvested to accelerate its global expansion.

“Our users live an international lifestyle, and they need a bank that’s global too. As we grow, it’s clear how much they need a bank that works for them, wherever life takes them”, says Ali Niknam – founder and CEO of bunq. “That’s why we’re fast-tracking our entry into the US. Today’s step brings us closer to making that vision a reality.”

bunq has filed for a broker-dealer license with FINRA and the SEC. This first step will allow American users to invest in stocks, mutual funds, and ETFs, while also offering cash management features such as automatic transfers to FDIC-insured accounts. Through its partnership with Mastercard, the mobile bank will also introduce debit cards.

The company is now awaiting regulatory approval and continues discussions to strengthen its global offering and expand its presence in the US.

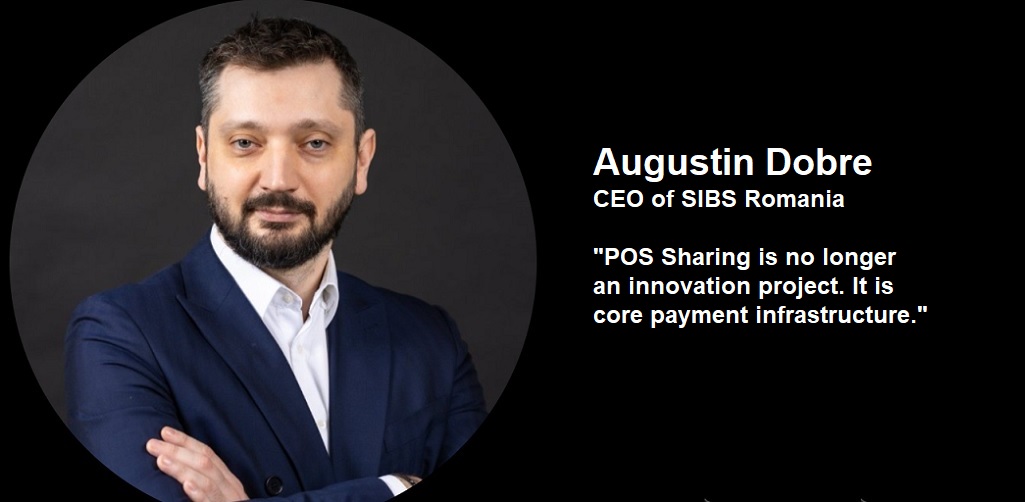

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: