Fintech industry in Romania: despite the annual growth of over 20% in revenues, profitability remains a weak point. Only 10 of the 23 RoFintech member companies were profitable in 2023. Two companies reported zero revenue!

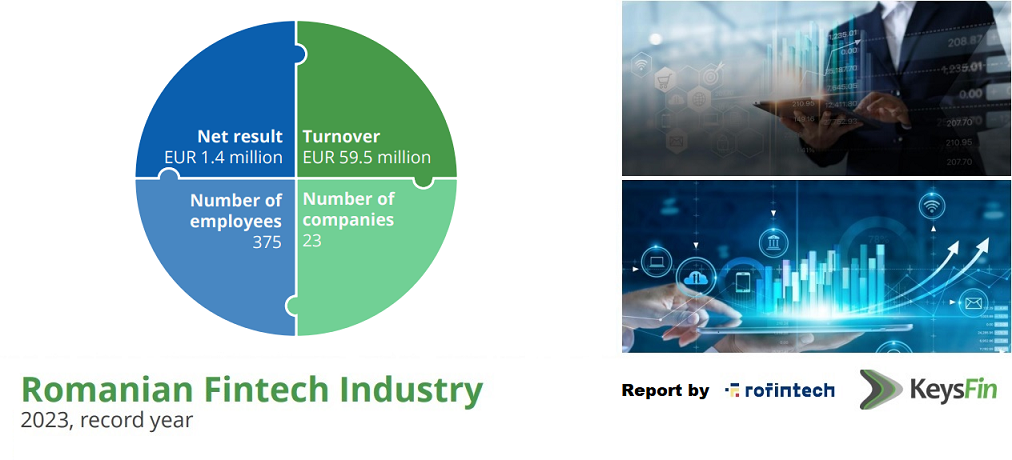

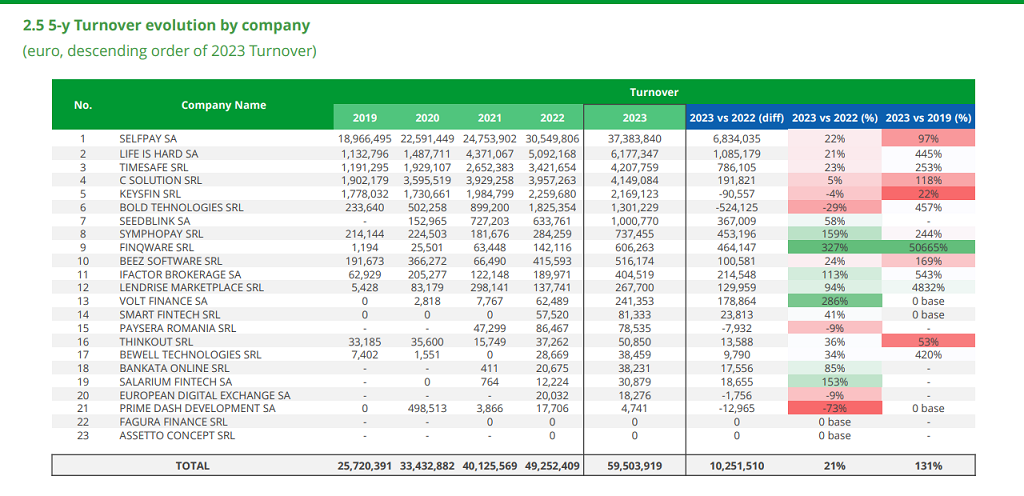

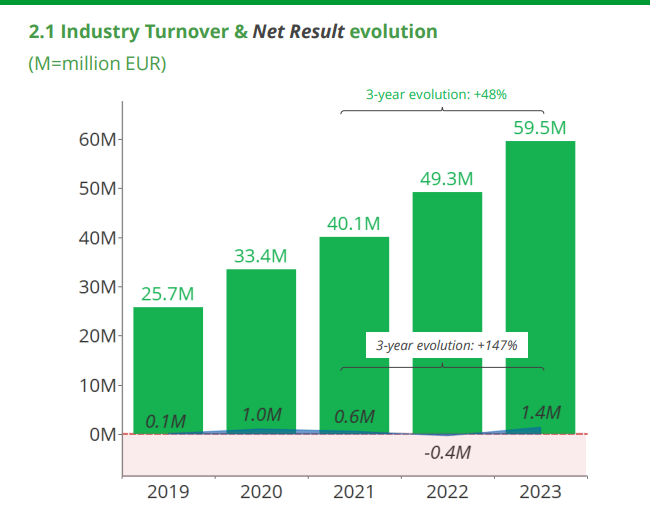

The Romanian fintech industry experienced a record-breaking year in 2023, with revenues reaching €59.5 million, a 21% year-over-year increase and an astonishing 131% growth compared to 2019. According to the latest KeysFin report, this expansion has been fueled by a surge in digital adoption, increased investment, and a regulatory landscape that continues to support fintech innovation.

Yet, despite these impressive figures, profitability remains a challenge, with more than half of fintech companies reporting losses.

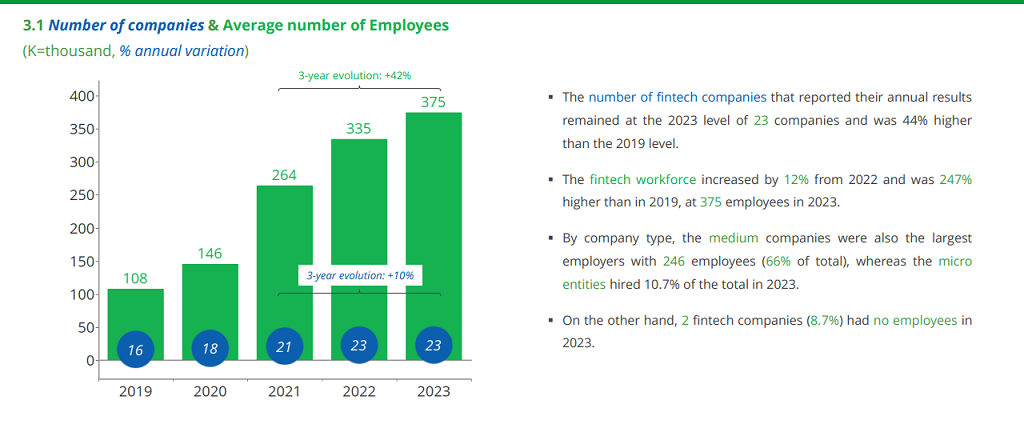

The turnover of local fintech companies increased by 21% when compared to 2022 and was 131% higher than in 2019, to the record level of EUR 59.5 million in 2023, according to the data extracted in January 2025.

Looking ahead, 2024 projections suggest revenue could surpass €65 million, but the authors of the report are wondering: can Romanian fintechs turn growth into sustainable profit? Can the industry sustain this momentum of growing while ensuring financial sustainability?

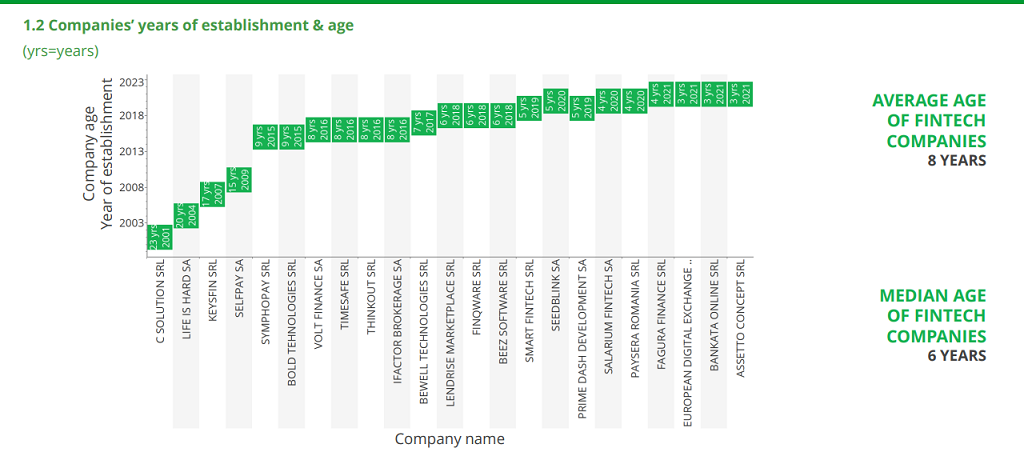

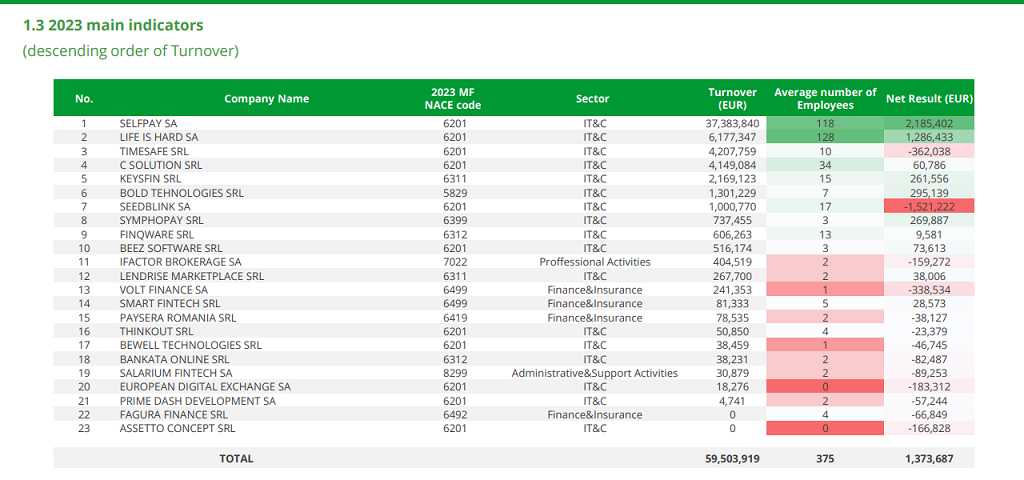

Market Concentration: Five Companies Dominate the Industry

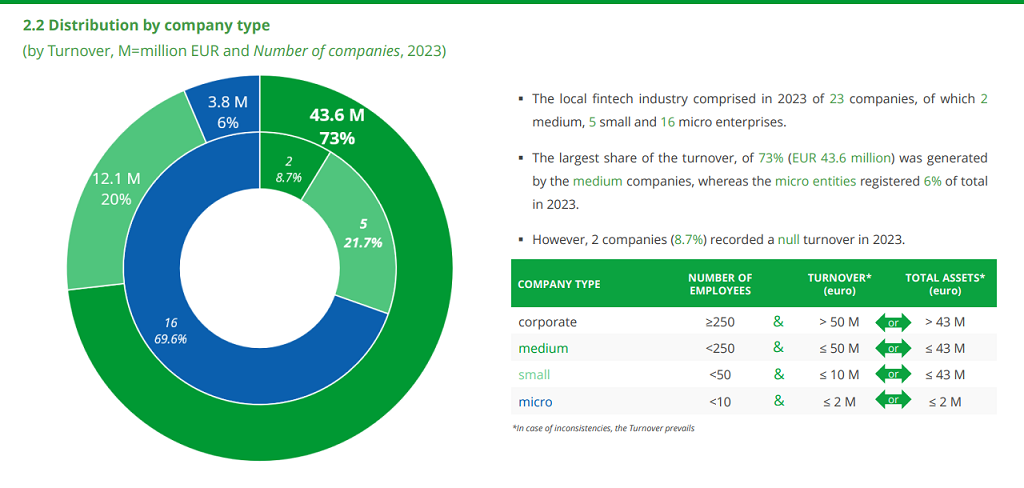

The Romanian fintech sector is small, but highly concentrated, with just 23 companies. The top five generate 83% of the total revenue, leaving smaller players struggling.

SELFPAY SA remains the market leader, with €37.4 million in revenue (63% of total turnover), nearly doubling its revenue in the past five years.

LIFE IS HARD SA ranks second with €6.2 million in revenue and is also the industry’s largest employer, with 128 employees (34% of the workforce).

TIMESAFE SRL recorded the highest YoY growth (+23%), reaching €4.2 million.

BOLD TECHNOLOGIES SRL struggled, with a 29% revenue drop, showing that competition is intensifying.

Finqware, Volt Finance, and Salarium had annual percentage growth rates of over 100%.

Two companies reported zero revenue, raising questions about their viability.

Profitability: More Than Half of Fintechs Still Losing Money

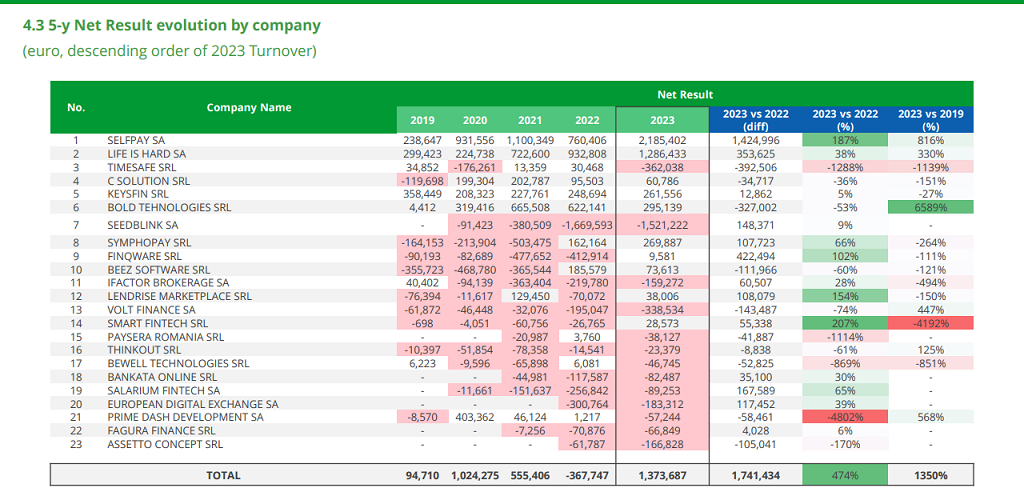

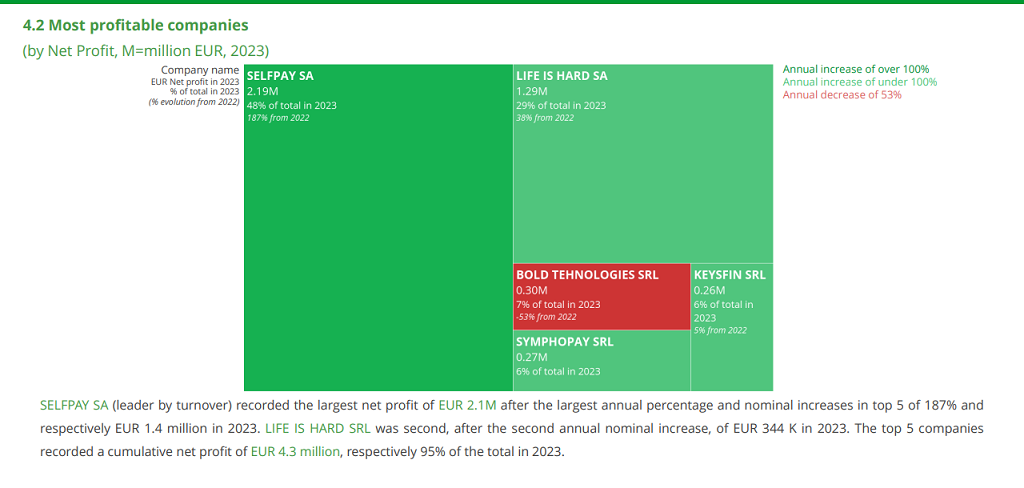

Despite industry-wide growth, profitability remains a weak point. Only 10 of the 23 companies (44%) were profitable in 2023. However, the overall net result jumped 474% YoY, reaching €1.4 million, thanks to a handful of successful firms.

SELFPAY SA was the most profitable, with €2.18 million net profit, accounting for 48,5% of total industry profits.

LIFE IS HARD SA followed with €1.29 million, reinforcing its strong financial position.

SYMPHOPAY SRL saw a 66% profit increase, proving that smaller players can scale profitability.

BOLD TECHNOLOGIES SRL’s profit dropped by 53%, showing the impact of weak market positioning.

This profitability gap highlights a key industry challenge: many fintechs are prioritizing market share over financial sustainability. Investors are asking: when will fintechs shift from growth to stable profits?

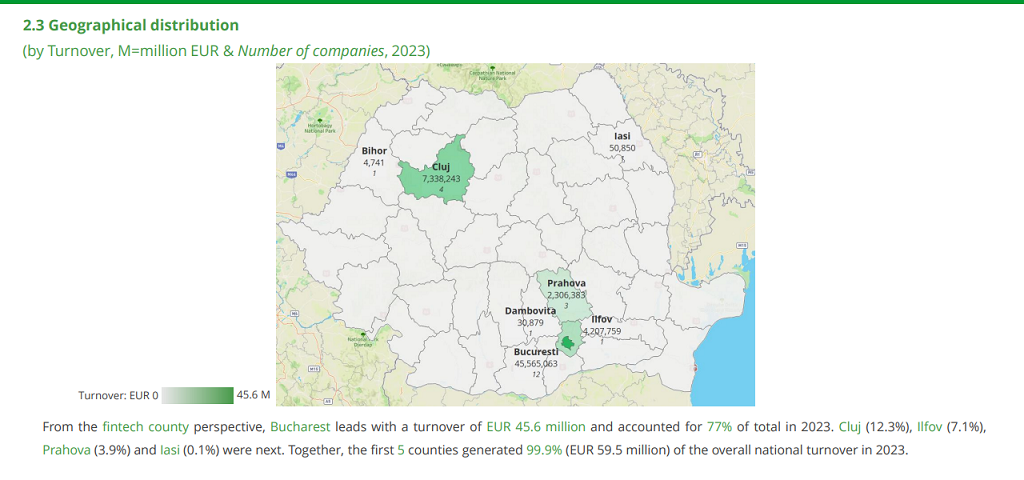

Bucharest Leads, but Cluj and Ilfov Are Catching Up

The Romanian fintech ecosystem remains highly centralized, with Bucharest accounting for 77% of total industry turnover (€45.6 million). This concentration suggests that while fintech innovation is thriving in the capital, other regions are struggling to keep pace.

Beyond Bucharest, only four counties contribute meaningfully to the industry: Cluj (12.3%), Ilfov (7.1%) and Prahova (3.9%). Together, these regions generate 99.9% of the national fintech turnover, leaving the rest of Romania virtually absent from the sector. While tech hubs like Cluj-Napoca show promise, Romania’s fintech expansion remains an urban-centric phenomenon, requiring regional investment and infrastructure improvements to create a more balanced ecosystem.

What’s Next for Romanian Fintech?

Looking toward the future, several trends are expected to shape the Romanian fintech ecosystem. Open banking, propelled by the European PSD2 directive, is becoming an increasingly influential force. Companies like Finqware, which has seen an extraordinary 50,665% increase in turnover since 2019, are leveraging open banking technology to drive financial data aggregation and embedded finance models.

The likelihood of increased mergers and acquisitions (M&A) is also growing. While the KeysFin report does not explicitly highlight M&A activity, industry conditions suggest that some companies will need to consolidate in order to address profitability challenges. The fact that two fintech firms reported zero revenue in 2023 signals potential market exits, strategic partnerships, or buyouts in the near future.

Regulatory adaptation remains a crucial factor in the sector’s evolution. The National Bank of Romania (NBR) has established a stable regulatory framework, but fintech companies must navigate continuously evolving compliance requirements, especially in the finance and insurance sectors, where regulatory costs tend to be higher.

Meanwhile, the „Buy Now, Pay Later” (BNPL) model is gaining traction in Romanian e-commerce. Lendrise Marketplace SRL, which recorded a 94% revenue increase in 2023, is well-positioned to capitalize on changing consumer spending behaviors and digital payment preferences.Artificial intelligence (AI) is another area set to transform fintech operations, particularly in risk management, fraud detection, and credit scoring. While companies like Volt Finance SA are investing in AI-driven transaction monitoring, their financial struggles in 2023 suggest that it may take time before they emerge as market leaders in AI-powered financial services.

Fintech at a Crossroads: Growth or Profitability?

The Romanian fintech industry has proven its ability to grow, but sustaining momentum requires a shift to profitability. Surpassing €59.5 million in revenue was a milestone, but over half of fintechs still lose money.

With rising competition, regulatory pressures, and economic shifts, fintechs must adapt fast. The winners will be those that balance innovation with financial stability. As 2025 approaches, the big question remains: which companies will thrive, and which will struggle to survive?

____________

KeysFin study aims to provide an overview (in terms of turnover, workforce, profitability, etc.) of the evolution of the local fintech industry to identify the main opportunities, risks, and trends in stagflation conditions. The report define the local Fintech Industry as being comprised of the 23 members of the Romanian Fintech Association.

RoFintech (Romanian Fintech Association) is the leading hub for Romania’s fintech ecosystem, dedicated to fostering innovation, collaboration, and growth in financial technology. By bringing together fintech professionals and industry experts, we support the development of cutting-edge solutions and drive the digital transformation of financial services. Through networking, knowledge-sharing, and strategic partnerships, our ultimate goal is to position Romania as a key player in the global fintech landscape.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: