The US Government’s Bitcoin… What? Whatever it is called, it is not strategic and it is not a reserve.

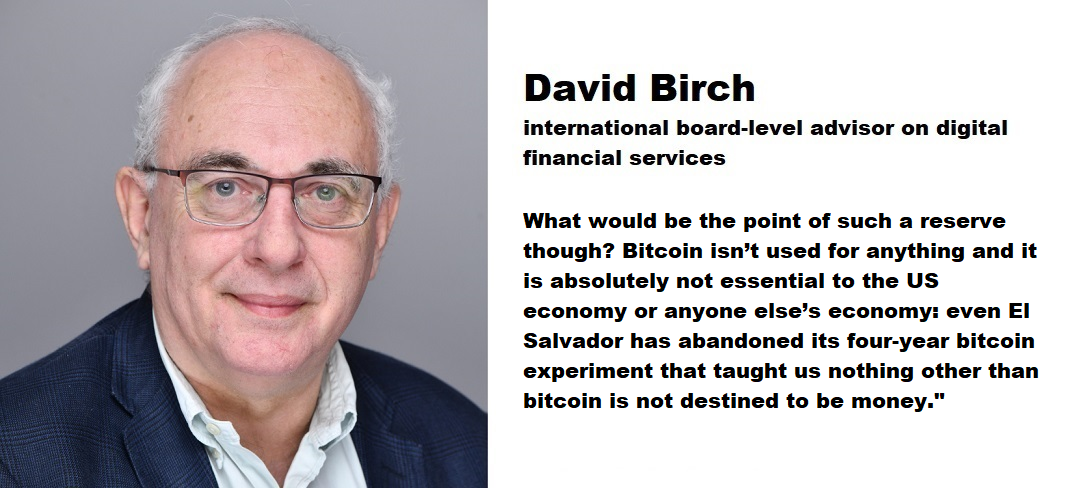

an article written by David Birch

A strategic reserve is a stock of a systemically important input, which can be managed to mitigate economic disruption. The key example that we all think about is the US strategic petroleum reserve (SPR) which was created in response to the Arab oil embargo half a century ago. It was most recently accessed to reduce pressure on energy prices after the Russian invasion of Ukraine. The stockpile makes sense because the commodity is essential to the economy: without petroleum the economy will grind to a halt.

By contrast, not only is bitcoin not essential to the economy it has, so far as the numbers tell us, no real utility. If the value of Bitcoin hit zero tomorrow (perhaps because of quantum computer or something), it would not matter to the US economy at all.

The Plan

While it is not for me to comment on American politics, I cannot help but notice that there is a new President and that one of the proposals that he originally floated was a „strategic reserve” where the US would hoard billions of dollars worth of the cryptocurrency.

Senator Cynthia Lummis introduced the BITCOIN Act of 2024, which proposed that the US Treasury establish this reserve by acquiring one million BTC over five years, with annual purchases of 200,000 BTC. This initiative positioned Bitcoin as a strategic asset to hedge against inflation, reduce national debt and strengthen the US’s financial leadership globally (although how is not exactly clear to me, to be honest).

(A million bitcoins would cost well over $100 billion even at current prices: if the US government was known to be a price-insensitive buyer then the government could easily end up acquiring the coins at $1,000,000 per coin, making a trillion dollar reserve.)

What would be the point of such a reserve though? Bitcoin isn’t used for anything and it is absolutely not essential to the US economy or anyone else’s economy: even El Salvador has abandoned its four-year bitcoin experiment that taught us nothing other than bitcoin is not destined to be money.

To a first approximation then, bitcoin is used only for speculation (and I suppose some ransomware too). If bitcoin goes away, it does not matter. Planes will still fly, lathes with still turn, corn will get harvested.

My view remains that bitcoin holdings are not a reserve at all but might more properly be labelled as stash, and it is fair to observe that economists consider such a stash of little value to taxpayers but of great value to the crypto “whales” who hold most of it. Given that the cryptocurrency market is manipulated by those whales, it is no surprise that their sentiment is in favour of the government buying bitcoin.

Eswar Prasad, a professor at Cornell University and a senior fellow at Brookings, drew an interesting parallel between the US government support for cryptocurrencies and the Chinese government’s support for the domestic property sector to drive its economy while touting it as a way for households to build their own wealth. Now that that property bubble is bursting, the burden is falling heavily on the lower-income households who locked up a large share of their savings in property or are now stuck with failed developers.

Gold

One of the pro-reservists arguments in favour of such action is that bitcoin is a form of digital gold, and since the government holds actual gold then it should sell some of it and replace it with the modern alternative. But that gold has little utility either. Gold reserves (about a sixth of global reserve assets) are no longer used to settle international accounts but are there as a hedge against exchange rate risk, but the fact is that much of the world’s official gold reserves are held for no better reason than sheer inertia. There is no benefit to replacing them with digital gold (or lithium, or water or anything else that might be more scarce in the future).

(Never mind national reserves, though: some observers think that the creation of a strategic Bitcoin reserve is far more likely to happen at the state level first. Ten U.S. states have already proposed some form of reserve, including a proposal in Texas to build up a Bitcoin reserve simply by encouraging Bitcoin miners in the state to pay their taxes in Bitcoin.)

The US is not the only jurisdiction debating a bitcoin stash. Germany’s former federal finance minister has pushed for the European Central Bank (ECB) to consider adding Bitcoin to their reserves, one of Hong Kong’s lawmakers has proposed incorporating Bitcoin into the country’s fiscal reserves and in Poland, a libertarian politician has vowed to make the nation a crypto hub if elected president by creating a national Bitcoin reserve to position the country as a leader in crypto-friendly regulation and policies (although again I must be honest and say that I do not see the relationship between stashing cryptocurrencies and being a leader in crypto-friendly, regulation, whatever that is).

In Switzerland there will be a public referendum that could make the country the first to officially hold Bitcoin as a reserve asset. Quite how the adoption of such a volatile and manipulated asset aligns with traditional Swiss characteristics such as stability and financial independence is, I have to say, not clear at all.

Taking Stock

The proposals to create a bitcoin reserve, where the US would stash billions of dollars’ worth of bitcoins in a scheme that experts think has no value to taxpayers—but might jack up the value of the currency to the enrichment of the major bitcoin holders—seem distant from the values of the bitcoin vanguard who disdained market manipulation by governments. It is reasonable to observe that if Bitcoin is „freedom money”, a tool for financial sovereignty, then perhaps its fundamental properties might be challenged as institutional players co-opt its narrative.

(The further proposals to create a “crypto reserve” containing a number of different cryptocurrencies, not only Bitcoin but also XRP, solana and cardano, sent the prices higher but did subsequently translate into action.)

The pressure for a reserve is not really anything to do with the original vision of peer-to-peer electronic cash and freedom from censorship. The bitcoiners are excited because, as Brendan Greeley wrote in the Financial Times, if you held a portfolio of Andy Warhol paintings and someone in Washington proposed a strategic Warhol reserve, you’d be excited too.

As things stand, the cryptocurrency community were disappointed that as President Trump took office, neither his inaugural speech nor his initial executive actions actually delivered a real strategic Bitcoin reserve or a real reserve of digital assets of any kind.

What the administration delivered instead is a government stash, a stockpile of Bitcoin and other digital assets that have been obtained by the Department of the Treasury as part of „criminal or civil asset forfeiture proceedings”. In an executive order at the beginning of March, President Trump also asked other agencies will evaluate their legal authority to transfer any bitcoin owned by those agencies to the stash and said that the United States will not sell bitcoin deposited into the stash.

(Similarly, the Digital Asset stash will be built up from assets seized or forfeited.)

With the bitcoin and digital asset stash in place, I think that actually nothing has changed from the crypto enthusiasts perspective. They will continue to pressure for what they see as a real strategic Bitcoin reserve, and that pressure isn’t going to go away no matter what economists think.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: