Mobey Forum’s AI Expert Group has released a new infographic, ‘10 Must-Answer Questions for Banking Executives to Ask Before Going Live with Customer-Facing Conversational AI’, which provides critical insights for financial institutions implementing generative AI solutions.

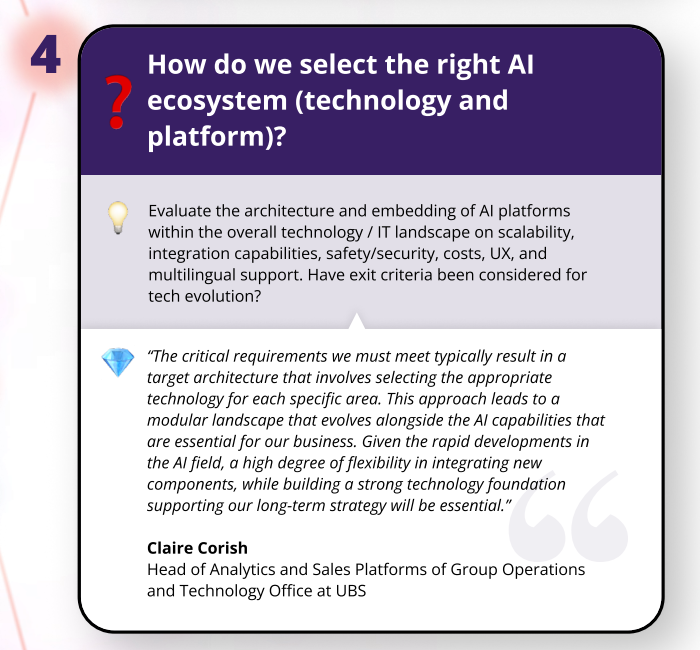

The infographic, developed through in-depth interviews with AI leaders from leading banks and other industry experts, outlines the key strategic, regulatory, and operational questions that banks must address to ensure the successful deployment of AI-driven solutions for customers. As conversational AI becomes a core component of digital banking, balancing automation with quality, security, and customer experience is essential.

“The future of customer-facing conversational AI is not just about reducing costs or replacing human interactions—it’s about enhancing the overall customer experience,” said Amir Tabakovic, co-chair of the Expert Group and Founding Partner of experiens AI. “Banks need a well-structured AI governance framework that ensures security, compliance, and continuous improvement while maintaining a human-centered approach.”

Key AI Considerations for Banks

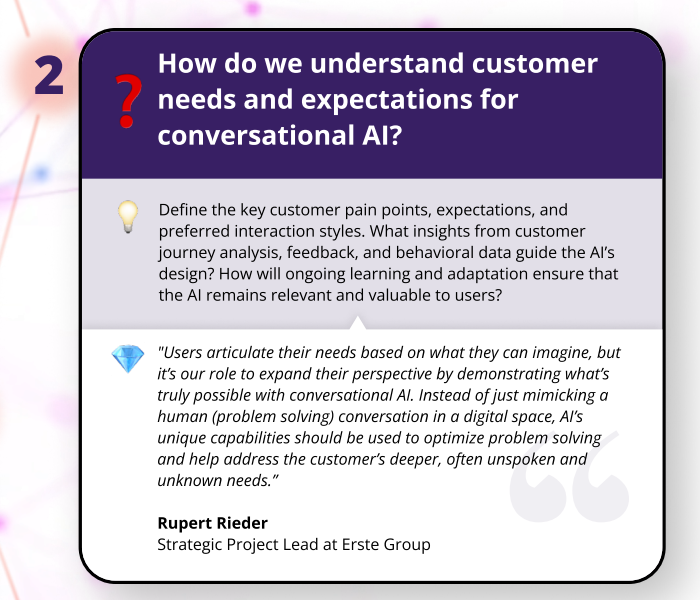

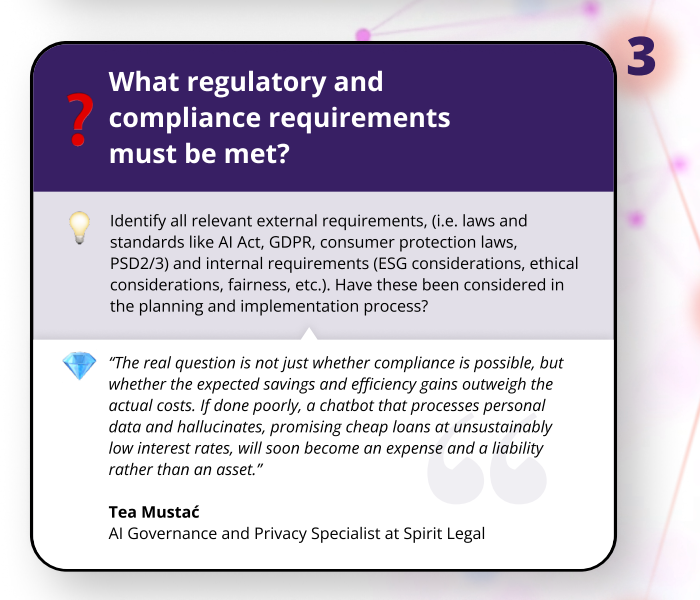

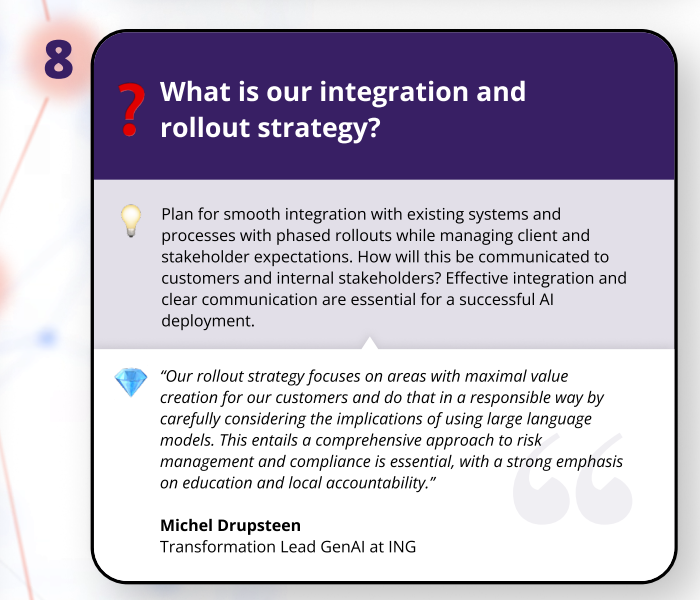

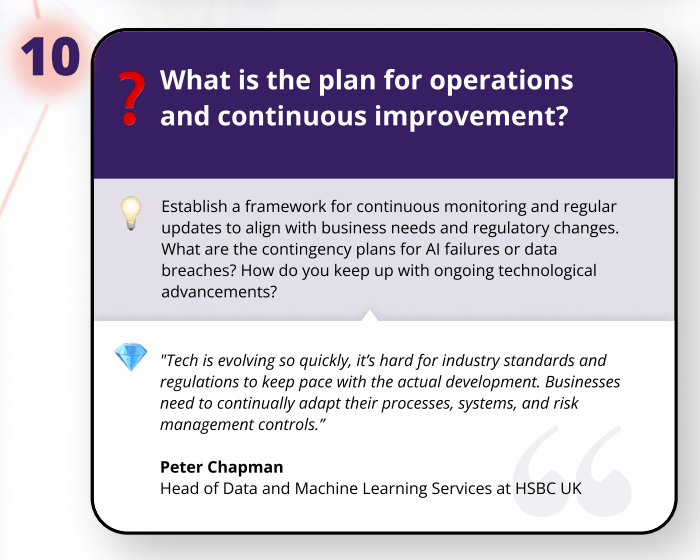

The report highlights ten crucial factors for banking executives, including aligning AI with business objectives, ensuring compliance with evolving regulations such as GDPR and the AI Act, as well as designing AI interactions that truly address customer needs.

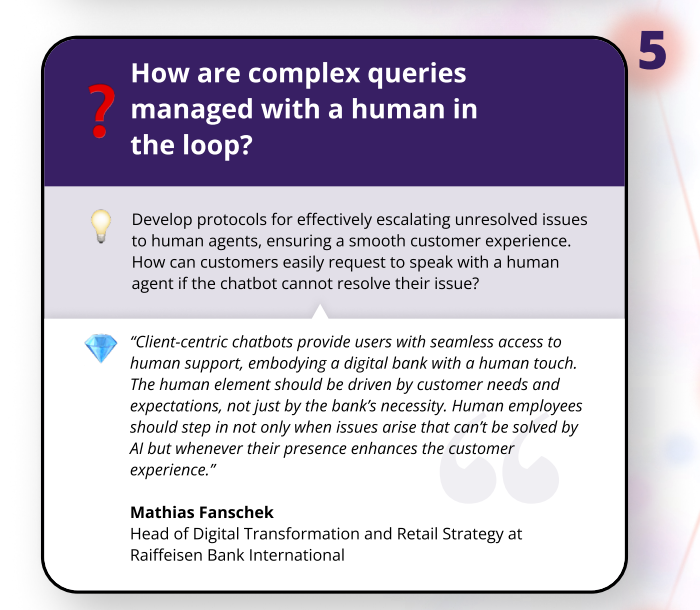

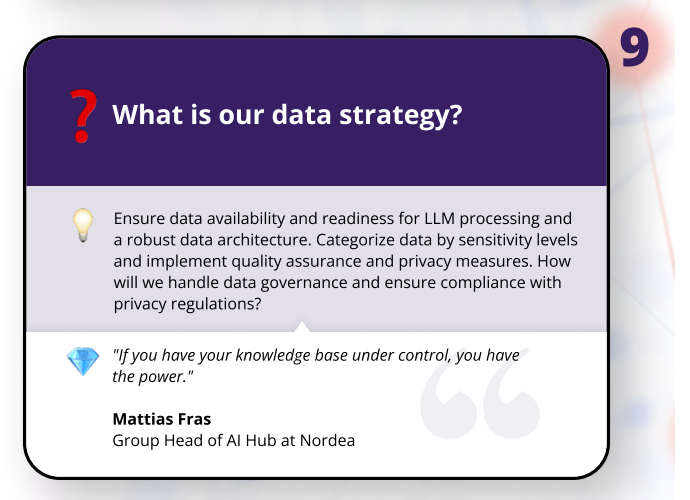

Effective AI deployment also requires clear escalation protocols for human intervention and strong safeguards to protect customer data and prevent misinformation.

“Users articulate their needs based on what they can imagine, but it’s our role to expand their perspective. Instead of just mimicking human conversation, AI should be designed to address deeper, often unspoken needs and optimize problem-solving,” said Rupert Rieder, Strategic Project Lead at Erste Group and co-chair of the Expert Group.

Fostering Collaboration and Best Practices

Mobey Forum’s AI Expert Group facilitates knowledge-sharing among banks to navigate AI challenges effectively.

“AI is transforming banking, creating both opportunities and challenges for financial institutions,” said Elina Mattila, Executive Director of Mobey Forum. “At Mobey Forum, our role is to bring our members together to share practical learnings, discuss best practices, and ensure they stay ahead of the curve in this rapidly evolving landscape.”

The full infographic, 10 Must-Answer Questions for Banking Executives to Ask Before Going Live with Customer-Facing Conversational AI Solutions, is available for download HERE.

Mobey Forum is a not-for-profit, member-based knowledge and networking platform that focuses on emerging technologies and business models in digital financial services. We connect banking practitioners around the world who are navigating similar challenges within their organisations and provide a trusted environment for sharing practical and behind-the-scenes information among members. Our Member Meetings and other activities enable our members to gain clarity on the latest trends and create content that shapes the industry. Familiar names in our membership include HSBC, ING, Nordea, DNB, CaixaBank, Erste Group, UBS, Interac, and Visa.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: