Offline card payments should work to a satisfactory extent by 1 July 2026. Similar solutions exist, or will soon, in Denmark and Norway.

To strengthen the resilience of the payment system, it urgently needs to be possible to pay offline with cards and use cash to pay for essential goods. Both public and private payments market actors need to take action to increase payments system preparedness. The general public also has a responsibility to safeguard their ability to make payments in the event of a crisis or, in a worst case scenario, war, according to the Riksbank’s Payments Report presented today.

In the report, the Riksbank emphasises that the state needs to play an active role in the payments market to contribute to innovation, competition and resilience, among other things. The role of the Riksbank depends on changes in the world around us and how well the market itself can fulfil society’s need for safe, efficient and accessible payments.

„One area that the Riksbank believes needs to be improved considerably, particularly in light of the geopolitical unease in the world, is the possibility to pay by card when the internet is not working – so-called offline payments. The possibility to pay offline in Sweden is currently limited and does not work at all if you tap your card or use your mobile phone for payments. In addition, these contactless payments contribute to more people forgetting their PINs and losing track of their cards.” – according to the press release.

“In light of the deteriorating security situation in Sweden and our neighbouring region, both public and private actors need to urgently step up their efforts to create a payments market that can withstand disruptions. The Riksbank is therefore prioritising work on improving the possibility of making offline payments by card to strengthen resilience. We have brought together the relevant stakeholders and together we will have a solution in place by 1 July 2026. But we also urge the public to strengthen their own payment preparedness and to have both physical payment cards and cash available and to use these payment methods regularly,” says Governor Erik Thedéen.

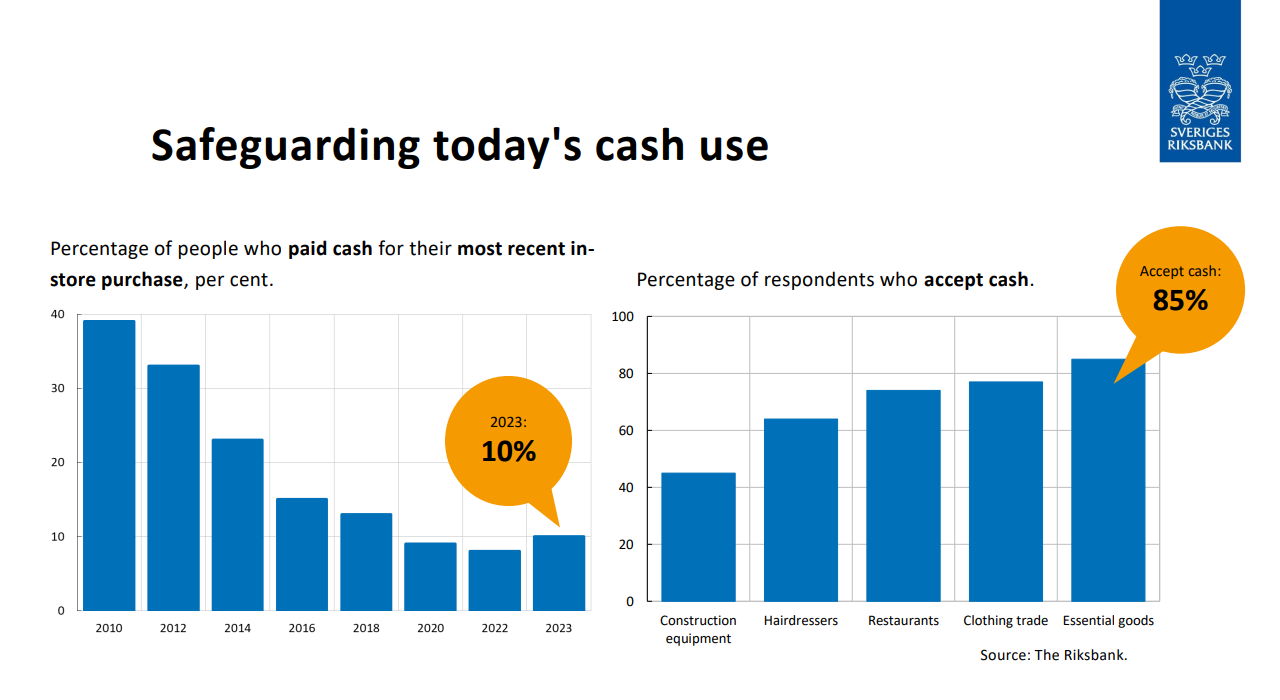

Cash remains an important payment option, not only for contingency planning reasons, but also for people who, for various reasons, are unable or unwilling to access digital services. The Riksbank considers that legislation is required to maintain the use of cash and is therefore in favour of the fact that a Cash Inquiry, appointed by the Ministry of Finance, presented such proposals at the end of last year.

“To secure the cash infrastructure in Sweden and for cash to continue to function as a means of payment, the Riksdag and the Government should introduce a cash obligation for the sale of essential goods and legislate on measures to protect the entire cash chain. We also believe that there is reason to consider a maximum limit for cash purchases to make it more difficult for the criminal economy,” continues Erik Thedéen.

The Riksbank also writes that other measures need to be taken to increase the accessibility of the payments market for those who are financially excluded. For example, more people need to have access to a payment account as it is virtually impossible to receive wages or pay bills without it today. The problem affects several groups in society, such as refugees and visiting researchers, according to a report commissioned by the Swedish Post and Telecom Authority.

“Without a payment account, you cannot participate in society on the same terms. A common reason for banks to deny or close accounts is that they think they are unable to fulfil the requirements in the anti-money laundering and anti-terrorist financing regulations. These are serious social problems that must of course be countered. At the same time, we believe that more people should have access to a payment account with basic functions,” says Erik Thedéen.

Another priority area for the Riksbank is to enable instant payments to a greater extent. Swish payments have always reached the recipient immediately, but with effect from last autumn banks can offer more services than Swish. For example, this could involve purchases that are currently paid for by online bank transfers, but where both payer and recipient want to see that the payment has been received straight away. The Riksbank has made this possible through changes in the underlying infrastructure, and it is ultimately up to the banks to offer new services.

A new survey by the Riksbank shows that half of the small business owners who participated want money to reach their accounts immediately instead of after 1-3 days.

“By eliminating intermediaries and shortening transaction times, the economic costs of payments are reduced, which benefits both businesses and consumers. Companies can then have better control over their cash flow and improved liquidity. Even the financially vulnerable with small margins will benefit when payments can reach them directly. We therefore call on the banks to offer more instant payment services, just as they do in our Nordic neighbours today,” continues Erik Thedéen.

The Riksbank also actively cooperates with other central banks and national and international private banks to enable instant cross-border payments within the framework of the TIPS cross-currency service. The service will enable cross-currency payments from October this year.

“Cross-border payments are an area with great potential for improvement. Today, making a payment between Ystad and Copenhagen is significantly slower than making a payment between Ystad and Haparanda. To speed up cross-border payments, we want banks to join the TIPS cross-currency service as soon as possible,” concludes Erik Thedéen.

At the same time, the Riksbank emphasises that the market control systems used to prevent financial crime need to continue to be strengthened to cope with more instant payments, both with regard to payments made within Sweden and to cross-border payments.

_____________

The Payments Report describes and analyses developments in the payments market over the past year. It presents the Riksbank’s assessments and policy stance in the area of payments. The aim is to disseminate knowledge and to contribute to debate, and make it easier for external parties to monitor, understand and evaluate the Riksbank’s work on payments. Read the whole report on the Riksbank’s website: Payments Report 2025.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: