26% of American adults start investing in cryptocurrency after Bitcoin hit $100K – study

70% of American adults now own crypto as Bitcoin surpasses $100K. This could be as many as 183 million people, according to a report by NFTEvening.

In late 2024, the cryptocurrency market witnessed a historic surge, with Bitcoin surpassing the $100,000 mark for the first time. This milestone triggered a wave of mainstream adoption, with a significant increase in Americans owning digital assets. This rapid growth in crypto ownership continued into 2025, fueled by a growing understanding of the technology and its potential benefits.

This report by NFTEvening dives into the reasons behind the cryptocurrency market’s explosive growth in 2025. We surveyed over 1000 US-based residents to explore the factors driving crypto adoption, analyze the changing investor sentiment, and examine the evolving landscape of the crypto space.

How many Americans own crypto in 2025?

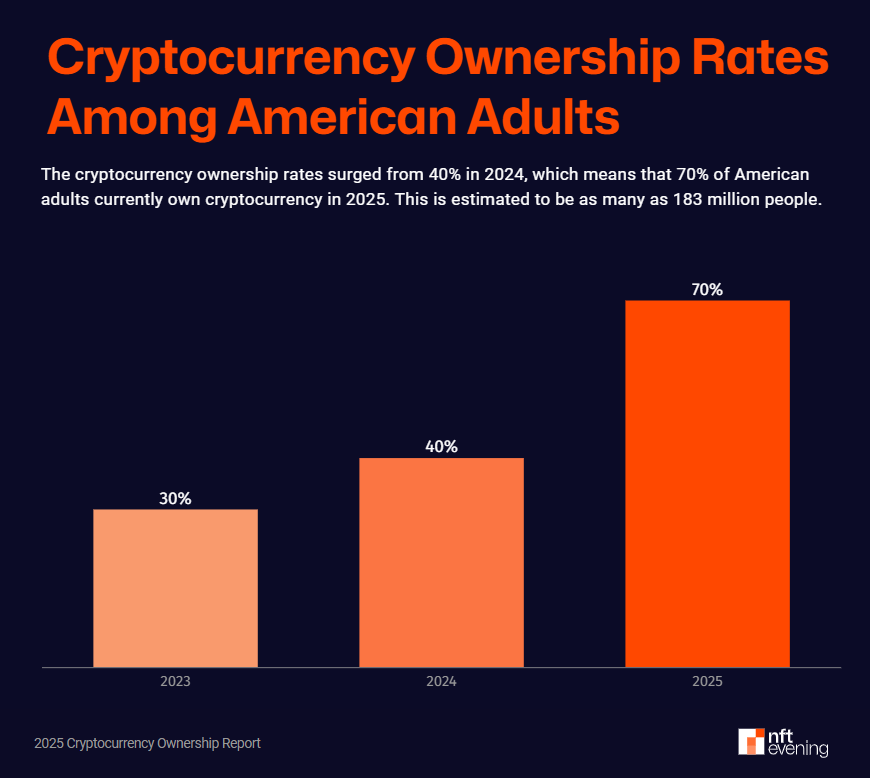

In 2025, 70% of American adults will own cryptocurrency, which translates to approximately 183 million individuals. The ownership rate has significantly risen from 40% in 2024 to 70% in 2025, indicating a growing acceptance and interest in digital assets among the American population.

Who Uses Cryptocurrency?

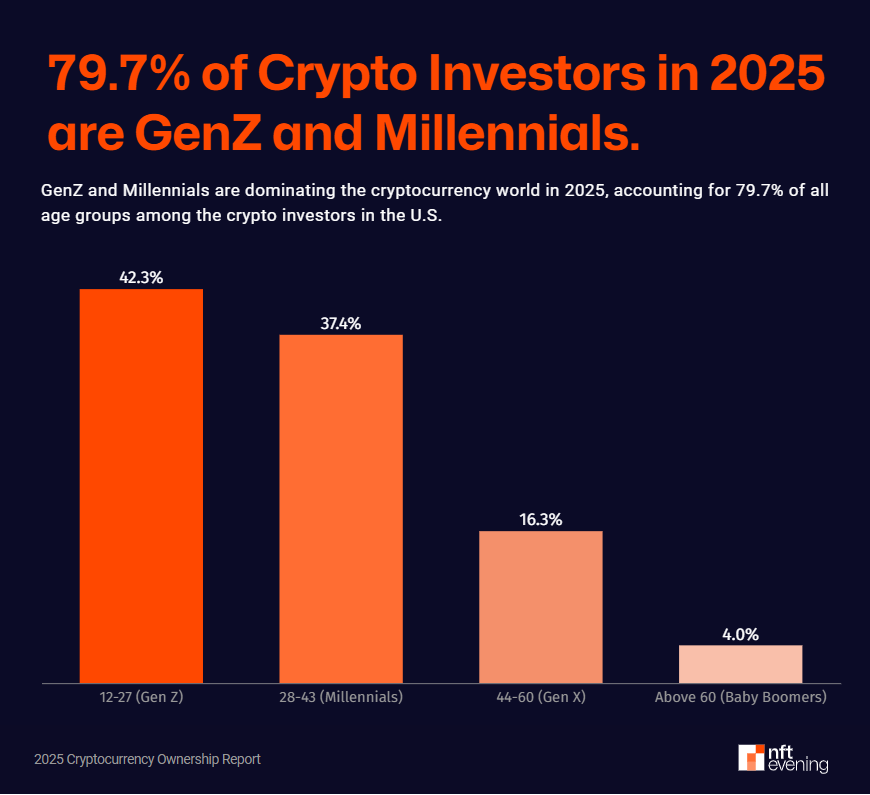

Age

Cryptocurrency ownership spans across various age groups. In 2025, Gen Z (aged 18-27) leads with 42.3% ownership, with those below 18 represents only 0.3%. This is followed by Millennials (aged 28-43) at 37.4%. Gen X (aged 44-60) makes up 16.3%, while individuals above 60 years old account for 4.0% of owners.

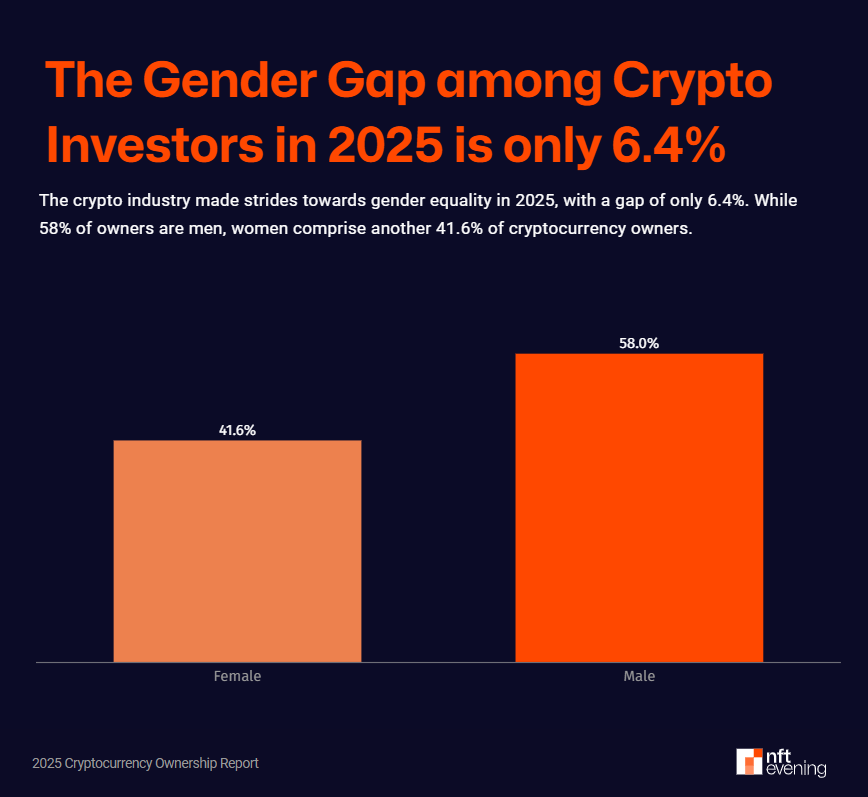

Gender

In 2025, cryptocurrency ownership is slightly skewed towards males, with 58% of owners identifying as male. Females comprise 41.6% of cryptocurrency owners, and 0.4% preferred not to disclose their gender.

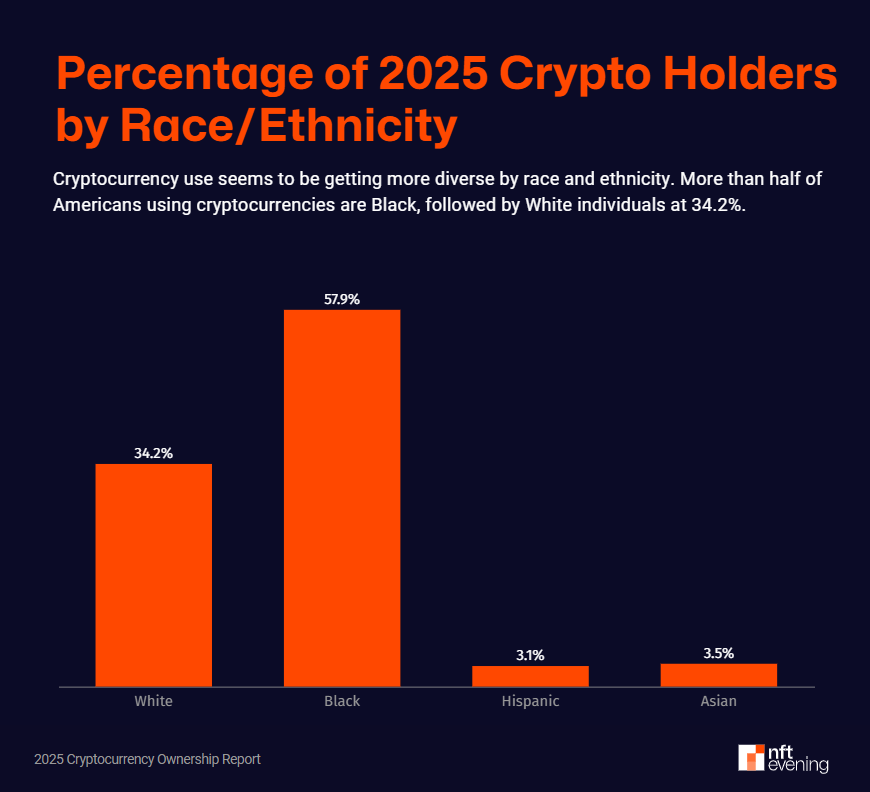

Race/Ethnicity

The racial and ethnic composition of cryptocurrency owners in 2025 is diverse. The majority are Black at 57.9%, followed by White individuals at 34.2%. Hispanics and Asians constitute 3.1% and 3.5%, respectively, while 1.3% preferred not to specify their race or ethnicity.

Cryptocurrency Ownership and Sentiment in 2025

Current Crypto Owners

In 2025, a staggering 96.7% of current cryptocurrency owners continue to hold onto their investments. This demonstrates a strong confidence in digital assets among existing investors.

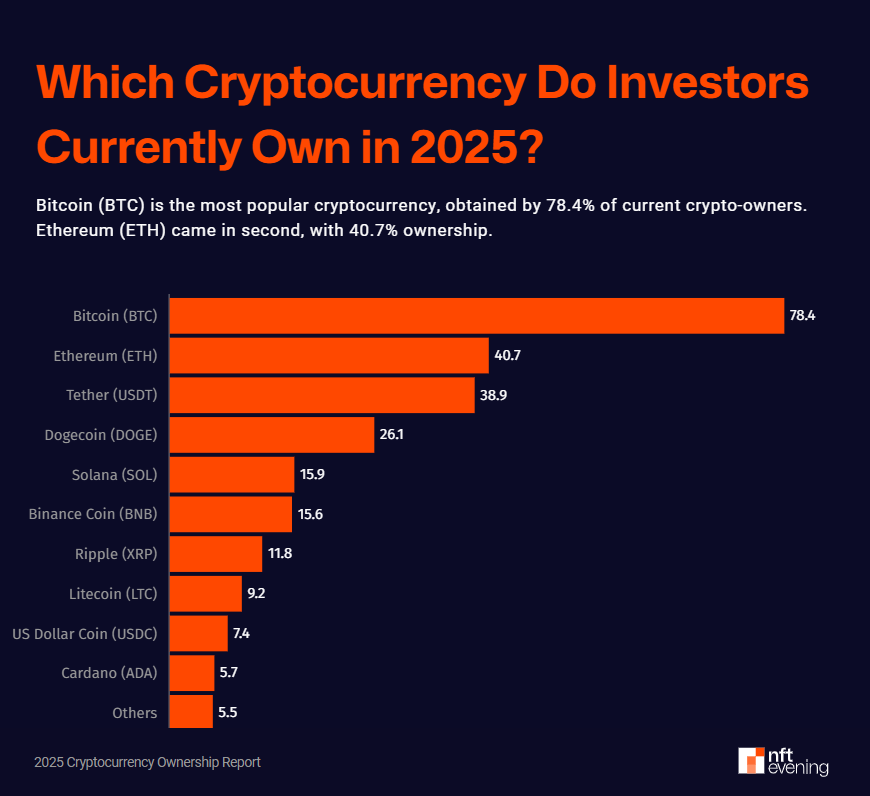

Bitcoin is the most popular cryptocurrency, with 78.4% ownership among crypto holders. Ethereum is the second most popular, with 40.7% ownership. Other widely owned cryptocurrencies include USDT at 38.9%, Dogecoin at 26.1%, and Solana at 15.9%.

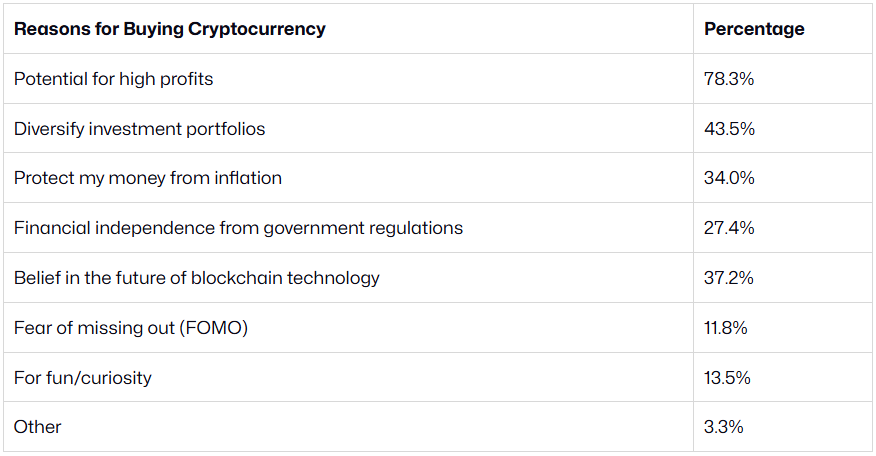

Reasons for Cryptocurrency Adoption

The most common reason for investing in cryptocurrency is the potential for high profits, as mentioned by 78.3% of investors. Diversifying investment portfolios motivates 43.5% of investors, while 34% aim to protect against inflation. Achieving financial independence from government regulations is a goal for 27.4%.

Additionally, 37.2% believe in the future potential of blockchain technology, while a smaller percentage invest out of curiosity or fear of missing out (FOMO).

Non-Crypto Owners

The future of cryptocurrency looks promising, with 13.6% of non-owners planning to enter the market by the end of 2025. While 52.8% of non-owners considering buying cryptocurrency at some point in the future, 33.6% of non-owners indicate they have no plans to invest in cryptocurrency.

Concerns Preventing Cryptocurrency Adoption

Several factors deter non-owners from entering the cryptocurrency market. The top concern is insufficient knowledge, reported by 51.5% of respondents.

Fear of losing money affects 48.2%, and security risks such as hacking or scams are significant barriers for 39.2%. Other concerns include price volatility at 33.6% and a lack of government or banking protection at 26.6%.

Methodology

The findings in this report are based on a survey of 1,006 Americans conducted in December 2024. The survey analyzed how many people own cryptocurrency, their demographics, and the reasons behind their choices. The report uses clear numbers and patterns to explain how crypto has become more mainstream. Data collected by Security.org from 2023 and 2024 was also used to compare trends over time.

More details here

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: