The domestic market share of national card schemes is declining.

The European Central Bank (ECB) published the latest report on card schemes and processors. Card payments have emerged as the dominant electronic payment method in the European Union (EU), accounting for 70 billion payments – 54% of all non-cash transactions – in 2023.

The report’s findings raise questions about the EU’s strategic autonomy in payments, particularly given the growing dominance of international card schemes.

Card schemes

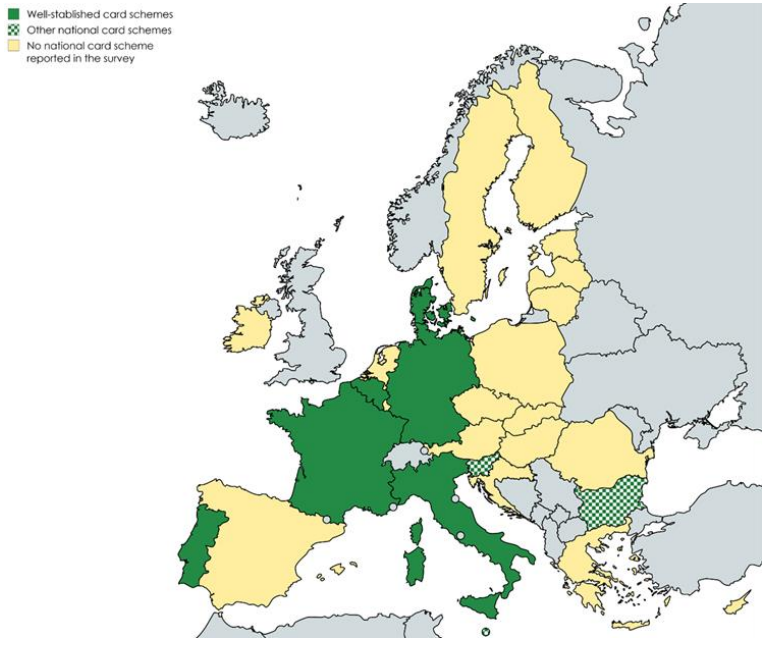

The report shows that there are currently only nine national card schemes active in the EU, each operating in only one Member State (Figure 1). These schemes are facing a broader trend of declining domestic market shares.

In the euro area, 13 countries rely entirely on international card schemes for card transactions. Overall, in 2022 international card schemes accounted for approximately 61% of euro area card payments, with national schemes making up the remaining 39%. The share of national schemes is even lower – 37% – if transactions of euro area cardholders with non-euro area merchants are considered. These are performed by international card schemes only since national card schemes can only execute card transactions within their country.

Card processors

There are four major cross-border card processors out of a total of 80 providers identified in the EU. While the processors operating in a single Member State are mostly companies headquartered in the EU, none of the processors operating across EU borders can be identified as fully EU-owned.

The report provides an outlook of the evolution of card schemes and processing entities in EU Member States. It relies on data retrieved through a consultation with the European System of Central Banks, including all 27 national central banks. The data discussed in the report were submitted as at February 2024.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: