Publication of the EDS Local File Specifications

The European Payments Council (EPC) published the EPC Directory Service (EDS) Local File, downloadable in XML, JSON, or CSV format. The file contains key identification, adherence data, and Application Programming Interface (API) endpoint related information.

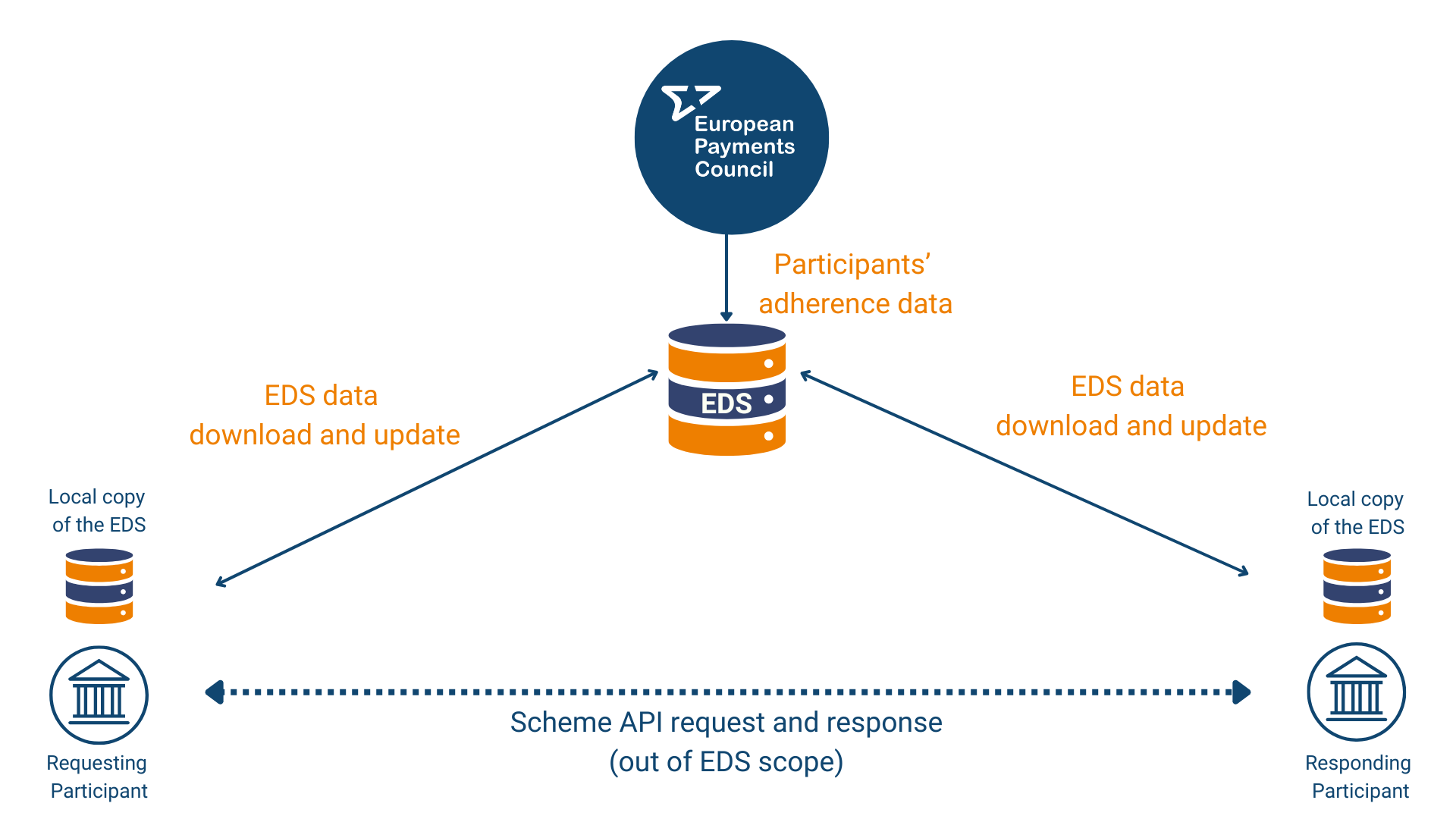

Generated daily, the EDS Local File ensures up-to-date information for payment service providers (PSPs) and Routing and/or Verification Mechanisms (RVMs), helping participants confirm API endpoints and validate payment service provider details. It can be downloaded from the EDS via Graphical User Interface (GUI) access after user authentication or obtained via an EDS API. It can be parsed and imported in the IT system of the participants for an optimised access.

Securing reachability and interoperability: the EDS

In API-based schemes, two scheme participants may communicate through APIs either directly or through a proxy, e.g. a Routing and/or Verification Mechanism (RVM) in the VOP scheme, and a Referenced Technical Service Provider (RTSP) in the SRTP scheme. Before this API-based communication may take place, however, all scheme participants in the network need to know how to reach each other (i.e. the network address of the other party) and have all the information needed to interoperate (e.g. knowing which options may be supported by the other party).

For this purpose, the EPC introduced the EPC Directory Service (EDS). This directory service is the default mechanism to facilitate reachability and interoperability across all API-based EPC scheme participants.

More details here.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: