Belgians are embracing the digital world in ever-greater numbers: the number of mobile payments using Bancontact and Payconiq rose by 28% compared to last year. Also, Bancontact: figures for last year from the National Bank show that 53% of all physical purchases in Belgium were made using a card.

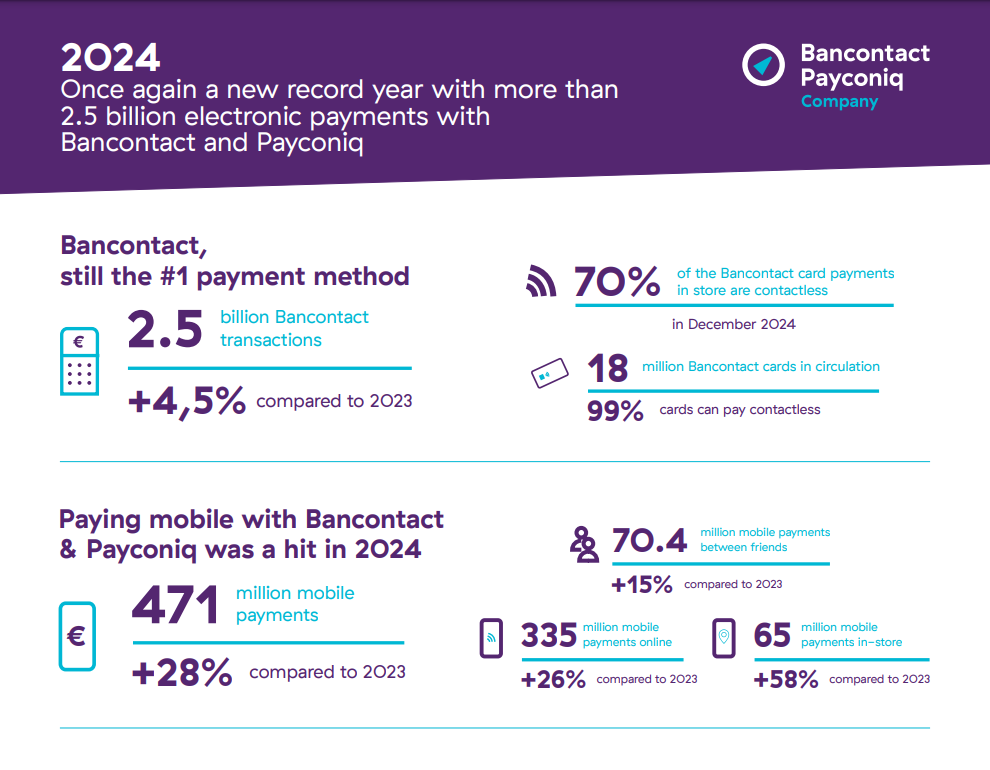

In 2024, Bancontact Payconiq Company recorded 2.5 billion payments made with Bancontact and Payconiq. That was a 4.5% increase overall compared with the previous year. Belgians are using their smartphone more and more to make payments between friends, in shops and online, with the total number of mobile payments rising 28% compared to 2023.

Contactless card payments becoming increasingly the norm: in 2024, the company racked up 1.9 billion Bancontact in-store card payments, 1.35 billion of which were contactless.

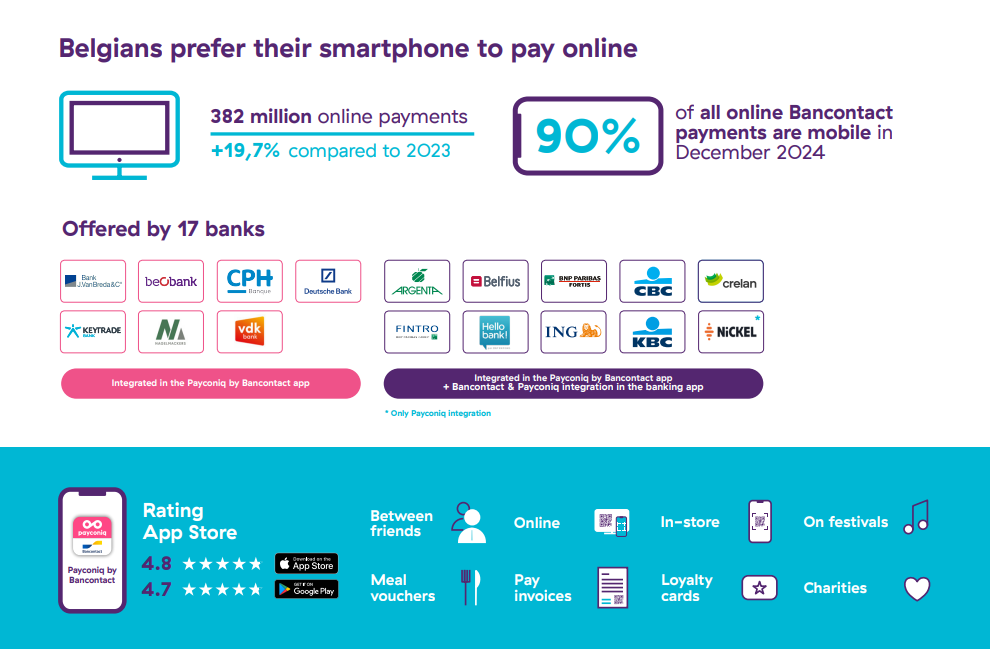

No doubt about it: online payments (using a smartphone or card reader) also had the wind behind them last year: in 2024, the company recorded 382 million online payments, which was up 19.7% compared to 2023.

Mobile payments using a smartphone gaining popularity at lightning speed: last year, the company recorded 471 million mobile payments using the Payconiq by Bancontact app or a banking app that supports payments with Bancontact and/or Payconiq. This represents a growth of almost 30% compared to 2023.

In 2024, 70.4 million mobile payments were made between friends, a rise of 15% compared with 2023.

Belgians continue to use their smartphone more often to pay when they go shopping in bricksand-mortar shops. 65 million mobile payments were made in-store at merchants. That’s an increase of 58% compared to 2023.

In total, Belgians made online payments using their smartphone around 335 million times. In December 2024, 90% of all online purchases using Bancontact were made with a smartphone.

Nathalie Vandepeute – CEO Bancontact Payconiq Company: “The expertise that we have in-house is the result of our strong connection with the needs in the market. I do not believe in blindly developing solutions that are designed in an ivory tower, somewhere far from the market itself. Only by fully understanding the specific needs of the Belgian merchants and consumers – not just the digital natives, but people of all ages – and translating them seamlessly into user-friendly payment solutions with high added value, can you convince consumers and merchants to make the switch to digital payments. It’s their money, after all. So, they need to have confidence. And you need to gain their confidence.”

The Payconiq solution is an extremely popular solution for merchants, the cimpany said. It involves shoppers scanning the merchant’s QR code – displayed on a sticker in-store, integrated into the cash register system, or on the merchant’s payment terminal or smartphone. In the future, Bancontact Payconiq Company will also distribute the European Wero product. This will mean that Belgian merchants who are connected to the Bancontact Payconiq Company network will then also have a quick and easy way to receive payments from European customers.

The Payconiq by Bancontact app allows, amongst other things, to pay using Bancontact or Payconiq

solutions in shops and online, as well as to pay back friends. The app is very much used for payments between friends and online. It is also gaining in popularity for making payments in physical stores. And it also allows you to pay certain invoices quickly.

For payments in the physical store, users simply scan the Payconiq QR code at the merchant. For online payments, they click on the Bancontact or Payconiq logo. If they buy directly on their smartphone, at the moment of the payment, the app opens automatically after selecting the Bancontact or Payconiq payment method.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: