Global banks will cut as many as 200,000 jobs in the next three to five years as artificial intelligence encroaches on tasks currently carried out by human workers, according to Bloomberg Intelligence (BI).

Chief information and technology officers surveyed for BI indicated that on average they expect a net 3% of their workforce to be cut, according to a report published Thursday. Nearly a quarter of the surveyed 93 banking executives (CIOs and CTOs) from major institutions like Citigroup, JPMorgan and Goldman Sachs anticipate more sizable job losses, ranging from 5% to 10% of their total staff.

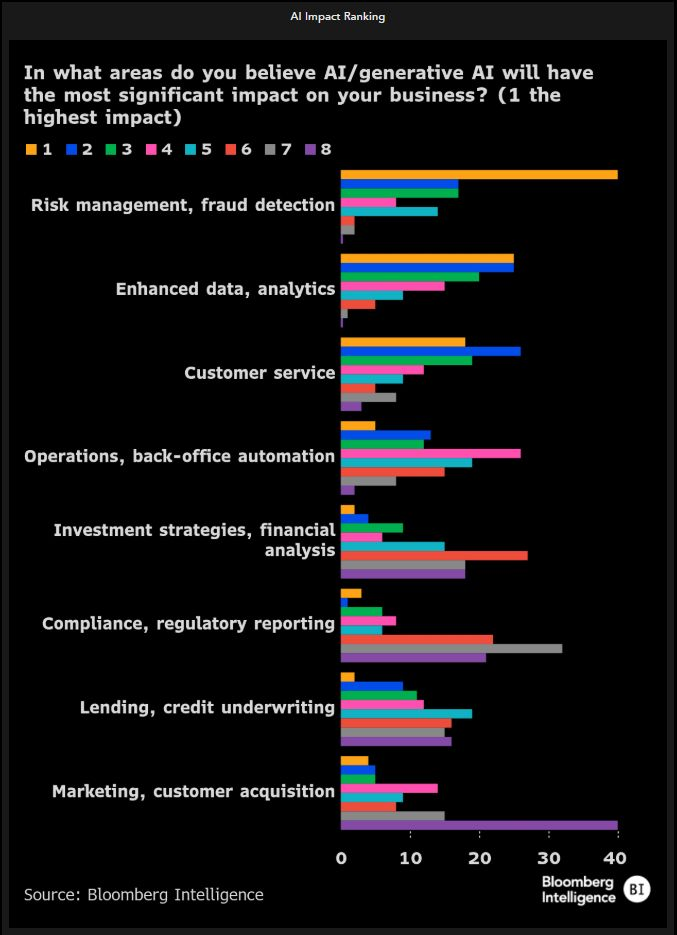

„Back office, middle office and operations” roles will likely be the most vulnerable. Positions involving data analysis, financial trend assessment and risk evaluation are particularly vulnerable, as AI systems can process vast amounts of information and generate insights at speeds far surpassing human capabilities.

Bloomberg Intelligence senior analyst Tomasz Noetzel, who authored the report, stated that AI is more likely to transform these roles rather than eliminate them entirely.

This shift toward AI is expected to increase bank profitability, with projections suggesting a 12% to 17% rise in pre-tax profits by 2027, equating to an additional $180 billion in total profits. Moreover, 80% of respondents believe that generative AI will enhance productivity and revenue by at least 5% in the same timeframe.

Reid Hoffman – the author of Superagency, commented: „There are certain jobs—especially those involving repetitive, robot-like tasks—that AI will transform. After all, robots will always be better robots than humans. But humans thrive when they’re empowered to be better humans. With AI, people will unlock new skills and deepen natural talents –– achieving what I call “superagency.”

Ultimately, the surge in productivity will guide business leaders to a realization: the right move isn’t to do the same work with fewer people but to create even greater value by leveraging more employees with new AI-driven superpowers.

Our goal should be clear. Build technology that works with us, not for us—tools that extend what it means to be human, not replace it. Because when we amplify human ingenuity, the possibilities are infinite.„

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: