eBay and Klarna, the AI-powered global payments network and shopping assistant, have announced the expansion of their strategic partnership to key European markets. According to a 2024 PYMNTS Intelligence report, nearly half of Gen Z and Millennial consumers have used BNPL in the past 12 months.

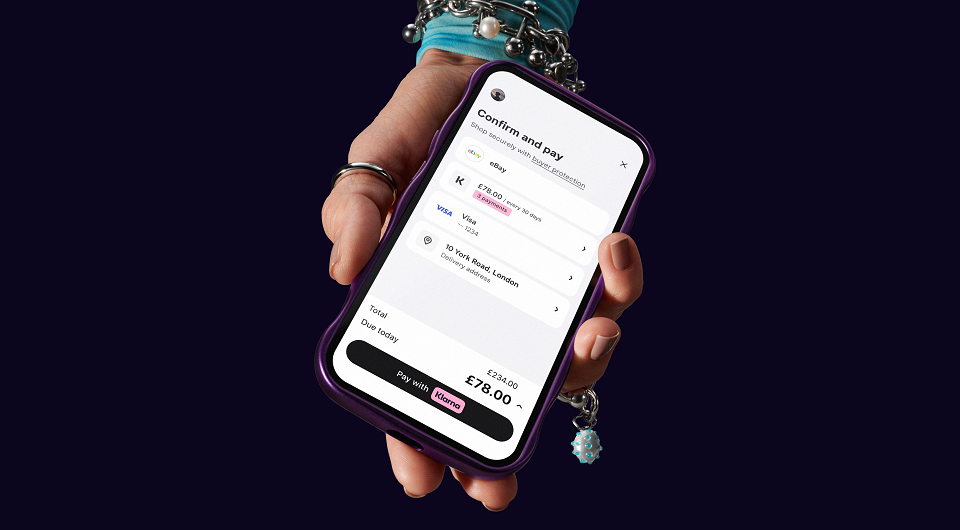

Expanding from a successful launch in Germany, eBay is offering Klarna’s flexible payment options to millions of shoppers in the U.K., Austria, France, Italy, the Netherlands and Spain, with more markets coming soon. With holiday shopping expected to increase this season, eBay shoppers can choose from Klarna’s payment options depending on their location, including interest-free Pay in 3, Pay in 30 days, or Financing for larger purchases with monthly repayments made over a longer period of time.

Avritti Khandurie Mittal, VP & General Manager of Global Payments and Financial Services at eBay said: „We are unlocking greater payment choice and flexibility for eBay shoppers by expanding our strategic partnership with Klarna to several key markets. People turn to eBay’s more than two billion listings to find the things they love, from a rare Pokemon trading card to a gently pre-loved Birkin bag or that well-priced Rolex watch. We know our customers value the ability to pay in a way that works for them. With Klarna, eBay shoppers now have the flexibility to pay over time by selecting from a variety of Klarna’s pay later payment options at checkout.”

David Sykes – Chief Commercial Officer at Klarna, said: “eBay is one of the biggest and best marketplaces in the world and we’re thrilled to partner with them. With more flexible payment options and the new resell feature, we’re making it easier than ever for millions of people to buy and sell everything—from collectible sneakers to strollers and designer bags—on eBay.”

„As consumer demand for sustainable choices grows, the resale market is booming. Starting today, Klarna users can now resell items bought through its app on eBay in minutes, with automatic listing details and images. Shoppers in the U.K., Germany, Spain, Italy, France, Austria, and the Netherlands can maximize the worth of their past purchases, generate extra income, and contribute to recommerce.” – according to the press release.

This new feature coincides with eBay’s recent announcement of free selling in the U.K., which combined with a new streamlined listing process, simple delivery, and enhanced wallet functionality through eBay Balance, is improving the selling experience on eBay.

Strategic partnerships set to accelerate growth

Klarna has made significant progress in becoming a ubiquitous global payment option. Klarna is set to become a default option via Worldpay and has expanded its partnership with Adyen, bringing Klarna to hundreds of thousands more merchant checkouts and 450,000 retail terminals in-store. Another milestone is Klarna’s launch with Apple Pay in the U.S., UK and Canada alongside the launch of Klarna on Google Pay in the US in 2025. These partnerships position Klarna to capture a larger share of the $450 billion payments revenue opportunity, driving future growth.

More brands are choosing Klarna as their global payments partner; recent launches include Zoom and Lenovo who brought flexible payments to 15 markets simultaneously, thanks to Klarna’s truly global footprint. This momentum in global expansion highlights how more partners are choosing Klarna as their unified growth partner, driving increases in average order value, conversion rates, and sales across the board.

Rapid adoption of next gen digital banking products

„Klarna balance, a newly launched product tapping into retail banks’ core business: everyday spending and saving, has attracted 1.6 million users in just three months. Klarna cashback has driven nearly $5 million in rewards, putting money back into customers’ Klarna balance accounts. The cashback offers have also boosted merchant sales by up to 30%, supporting GMV growth and affiliate partnerships.” – the company explained.

Strong Performance and Continued Growth

Net income reached SEK 216 million in Q3 2024, a 57% improvement as Klarna continues to compound growth and enhance efficiencies through AI innovation. Net income (loss) for the first nine months of 2024 was SEK (116) million, a 94% improvement compared to the same period last year. Revenue increased by 23% in the first nine months, driven by a 16% growth in Gross merchandise volume (GMV) and an increased revenue take-rate. The US market remains a key growth driver, with revenue up 33%, supported by major merchant partnerships with brands like Fashion Nova, Expedia, and Uber.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: