Crypto Outlook 2025 – The largest paradigm shift in digital asset history?

The U.S. elections catalyzed what might be the largest paradigm shift in digital asset history. They marked a seismic transformation in the regulatory landscape, with the world’s largest economy pivoting from tight restrictive oversight to institutional embrace. Talk about a plot twist, the dramatic rebound from Operation Chokepoint 2.0’s debanking initiatives to discussions of a national strategic Bitcoin reserve heavily signals a fundamental realignment of government stance toward digital assets – this goes way beyond a Bitcoin ETF or BlackRock’s courtship with crypto assets.

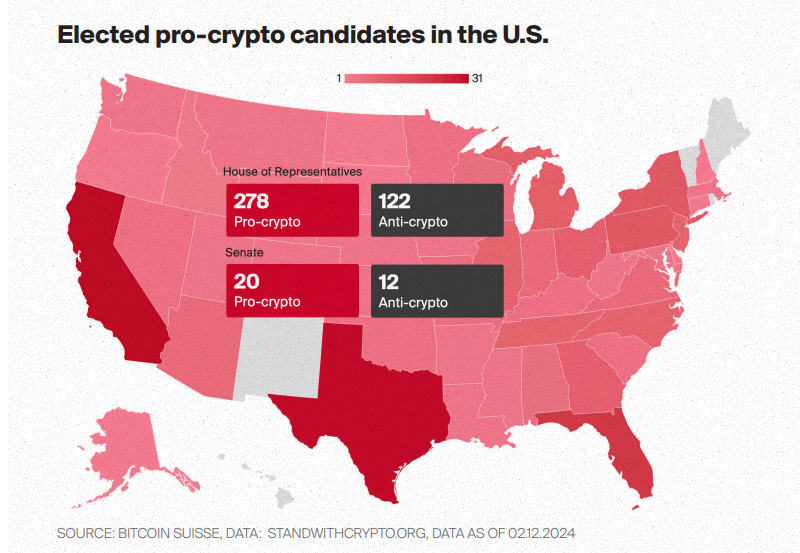

Crypto PACs deployed >$130M in election spending, securing bipartisan victories and establishing what is unmistakably the most pro-crypto Congress in history. We deem the upcoming era to be crypto’s equivalent of the late 90s internet boom, when regulatory breathing room and accommodative frameworks unleashed a wave of innovation.

With shattered ETF records and institutional entries at unparalleled pace, legacy players are not just dipping their toes anymore; they’re diving headfirst into everything digital assets. Yet, the evolving landscape extends far beyond traditional finance. New verticals such as DePIN, DeSci, and DeAI are emerging not as mere narratives but as solutions to tangible challenges.

Polymarket crossed the chasm, while developments in on-chain privacy and institutional-grade DeFi provides even more reasons to be excited about the next wave of adoption.

Translating the above into more actionable substance, the Outlook 2025 predictions aim to cover the breadth of the crypto market and range from improving macroeconomic conditions and liquidity, which are pivotal in sustaining the ongoing crypto cycle, to Bitcoin’s projected journey to new all-time highs. Further key themes include Bitcoin’s emergence as a strategic reserve asset, Ethereum’s increasing institutional adoption through staking dynamics, and the deemed resurgence of altcoins and NFTs.

BTC emerges as strategic reserve asset in the U.S.

Bitcoin is on the cusp of becoming structural to global reserve strategies. As the world navigates increasing fiscal uncertainty, geopolitical fragmentation, and a shifting monetary order, we project that Bitcoin will emerge as a primary asset in national reserves, transforming the way nations hedge against risk and assert economic sovereignty by diversifying public funds. Record central bank gold purchases and growing sovereign experimentation with Bitcoin strongly signal that reserve asset diversification is becoming increasingly relevant.

With the upcoming Trump administration, we observe growing momentum in the U.S. for adoption of Bitcoin as a strategic reserve asset. The Lummis Bitcoin Act, proposing acquisition of 1M BTC, represents a watershed moment, potentially positioning the U.S. as the dominant nation-state holder with approximately 5% network ownership, in dollar terms roughly on par with its current stake in global gold reserves. The U.S. government’s existing 200k BTC holdings from law enforcement seizures could serve as a springboard for a broader reserve strategy and provide operational precedent.

Beyond federal initiatives, momentum is tapering down to the state level. While states like Florida and Pennsylvania are pursuing ambitious direct Bitcoin acquisition strategies for their treasuries, others such as Michigan and Wisconsin are taking a more measured approach through Bitcoin-related ETFs and trusts. Public and private sector adoption metrics continue to grow alongside, with institutions adding significant volumes of Bitcoin to their balance sheets, underscoring its growing role in treasury management.

On a global scale, Bitcoin’s increasing prominence as a reserve asset is tangible. In our assessment, its surpassing of the British pound to become the 5th largest currency and its rise to the 7th largest global asset are pivotal milestones. Geopolitically, Bitcoin’s neutral nature is becoming increasingly attractive, as demonstrated by Russia’s and China’s recent recognition of Bitcoin as property.

As a hedge against potential dollar instability and as a force supporting dollar supremacy, Bitcoin is increasingly perceived as panacea to the most pressing financial obstacles. With major fiat currencies shedding >70% of their purchasing power since 2000, the case for a hard monetary anchor is increasingly apparent. It furthermore provides crucial optionality to address mounting sovereign debt challenges. With U.S. federal debt at a record $36T projected to reach $153T by 2054, Bitcoin’s CAGR could provide governments with a powerful tool to offset debt.

BTC will trade above $180’000

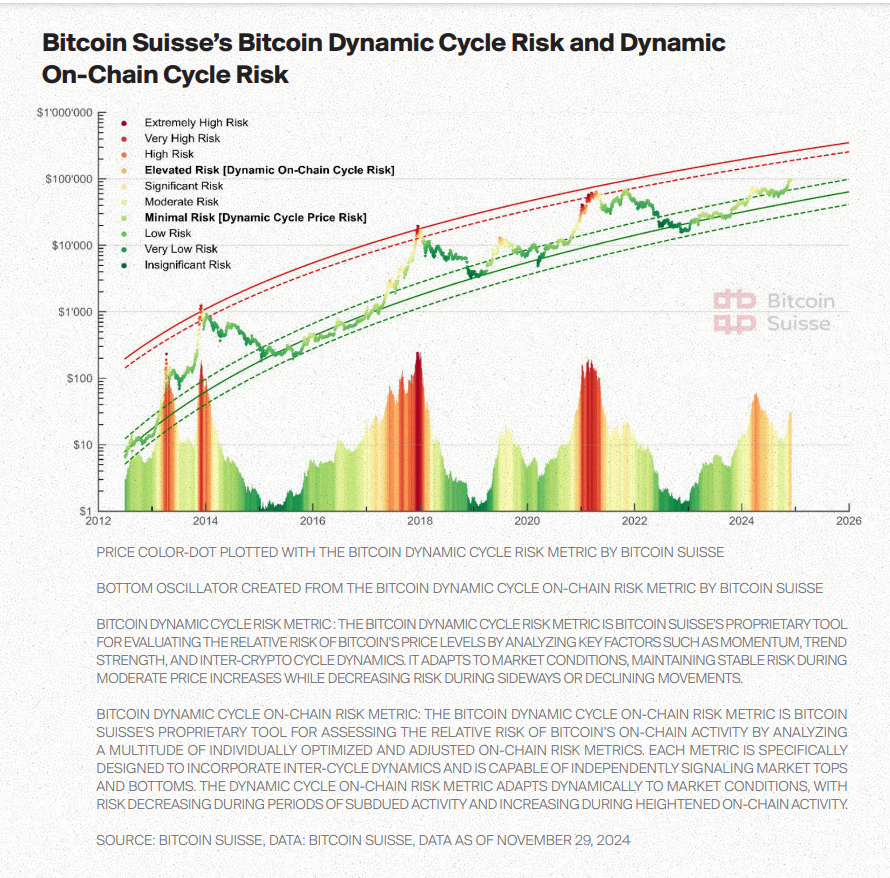

As we move into 2025, we continue to observe the unfolding of Bitcoin’s market dynamics, aligned with our cycle peak prediction first issued in November 2023. Our models predict that Bitcoin will reach cycle peak valuations in the range of $180,000 to $200,000 throughout 2025. This projection, derived from Bitcoin Suisse’s Dynamic Cycle Risk and Dynamic On-Chain Cycle Risk models, as well as aggregated growth projections, highlights that BTC is on track to set new all-time highs next year.

Bitcoin, accounting for just 0.2% of global financial assets, is dwarfed by traditional asset classes such as real estate, bonds, and gold. However, increased institutional adoption— and potentially imminent adoption by nation-states, particularly through significant moves by major players like the U.S.—could drastically alter its trajectory, disrupting traditional markets and accelerating Bitcoin’s exponential growth.

With current global assets totaling $910 trillion, if Bitcoin were to capture even a 5% to 10% share of these assets, holding all else equal and disregarding the substantial nominal growth expected in global assets over time, this would represent an overall growth of 25 to 50 times from current levels—implying a price of $2.5 million to $5 million per BTC.

Such a scenario, while substantial, appears to be a steppingstone for longer-term projections, such as Michael Saylor’s prediction of Bitcoin reaching approximately $13 million per BTC by 2045. In the short term, however, such adoption could ignite a ‘supercycle,’ pushing valuations beyond $300,000 during this cycle, aligning with the upper bounds of current trendline projections.

More details here: Bitcoin Suisse OUTLOOK 2025

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: