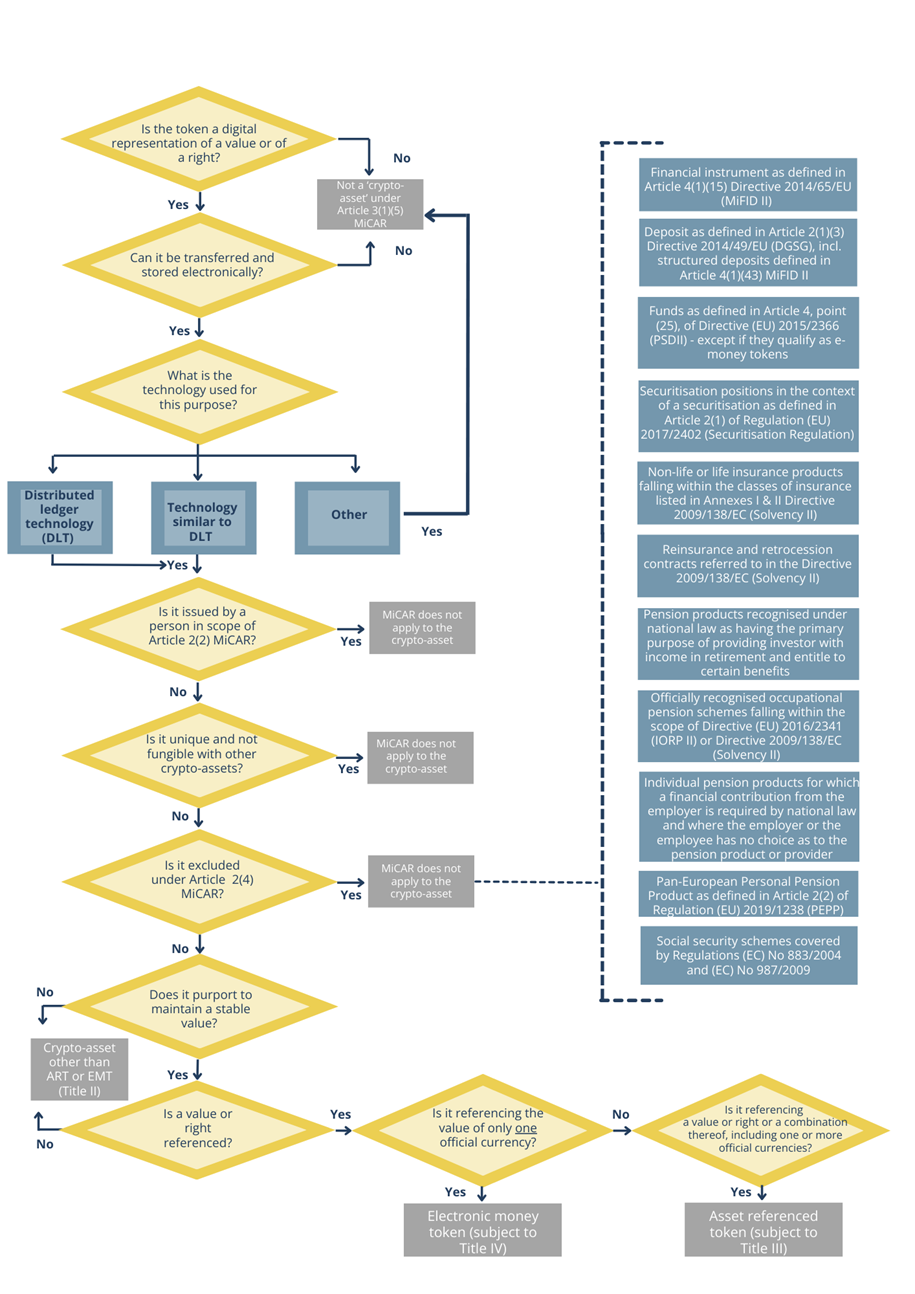

ESAs provide Guidelines to facilitate consistency in the regulatory classification of crypto-assets by industry and supervisors

The three European Supervisory Authorities (EBA, EIOPA and ESMA – the ESAs) published joint Guidelines intended to facilitate consistency in the regulatory classification of crypto-assets under MiCAR. The Guidelines include a standardised test to promote a common approach to classification as well as templates market participants should use when communicating to supervisors the regulatory classification of a crypto-asset.

To support market participants and supervisors in adopting a convergent approach to the classification of crypto-assets the templates for explanations and legal opinions provide descriptions of the regulatory classification of crypto-assets in the following cases:

. Asset-referenced tokens (ARTs): The white paper for the issuance of ARTs must be accompanied by a legal opinion that explains the classification of the crypto-asset – in particular, the fact it is not an electronic money token (EMT) nor a crypto-asset excluded from the scope of MiCAR.

. Crypto-assets that are not ARTs or EMTs under MiCAR: The white paper for the crypto-asset must be accompanied by an explanation of the classification of the crypto-asset – in particular, the fact that it is not an EMT, an ART or crypto-asset excluded from the scope of MiCAR.

The overall aim of these Guidelines is to promote convergence in classification for the consistent application of MiCAR across the EU. In turn, this is intended to contribute to enhancing consumer/investor protection, securing a level playing field, and mitigating risks of regulatory arbitrage. These guidelines will be translated into the official EU languages and published on the ESAs’ websites. The guidelines will apply from three months after the publication of the translations.

Standardised test for crypto-assets

Background and next step

The Guidelines have been developed in accordance with Article 97(1) of the Regulation on Markets in Crypto-assets (MiCAR) (Regulation (EU) 2023/1114) which requires the ESAs, by 30 December 2024, to jointly issue Guidelines in accordance with Article 16 of the ESA Founding Regulations (Regulation (EU) No 1093/2010, Regulation 1094/2010, Regulation 1095/2010) to specify the content and form of the explanation accompanying the crypto-asset white paper referred to in Article 8(4), and the legal opinions on the qualification of asset-referenced tokens (ARTs) referred to in Article 17(1), point (b)(ii), and Article 18(2), point (e) of MiCAR. The Guidelines are required to include a template for the explanation and the opinion and a standardised test for the classification of crypto-assets. This is the only joint ESA policy mandate under MiCAR.

MiCAR establishes regimes for regulating the issuance, offering to the public, and admission to trading of ARTs and EMTs and other crypto-assets. The Regulation also establishes a framework for crypto-asset service provision.

The regime for ARTs and EMTs established by MiCAR entered into application at the end of June 2024, with other parts of the Regulation (issuance of other types of crypto-assets, and crypto-asset service provision) entering into application at end-2024.

_____________

Documents

ESAs Guidelines on templates for explanations and opinions, and the standardised test for the classification of crypto-assets (914.28 KB – PDF)- Download

Related content

ESAs Guidelines on templates for explanations and opinions, and the standardised test for the classification of crypto-assets under MiCAR

Topic

Asset-referenced and e-money tokens (MiCAR)

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: