Can a bank become a superapp?

an article written by Panagiotis Kriaris, Head of Business and Corporate Development at Unzer

It’s not PayPal, Revolut or Square but it has been winning the SuperApp race. And it’s a bank…How can a bank become a SuperApp? Let’s take a look.

Bank Kaspiyskiy was a small bank founded in Almaty, Kazakhstan in 1991. In 2002 it was privatized and rebranded as Kaspi Bank. It was the first milestone in a long and impressive journey that transformed a local commercial lender to a SuperApp that is today:

— used by 70% of Kazakhstan’s 20 mn population

— 11.2 mln monthly active users out of a population of 19.7 mln people

— 30% of Kazakhstan’s 2 mn merchants accept Kaspi payments

What big players have strived to achieve, a small bank from Kazakhstan managed to do. Kaspi.kz is the closest thing to the Tencent and WeChat originals.

Here is my summary of how they pulled it off:

— Digital native play. Kaspi is mobile only.

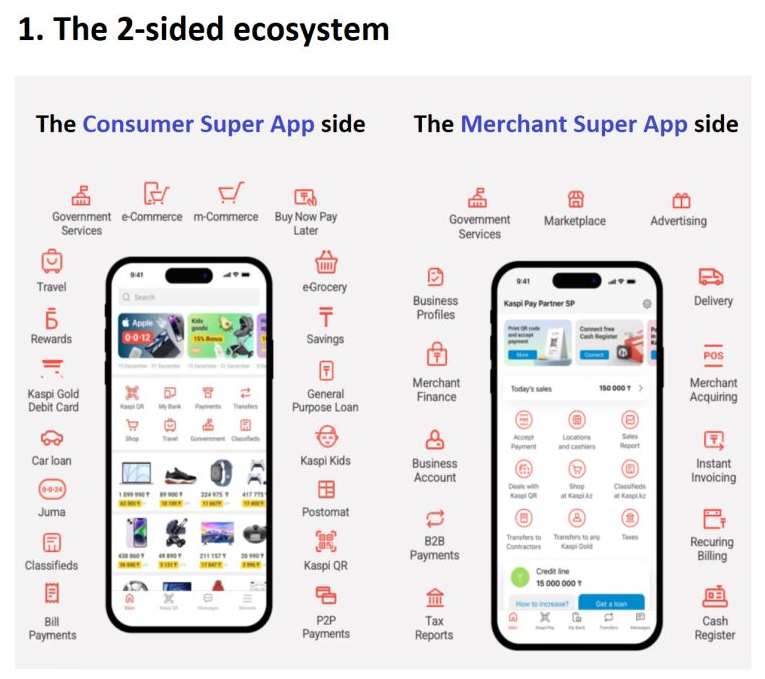

— They employ a two sided ecosystem play connecting merchants with consumers: Kaspi.kz is the SuperApp for consumers and Kaspi Pay is the SuperApp for merchants

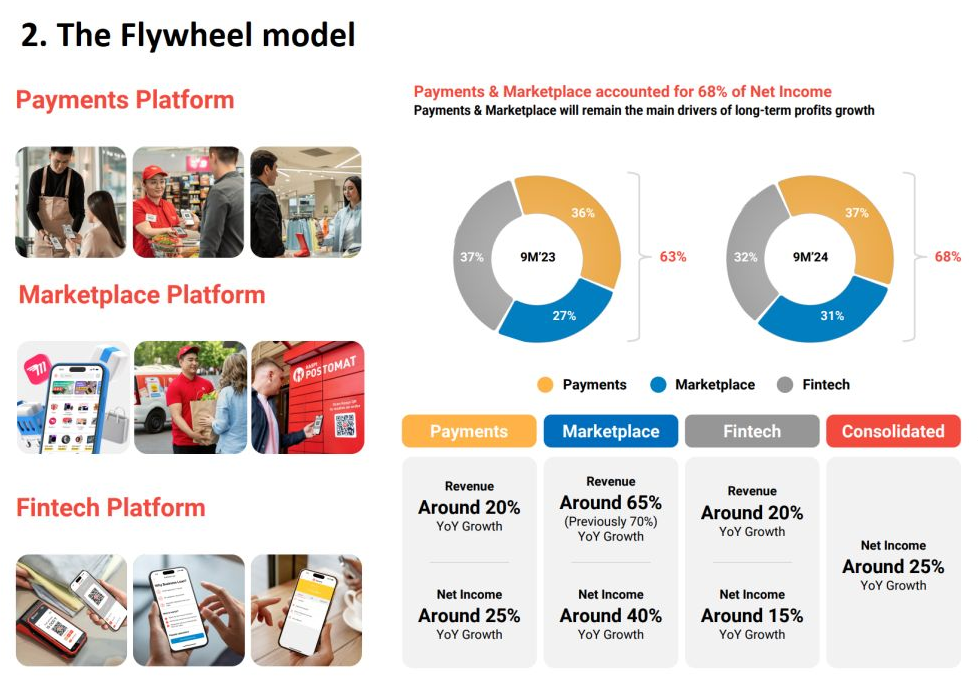

— Kaspi has 3 platforms (Payments, Marketplace, and Fintech). All can be assessed via the consumer and merchant SuperApps

— All Kaspi services are designed to be highly relevant to users’ everyday needs and enable consumers and merchants to connect and transact, via their proprietary payments network

— The combination of a large, highly engaged consumer and merchant base, best-in-class, highly relevant digital products and a capex lite approach, results in strong top-line growth and a profitable business model

— P2P, Bill Payments, BNPL, Kaspi QR and GovTech as the basis for high day-to-day consumer engagement

— Continuous introduction of new products to drive higher transactions across more areas of household spending and merchant activity

— New product example: Kaspi B2B Payments – born out of Bill Payments and P2P – connecting small merchants with wholesalers, distributors and manufacturers, allowing invoices to be settled instantly

— Focus on onboarding as many merchants as rapidly as possible with Kaspi Pay and m-Commerce in the driving seat

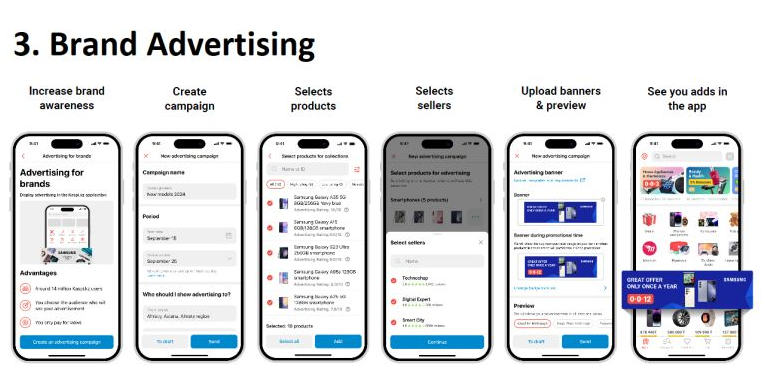

— Ecosystem play via adjacent, beyond banking merchant services: e-Commerce, B2B Payments, Kaspi Advertising, Kaspi Delivery, financing for merchants and SMEs

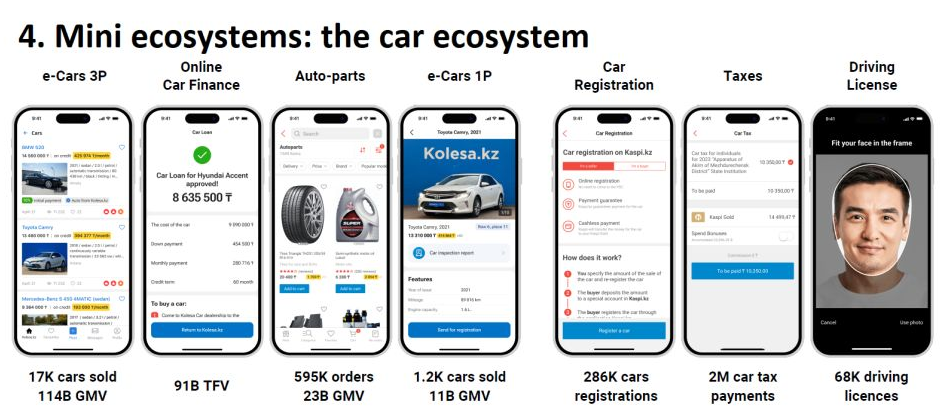

— Focus on growing less mature services like including eCommerce & Kaspi Postomats, Kaspi Travel, e-Grocery and Kaspi Classifieds following a mini-app approach

The rise of the platform economy is here and is reshaping banking from the ground up. Whatever they do – and it doesn’t have to be a SuperApp – banks need to get out of their comfort zone and find new ways of adding value.

The Kaspi.kz case study and how they dit it

Graphic sources: Kaspi.kz, Fintech in Kazahkstan

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: