Chatbots are just the beginning of the evolution from the current knowledge-based, generative AI-based tools—such as chatbots that answer questions and generate content—to agents that use models to execute complex, multistep workflows across a digital world, moving from talking to doing.

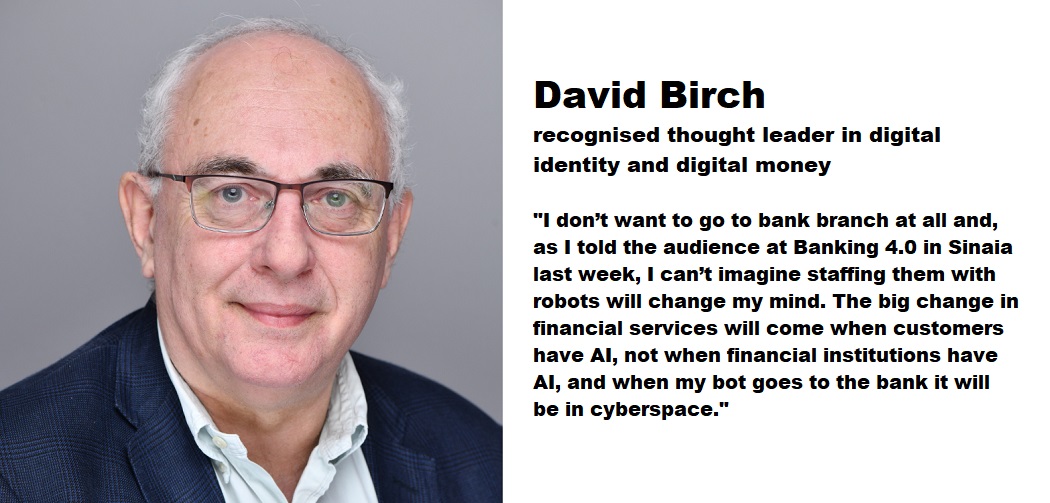

an article written by David Birch, author, advisor and commentator on digital financial services.

Coinbase founder Brian Armstrong made an interesting comment on TwiX, talking about how AIs cannot get bank accounts but can get cryptowallets. He was making the point that AI agents can now use USDC on Base to transact with humans, merchants or other AIs. While it is right to say that (for now) an AI cannot open a bank account, there’s nothing to stop an AI from using a bank account to make and receive payments.

In fact, thanks to open banking, it is actually quite easy for them to do this. Mike Kelly, who is both an expert on the UK’s open banking infrastructure (and something of a fintech nuts and bolts guy) demonstrated this some time ago when he built a plug-in to link ChatGPT to his bank account using the UK’s open banking APIs. The plug-in, called “BankGPT” can tell you your balance, find transactions, discuss your budgeting and even make payments.

Connecting bots to banks is not by any stretch of the imagination rocket science: In fact it is an inevitable progression given the interplay with open banking initiatives around the world and AI systems that are becoming increasingly agentic: That is, capable of dynamically and independently carrying out actions toward goals over extended periods of time, without humans being in the loop or pre-specifying their actions or subgoals.

As McKinsey say, chatbots are just the beginning of the evolution from the current knowledge-based, generative AI-based tools—such as chatbots that answer questions and generate content—to agents that use models to execute complex, multistep workflows across a digital world, moving from talking to doing. These agentic AIs (actually, for simplicity, let’s go back to calling them bots) will be more like human Internet users. That is, capable of traversing the matrix as humans do but much faster. That’s one way of looking at it but I think having intelligent users will have more of an impact on the share of the future online environment that having fast users!

McKinsey in 2020 were predicting the use of robots in bank branches, which seems unlikely to me. I don’t want to go to bank branch at all and, as I told the audience at Banking 4.0 in Sinaia this week, I can’t imagine staffing them with robots will change my mind. That’s just not where we the technology is going. In fact, as I have often said, the big change in financial services will come when customers have AI, not when financial institutions have AI, and when my bot goes to the bank it will be in cyberspace.

Citi GPS’ June 2024 report on “AI in Finance: Bot, Bank & Beyond” makes for pretty interesting reading if you are curious about the impact of AI on a global financial institution (full disclosure: I was one of the expert contributors to this report). In the report, the former Standard Chartered Group Chief Data Officer Shameek Kundu says that “the biggest new thing will be the growth of non-human customers”.

I could not agree more and at the event I made a few suggestions as to what competition might look like in this new world.

These suggestions are nothing much more than informed guesses right now because it would be bold to point of hubris to put forward a solution to the impending “three bot problem” of interacting customer AI, bank AI and regulator AI to determine the trajectory of financial services in the world just around the corner.

Having said that, there is one thing that I think is pretty clear and that is that banks will likely need to compete much more sharply on price to retain clients’ wallet share. Why? Well, bots can compare multiple prices simultaneously, so being the cheapest will likely always be a significant factor, but if it is the only factor than the banks’ only strategy is a race to the bottom to be the cheapest pipe.

Banks could therefore adopt an execution strategy focused on operational efficiency, enabling them to compete on volumes and win deals purely based on price but since prices will rapidly fall to the lowest level, banks may need to find other competitive advantages. They may need to optimise their operations for bot preferences, which might differ from human preferences. For example, bots might prioritise factors like the speed of API response, API uptime, data accuracy, and richness of API data.

Optimising for these non-human factors could provide banks a competitive edge, so they should probably begin to assess their strategies for the medium term. If the face of the bank is not the branch or the website or the call centre but the API, then the nature of competition will be soon be very different.

If you are a banker, ask yourself this: what is your institution’s strategy for dealing with customers who suddenly become ten times smarter overnight?

Change is opportunity as someone like Confucius or Littlefinger might have said, and there must be fintech opportunity here. One example is Skyfire (which just raised $8.5 million from Neuberger Berman, Inception Capital, Arrington Capital and others), who have created a payment network specifically for bots to make autonomous transactions. Each bot gets a digital wallet with a unique identifier. Business can deposit funds for the bot to spend with customer-defined limits and they get a dashboard to view exactly how much, and where, their bot is spending.

This is a window into the financial market infrastructure of the future that will be used by both people and bots. In order for this to happen, and in order for the economy as a whole to benefit from the new opportunities here, we need a digital identity infrastructure capable of both giving identities to bots and providing a mechanism for bots to obtain permission to act on the account holders behalf.

(As it happens, this will be the subject of my closing keynote at ID Next in Utrecht next week!)

By the way, having just wasted hours of my time searching for the right investment savings account to move some money into, I personally cannot wait for the day when I can hand this mundane task over to a basic bot. That is absolutely not the same thing as giving a bot a bank account, though. For one thing, how would a bot pass banks’ stringent KYC checks?

Well, that’s for another day…

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: