Wallet wars: the battle for your digital life

Digital Identity is about to reshape finance. It’s finally happening.

An article written by Simon Taylor – Head of Strategy & Content at Sardine

While everyone’s watching AI, the biggest tech companies are quietly fighting for control of your digital identity. Apple owns 51% of the US smartphone market and just opened their NFC. PayPal is pushing Fastlane, Venmo, and partnerships. The banks launched Paze.

This isn’t about payments. It’s about who owns your digital future.

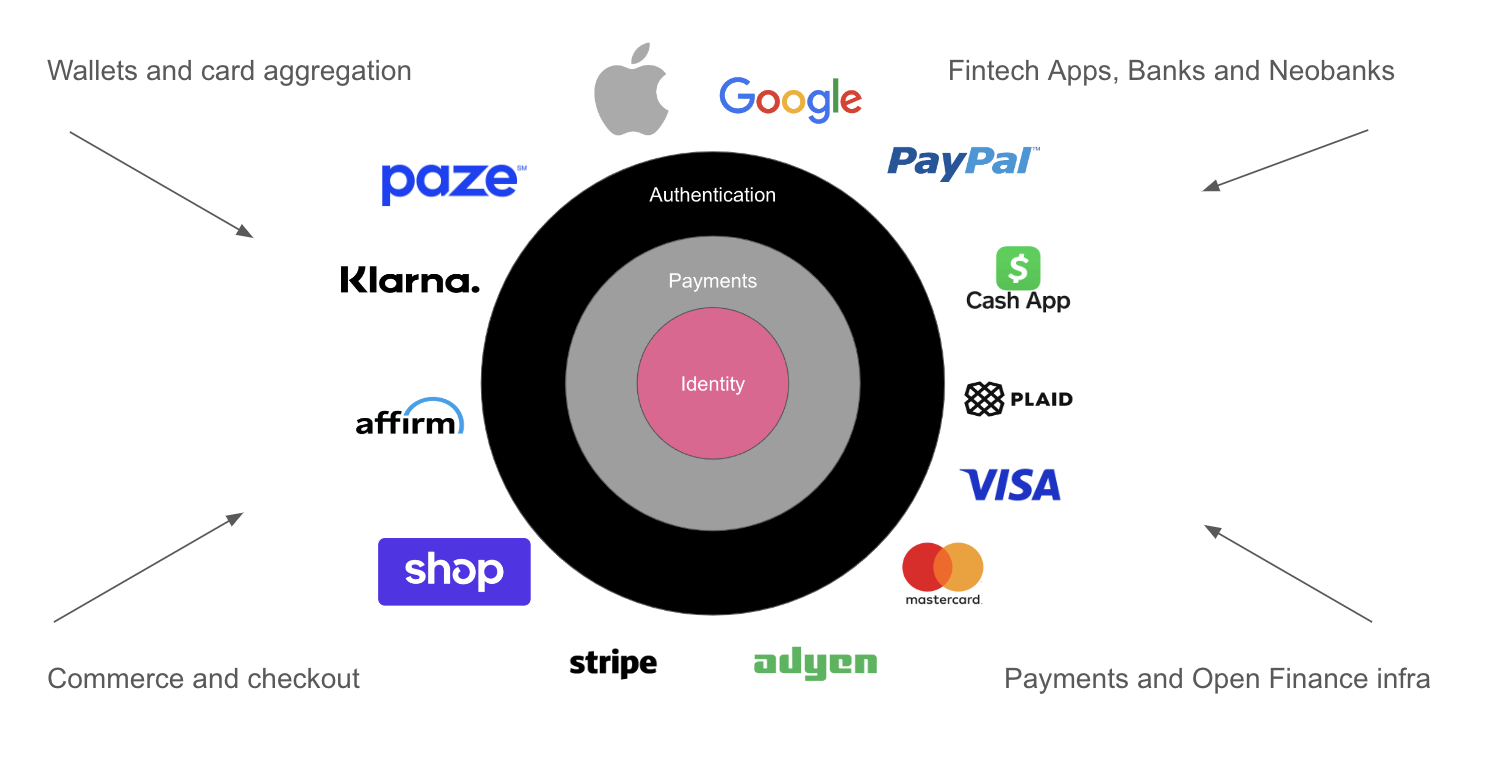

The wallet will become the consumers’ center of gravity, not the account, app, or checkout. Consumers have countless cards, apps, and accounts that will be bundled by a handful of market actors like Apple, PayPal, Cash App, and possibly even Paze. But there are a lot of challenges to overcome first.

A decade ago, card issuers talked about being „top of wallet.” Now, it’s about being the wallet itself. Whoever owns identity wins.

The time is now. After an explosion of unbundling the banks, we’re about to witness the great rebundling of financial services.

The crucial moment in the wallet wars was when the European Commission forced Apple to open NFC access to its devices, and now Apple has followed suit in many of its major markets.

NFC unlocks tap-to-pay, tap-to-enter (ticketing), tap-to-prove identity, and tap-to-anything.

Wallets will begin the great rebundling of finance.

Who will win?

Apple has 51% smartphone market share, identity + wallets + hardware + local AI, but lost its mojo and pace. OEM wallets can do strong identity, ticketing and payment methods. They’re also becoming accelerated checkouts and can bake agents into the device. Apple is in the lead and has all the tailwinds, but it is also moving slowly. Yet, Apple may have lost its mojo.

Banks and Paze will follow, not lead the market. I doubt they’ll do much with “AI agents”. They’ll have scale and instant distribution, but they won’t imagine the future. The Venmos and Cash Apps of the world have a generational opportunity to build something truly magical for their customer base.

PSPs can become the ultimate aggregation point. Stripe Link is fascinating. If you model it out, Stripe Link is a consumer wallet, but Stripe can support open finance, Visa flexible credentials, BNPL, and offer various accelerated checkout solutions. Expect Adyen to follow closely.

Open Finance has a claim at identity and aggregation but is probably more of a data provider. Plaid, in particular, is a strong consumer brand, but in time, „account ID” or Tokenized Account Numbers (TANs) start to resemble tokenized card numbers (DPANs). Open finance is ultimately infrastructure, not consumer.

Fintech wallets like Venmo and Cash App have a generational opportunity. They could innovate with AI Agent-like experiences. PayPal with 400m users, merchants, and now Fastlane and some Mojo is playing to win. Flexible credentials, tokenized accounts, and open access to NFC are a gift. If they can get a strong identity right, they can start to aggregate multiple services without providing them all in-house. Your wallet could be more of a marketplace and less of a store.

Accelerated checkouts provide convenience but need to become wallets. They’re almost the perfect wedge for commerce and user adoption, but they’re yet to bundle loyalty or identity well. Klarna and Affirm probably fit better in a wallet than existing as a wallet.

None of these players will disappear, all of them will continue to be in the landscape. But the prize? The prize is bigger than that” The Everything Wallet.

A wallet that combines identity, payments, and tap-to-anything will own the future consumer experience. There are many paths to becoming that wallet, but the prize is truly owning a customer in a way that wasn’t possible for the universal banks.

The players: OEMs, Fintech Apps and Banks have all started towards becoming an everything wallet. The OEMs are closer to identity, but with NFC available now its open season. The card networks, open finance companies and PSPs all have a path to more market share as infrastructure for identity in wallets.

The Everything Wallet will:

. Own a strong identity credential backed by a Government entity

. Aggregate all of my accounts, tickets, and loyalty

. Route my payments by highest points or lowest cost

. Manage delivery and returns elegantly

. Help me find new products

. Automagic away admin like taxes or refunds

. Support stocks, investments, and savings and manage sweeps

. Natively support stablecoin and cross-border rails (there’s an entire Rant about why for another day)

People don’t want to manage their money; they want software to do that for them. In the next 12 to 24 months, watch as Fintech companies, banks, and Tech companies go after identity and payment methods much more aggressively.

The battle for who gets to BE the wallet is on. Let the wallet wars begin!

Read the article in full here

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: