Klarna, the biggest global BNPL provider in the world with 85 million active consumers, is now available to users checking out on Apple Pay online and in apps with iPhone and iPad on iOS 18 and iPadOS 18 or later.

„Starting today, eligible Apple Pay users in the U.S. and UK will have access to Klarna’s flexible payment offerings, including pay later in three or four installments with no interest or over longer periods with APRs starting at 0%. The global expansion will continue with Canada slated to launch in the coming months.” – according to the press release.

“Consumers around the world have been asking for Klarna on Apple Pay, so I’m super proud to let them know it’s here! Our fair, flexible and interest-free payments options are now even easier to use at your favorite merchants when checking out on Apple Pay online and in apps in the U.S., UK and soon Canada. This is a big step toward our mission to offer consumers Klarna at every checkout.“ said Sebastian Siemiatkowski – Co-founder and CEO of Klarna.

Klarna’s Pay in 4 payment offering gives consumers 4 fixed repayments for purchases between $35-$2,000, all interest-free. Financing is available for higher ticket items with monthly repayments made over a longer period of time starting at 0% APR.

„We’re excited to give users in the U.S. and U.K. more choice in how they pay with the addition of Klarna’s flexible payment options right at checkout on Apple Pay,” said Jennifer Bailey – Apple’s vice president of Apple Pay and Apple Wallet. “With this rollout, users have the option to pay for purchases over time, and they get to enjoy the seamless and secure experience of Apple Pay that they already know and love.”

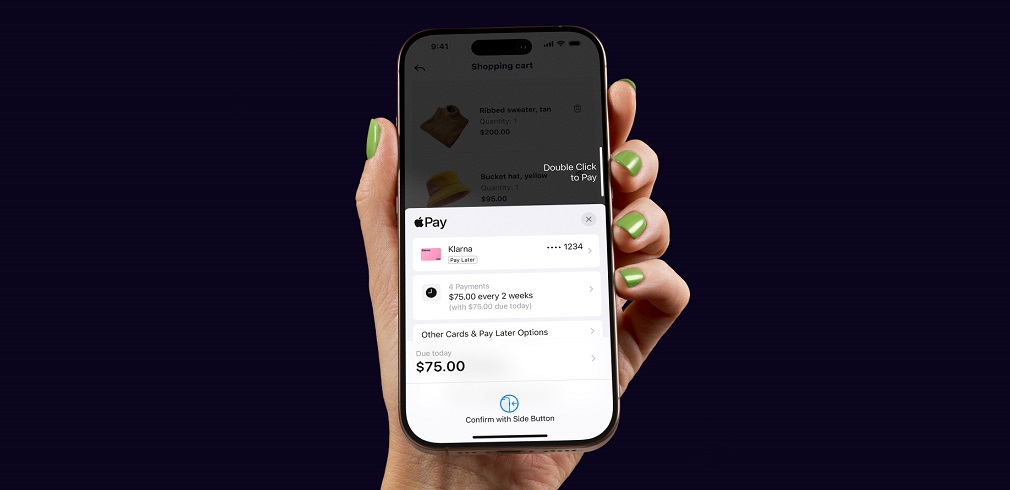

This new integration makes the world of flexible payment options even more accessible as consumers can make purchases using Klarna directly on an iPhone or iPad, in app and online with Apple Pay.

Eligible users can select ‘Other Cards & Pay Later Options’ when checking out on Apple Pay with an iPhone or iPad, and then select Klarna to access the Klarna products that are available to them. Once they agree to the terms, they can double-click the side button and authenticate with Face ID or Touch ID to confirm their purchase. Before approving the purchase, Klarna will make a new lending decision, using its industry-leading underwriting checks. This decision will not impact a customers’ credit score.

„With this integration, users can enjoy all the privacy and security features they love about Apple Pay. As with all Apple Pay purchases, when a user pays with Klarna, Apple does not keep a record of a user’s transaction history.” – the companuy explained.

Last month, Klarna became an official reseller with the launch of “Apple from Klarna”, a storefront in the Klarna app and Klarna.com where US customers can purchase Apple products using flexible payment options.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: