The British fintech company Pockit and the pan-European fintech Monese announced that they have agreed terms for Pockit to acquire Monese, subject to Change in Control approval by the FCA, creating the leading fintech for the financially underserved and lower-middle-income consumers across the UK and Europe.

Pockit and its shareholders, led by Puma Growth Partners (formerly Puma Private Equity), will make a significant injection of up to £15 million in equity capital to fund the integration and future growth of the business. Further financial terms of the deal are undisclosed.

The combined group will serve c.3 million customers and generate almost £30 million in annualised run-rate revenue.

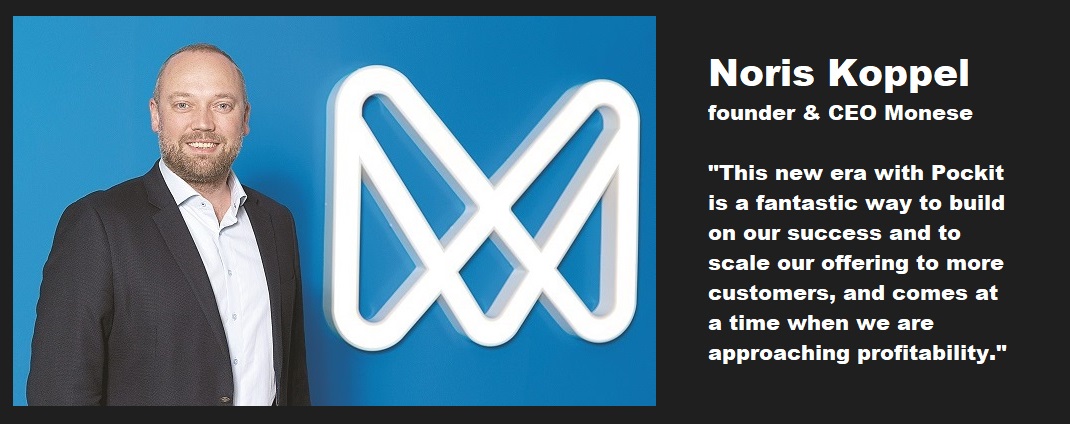

Following completion of the acquisition, Pockit founder and CEO Virraj Jatania will lead the enlarged business. Norris Koppel (photo), founder and CEO of Monese, will remain involved with the combined company post-completion to help ensure a smooth transition.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: