US banks invest three times more in tech than European banks

an article by Chris Skinner, independent commentator on the financial markets and the author of the bestselling book Digital Bank

I got an interesting question in my recent banking presentation:

US banks have spent far more on technology than banks in Europe – will European banks ever be able to catch-up?

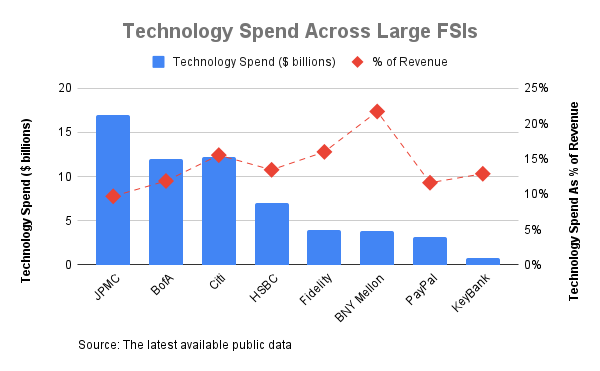

It is true that American banks have spent far more on tech. To illustrate the point: JPMorgan spent over $15 billion last year, and is forecast to spend $17 billion this year; Citigroup invested over $12 billion; whilst Bank of America spent almost $11 billion.

HSBC invests around $6 billion a year; Deutsche Bank almost $5 billion; and Barclays just over a billion.

In all of the above budgets, around half or more is spent on keeping the lights on, and then the rest on innovation and renovation. One of the standouts for me is that all of the banks have been working on improving their services through cloud and AI. Having said that, JPMorgan still operates more than 30 data centres and employs a technology workforce of more than 63,000 people. No wonder it costs so much.

Can the Europeans compete?

Yes, but maybe not the traditional European banks. Maybe it’s the fintechs.

Revolut is onboarding more people today than Facebook or Snapchat, and has a valuation of around $45 billion and growing. NuBank has over 100 million customers, a valuation of $56 billion and is growing fast. There are many others out there doing great things – you know their names – so, I wonder if the tens of billions spent by old banks is going to give them an edge of the tens of millions spent by new banks, and it always draws me back to a statement made by one start-up years ago:

“We achieve more with ten people and a million dollars than traditional banks achieve with 1,000 people and a billion dollars”.

Is this truth or dare?

My thinking is this. If half or more of a big banks budget is going into maintenance of existing systems, they need to sort it out and get rid of those systems. Everything today is cloud and AI – that’s where the money should be going, not into keeping 1970s COBOL mainframe systems running.

Now, of course, I know it’s not that easy. You’ve gotta keep the light on, but the trouble is that if the new kids on the block are stealing a massive march by innovating and you can’t keep up, then you’re dead.

Meanwhile, the question regarding can EU banks keep up with American banks … is that really a question? It’s not size that matters these days, it’s speed. So who’s got the biggest budget is just irrelevant. In fact, I told my European bank friends to send me a budget pic, and this is what I got.

You have to put everything into context.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: