Tink launches Merchant Information to give consumers full transaction visibility

The solution will be available in seven European markets in 2024 with a full European roll out to follow by spring 2025.

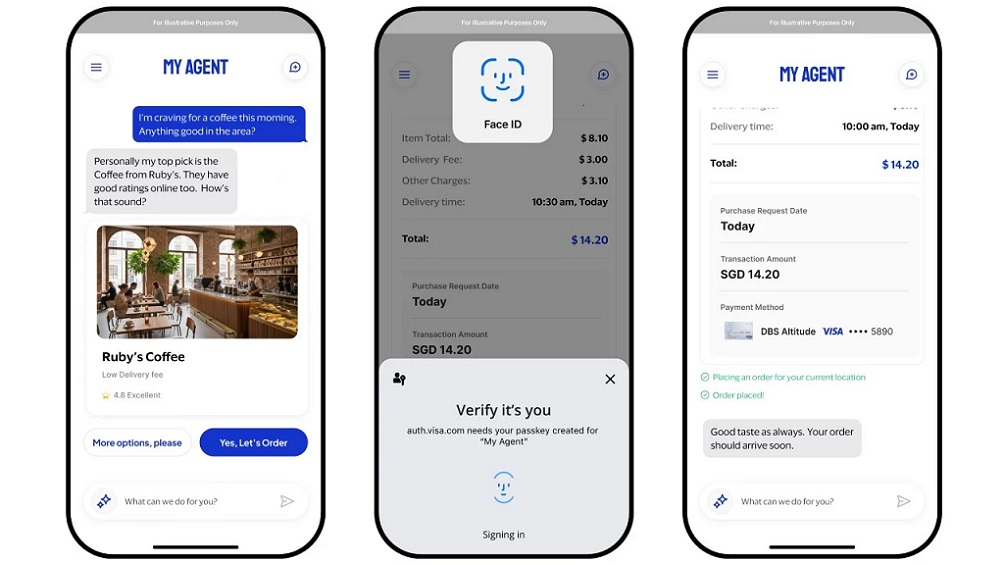

Merchant Information, a solution within Tink’s Consumer Engagement offering, „means banking app transactions are shown with a clear brand name, logo, location, and merchant contact details – reducing the need for consumers to contact their bank to enquire about transactions they don’t recognise” – according to the press release.

Merchant Information will enrich card and non-card transactions, providing consumers with a thorough understanding of their spend. Merchant Information will complement Tink’s existing data enrichment capabilities, including categorisation, recurring transaction prediction, and CO2 emissions.

As part of Visa, Tink’s Merchant Information leverages Visa’s global data network of 130m+ merchants as well as other third-party data sources for scaled coverage in 200+ markets. As a result, Tink’s capabilities enable banks to display clear, visually appealing transaction data in their app to drive consumer engagement.

Tink’s research* shows that 45% of adults in the UK already want their bank to show them more details about their individual payments, such as logo, location and retailer name. With this greater visibility, people can identify their transactions and better understand their finances.

For banks, this means cost savings from reduced call centre enquiries and transaction chargebacks. Tink’s analysis indicates that large issuers can save as much as €22m annually by providing greater clarity to their customers.

Merchant Information includes a series of benefits for consumers and banks:

. Reduce cardholder enquiries: the information simplifies transaction reconciliation, reducing transaction enquiry call volumes

. Fraud prevention: greater ability to deter friendly fraud and improve fraud models through granular transaction information

. A better digital user interface: the structured and clear transaction data drives in-app engagement and helps consumers to better understand and manage their finances

. Increase customer loyalty: clearer information on customer spend enables greater personalisation of services to drive customer engagement

Jack Spiers, Banking & Lending Director at Tink, commented: “By providing a clear and understandable way of presenting bank account transactions, Tink’s new Merchant Information solution is a win-win for all parties. Consumers can easily recognise their transactions, reducing the need to contact their bank for additional information or to request a refund. While for banks, this opens up large potential cost savings, through fewer enquiries.

“Banks and merchants are increasingly interconnected in their digital transformation journeys. Tapping into Visa’s extensive merchant data network, we can enhance the customer experience to give consumers the 360-degree understanding of their spend they deserve.”

_____________

* Consumer research was conducted by Censuswide on behalf of Tink in May 2024 amongst a nationally representative sample of 2,010 consumers aged 16+ in the UK. Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct and ESOMAR principles. Censuswide is also a member of the British Polling Council.

Tink, A Visa Solution, is a market-leading open banking platform serving some of the world’s largest financial institutions. Tink provides payments, banking, and lending solutions that power the new world of finance – whether that’s initiating account-to-account payments, onboarding new users, enabling better risk decisions or creating engaging money management tools. A wholly owned subsidiary of Visa, Tink was founded in Stockholm in 2012. Today, Tink and Visa’s open banking solutions are present in 20 markets, with 13,000 connections to financial institutions. Tink enables its partners to offer data-driven experiences that help eliminate complexity for millions of consumers across the globe.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: