Deposits And Cheques

When it comes to digital payments, everything old is new again.

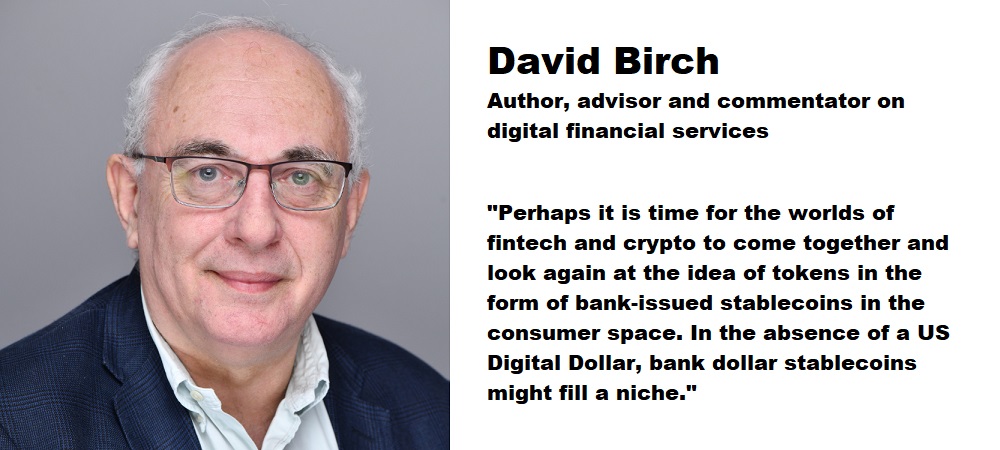

An article written by David Birch, a world-class keynote speaker, a published author on digital money and digital identity, a well-read fintech columnist, an inveterate social media commentator and an international board-level advisor on digital financial services. David is coming to Banking 4.0.

Here’s a way of improving the payments infrastructure and extending inclusion by using circulating bank-issued cheques instead of cash as a means of exchange. I’ll call it the d-cheque scheme and I’ll explain it using paper as the implementation.

Payments Push

The d-cheque scheme works in this way. Customers are given books of cheques that are preprinted with a maximum amount and protected with a simple anti-rewriting mechanism such as perforations with the same amount on them. To avoid the problem of cheques bouncing and the uncertainties related to clearing (and to obviate the need for any form of cheque guarantee card, as we used to have in the UK) the value of the cheques given to any customer is against money that is held in an interest-bearing account for them.

So, for example, I would ask Citi for $100 in d-cheques. Citi then gives me a book of ten maximum $10 cheques. The $100 is moved from my checking account to an interest-bearing deposit account solely for the purpose of backing the cheques. The cheques would be valid for, say, two years.

When I want to pay my gardener $20, I sign two of the cheques and give them to her. Now that the cheques have been signed by the owner, the gardener can use them in lieu of cash, up until the expiry date – no need to pay them into a bank account, which is the time-consuming and expensive part. She can use them to pay her mechanic, who can then use them at the farmer’s market and so on. Everywhere they go, they are accepted at par.

Such secure paper bearer instruments — no, wait, let’s stop calling them secure paper bearer instruments, let’s call them “tokens” — are pre-paid and therefore behave as a substitute for cash. The unsigned tokens are effectively an ATM at home and when you sign a $10 token to activate it, it is just as if you have drawn the $10 out of an ATM (except that it is cheaper and more convenient).

For those readers familiar with the technologies of cryptocurrency and business model of banks, this token scheme sounds something like the Regulated Liability Network (RLN) that proposes a settlement infrastructure to ensure that tokenised bank deposits are interoperable between the financial institutions that issue it (eg, Citi’s $10 tokens and Wells Fargo’S $10 tokens) — and indeed it is, except that it was invented in 1873 by a Mr. James Hertz as the “deposit-cheque” scheme. Mr. Hertz set up a “Cheque Bank” in London saying that he intended it to become the medium for the “accomplishment of an immense mass of small payments”.

The idea behind The Cheque Bank Ltd. was to address the limitations and risks associated with traditional cheques in the 19th century. At that time, cheques were primarily used by wealthy people (and businesses) and required the payee to have a bank account to deposit the cheque, which wasn’t always convenient or feasible for all individuals or businesses. It had quite a good “ignition strategy” as far as I can see. They were targeting businesses for whom the payment of wages in cash was an onerous and expensive task. According to the Handbook of London Bankers for 1876, there were nearly one thousand banks who honoured the tokens, so they clearly had something going for them!

Retail Pull

Sadly, the Cheque Bank is long gone. It shut down in 1902 after almost three decades in business. The London banking landscape had evolved significantly over that time, with many banks offering similar services directly to their customers. The issuing of cheques and the guaranteeing of funds became standard banking practices and the niche evaporated.

Already Here

I was thinking about the d-check scheme again because the RLN has just finished an experimentation phase which concluded among other things that at a practical level it made it tricky to showcase some of the benefits of a shared ledger. so whether it will continue to roll out is not clear. So will we see an electronic revival of the Victorian paper tokens as a form of money in the near future?

Perhaps. Fredrik Andersson and Judith Arnal, in their paper „Why would a traditional financial player be interested in issuing a stablecoin? ” suggest that a combination of straightforward financial interests (eg, float interest) and the desire to bring in new customers could be behind traditional market players deciding to issue their own stablecoins. They look at the case of SG-Forge, linked to Societe Generale,France’s third largest bank, which issued its own stablecoin (EURCV), using the CAST Framework of market standards designed for digital blockchain-based securities. EURCV is pegged to the euro and backed by cash, and the paper says there are some interesting use cases around decentralised financial services whereas for retail customers, it says that “their interests do not seem so clear-cut” and the use cases rather limited.

(SG are continuing with the experiment and has just announced the integration of EURCV and Solana’s offer “faster, more efficient, and cost-effective transactions”.)

Despite this, perhaps it is time for the worlds of fintech and crypto to come together and look again at the idea of such tokens in the form of bank-issued stablecoins in the consumer space. In the absence of a US Digital Dollar, bank dollar stablecoins might fill a niche. This is not far-fetched, although there are of course regulatory considerations. The Bank for International Settlement (BIS) recently released its „Recommendations for the Regulation, Supervision and Oversight of Global Stablecoin Arrangements” which call for good risk management and governance (and that sort of thing) so there are no fundamental barriers. The Federal Reserve has already said that state banks can do this (but they should obtain a written supervisory non-objection from the Fed before issuing, holding or transacting in dollar tokens used to facilitate payments, such as stablecoins.)

I could imagine holding bank-issued tokens in my digital wallet, but I have a suspicion that in time most people will drift towards tokens backed by central bank reserves rather than by commercial bank deposits. In other words, in a world with a digital dollar, it’s not clear why anyone would hold BankAmerica Bunce, CapOne Cabbage or Wells Wonga.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: