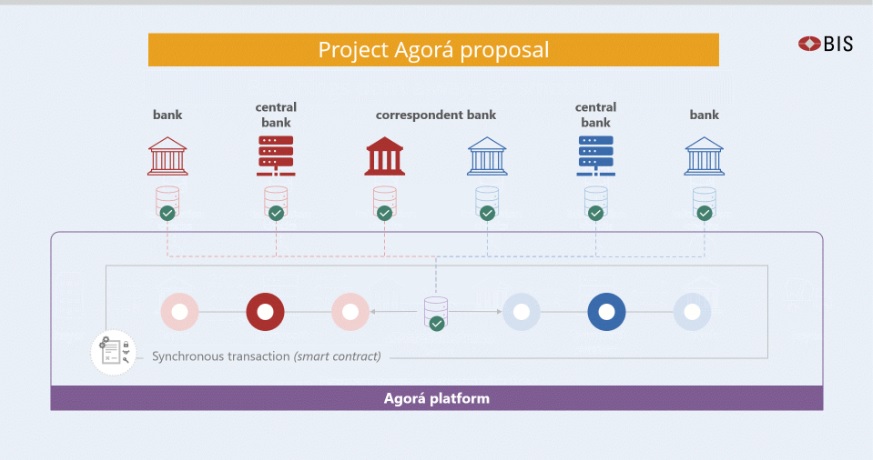

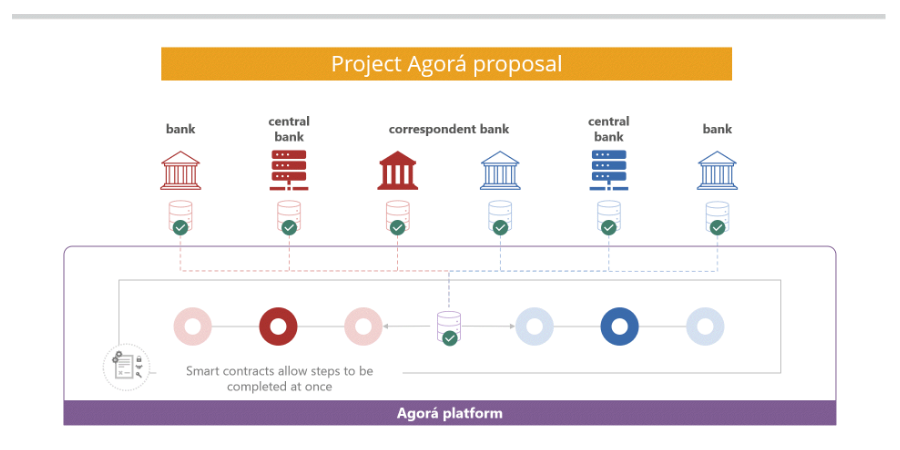

The project builds on the unified ledger concept proposed by the BIS and will investigate how tokenised commercial bank deposits can be seamlessly integrated with tokenised wholesale central bank money in a public-private programmable core financial platform. This could enhance the functioning of the monetary system and provide new solutions using smart contracts and programmability, while maintaining its two-tier structure.

„More than 40 private sector financial firms, convened by the Institute of International Finance, will join the Bank for International Settlements and a group of leading central banks in Project Agorá to explore how tokenisation can enhance wholesale cross-border payments.” – according to a press release.

The BIS and the IIF selected a diverse set of firms from applicants that met the eligibility requirements and other criteria laid out in the public call for participation. Participating firms must be regulated in a participating jurisdiction as a commercial bank, payment services provider, or financial market infrastructure company; be significantly involved in cross-border payments; and have innovation expertise. These firms represent a diversity of private sector partners in terms of business models, institution size, expertise and geography.

Project Agorá will now begin the design phase of the project.

The IIF has published the full list of private sector participants, copied here.

Project Agorá (Greek for „marketplace”) is structured as a public-private collaboration. It brings together seven central banks: Bank of France (representing the Eurosystem), Bank of Japan, Bank of Korea, Bank of Mexico, Swiss National Bank, Bank of England and the Federal Reserve Bank of New York. They will work in partnership with the selected financial firms, and the IIF will act as the private sector convener.

Smart contracts can enable new ways of settlement and unlock types of transactions that are not viable or practical today, in turn offering new opportunities to benefit businesses and people.

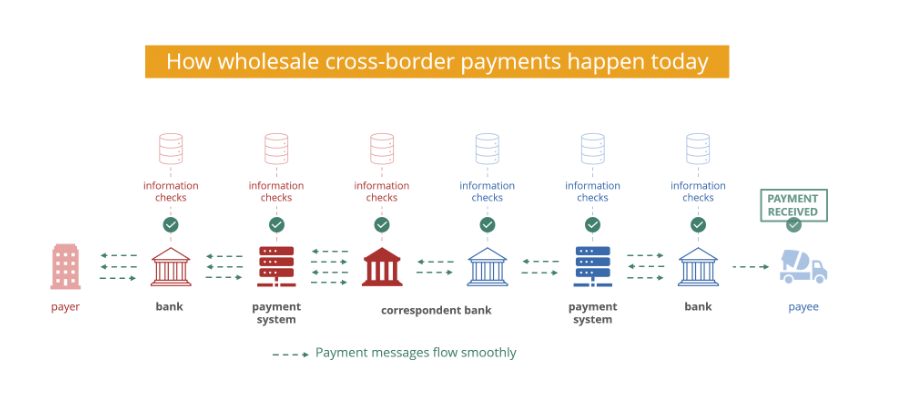

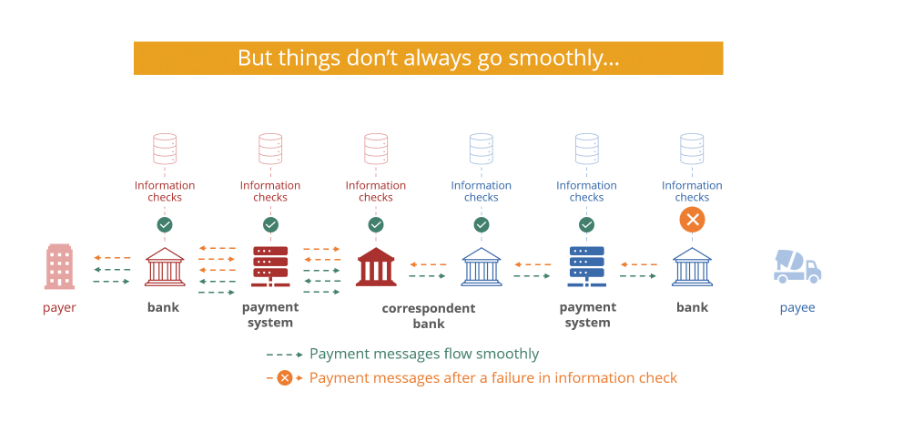

This major public-private partnership will seek to overcome several structural inefficiencies in how payments happen today, especially across borders. Challenges for cross-border payments include different legal, regulatory and technical requirements as well as various operating hours and time zones. Also among the challenges is the increased complexity of carrying out financial integrity controls (eg customer verification and anti-money laundering). These controls are often repeated several times for the same transaction, depending on the number of intermediaries involved.

BIS Innovation Hub projects are experimental in nature and aim to explore and deliver public goods to the global central banking community.

______________

Related information

Project Agora – Frequently Asked Questions

Blueprint for the future monetary system: improving the old, enabling the new (BIS Annual Economic Report 2024, Chapter 3)

Press releases

14 May 2024: BIS, central banks and the IIF invite private financial institutions to join Project Agorá

3 April 2024: Project Agorá: central banks and banking sector embark on major project to explore tokenisation of cross-border payments

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: