Point-of-sale terminals are starting to drive me mad, but fortunately they won’t be around for ever.

an article written by David G. W. Birch, author, advisor and commentator on digital financial services. He is an international keynote speaker and recognised thought leader in digital identity and digital money.

Paying for a drink in the coffee shop around the corner from where I live in England is quite straightforward. The terminal displays £3.50 or whatever and I tap my Lego on the terminal and walk off after the beep. It takes about, I don’t know, a second. It just doesn’t work like that in America.

(Yes, I pay by Lego, of course. Here is a video.)

The Payment Experience

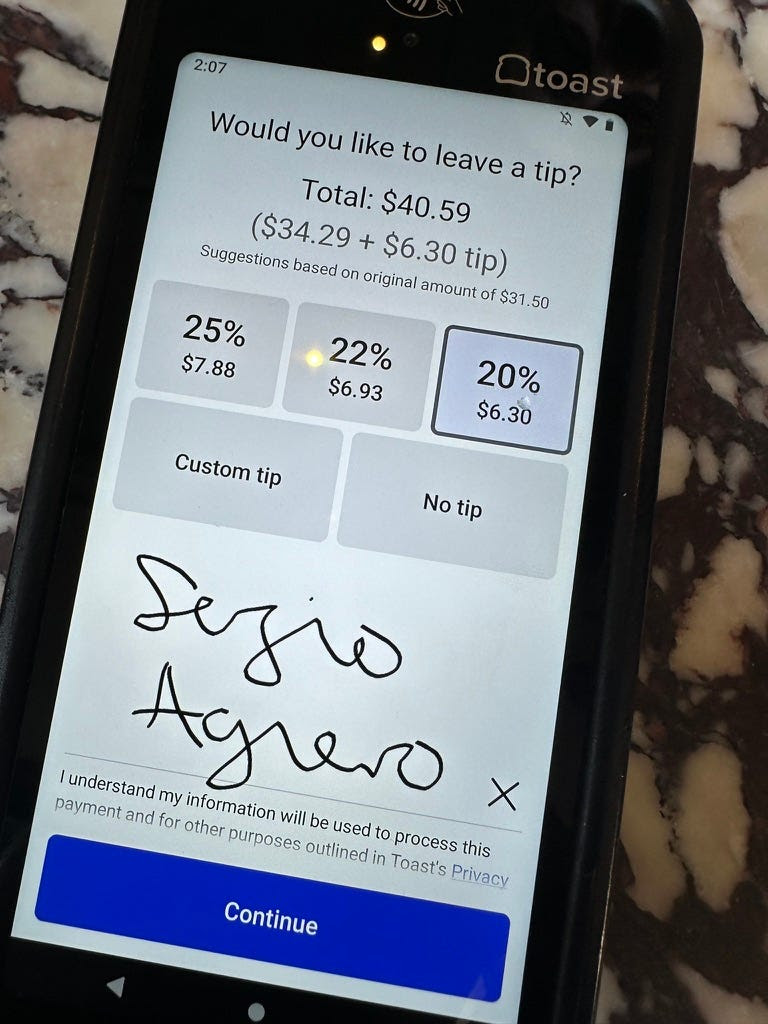

The last time I bought something in America (yesterday), the payment experience was very different. The goods were $3.50 or whatever and the terminal displayed $3.50 plus sales tax and then I had to press the button to say that I didn’t want to give a tip and then I had to press a button to say that I didn’t want to donate to charity and then I had to look around the terminal try and figure out where the contactless bit of it was and then I tapped and waited for the beep and walked off.

(Note that it’s not the principle of charity that bothers me, it’s the annoying experiences. In McDonald’s I always order using the self-service kiosks which are easy to use and quick and when you go to check out there they ask you if you want to round up and donate to charity and there I always press “yes” because it just doesn’t seem to interrupt the experience in the same way that selecting an amount does at a POS does, whereas at my local gas station it really is annoying when you just want to go in, tap and go and you find that you have to press that button about charity first.)

Charity is one thing but I have to say that as a foreigner the tip stuff drives me crazy. When I see the terminal in a coffee shop asking me to add a tip, I naturally press the button marked “no” but what I really want to press is a button marked „please pay your staff properly and stop this annoying checkout experience, it’s supposed to be fast, I just want to pay and go”.

1984? 1994? 2004? 2014? Nope. 2024.

If that process was not irritating enough (ie, pressing some buttons when you should just be tapping and walking away) it looks like it’s about to get a whole lot more annoying in Illinois where customers still apparently swipe their cards to pay for things. NBC News report that if the Governor signs the budget and revenue package that the legislators have approved, consumers paying by card may have to „swipe to pay for their goods and swipe again to pay the sales tax” for those goods because the Illinois Retail Merchants Association successfully lobbied to limit the fees that processors can charge on the sales tax portion of transactions.

I simply cannot imagine how much this is going to cost in rewriting software, educating customers, training staff and so on and I note that analysts who know a lot more about retail payments than I do have expressed concerns that the changeover might not benefit the merchants much anyway. Don Apgar, Director of Merchant Payments at Javelin Strategy & Research, points out that since processors who service merchants in Illinois will need to modify their platforms in response to the legislation, they will likely raise prices to merchants (and not only processors, because everyone else in the value chain must create separate tax-only transactions and reconcile them). In fact he says that some processors may choose to not make the investment and simply terminate Illinois merchants!

Payments Are Boring. There, I Said It

So what should happen at point-of-sale in Illinois, in America or in fact anywhere else? Well, as well all know, the trend in retail payments is towards digital wallets so another way forward might be to ignore the POS and card infrastructure altogether and go in-app. Then what would happen when I order coffee is that a request-to-pay (R2P) pops up on my phone and says „Joey Donuts coffee is requesting £3.50 is that OK?”and then I either do nothing because the AI in my phone can easily deal with such a simple request (it knows that I’m in the coffee shop, it knows roughly how much I generally pay, and it knows when I usually order stuff, so it can just pay for me, and it knows where I generally tip and how much) or I can use Face ID or similar to confirm the transaction.

Everything to do with tips, charity, surcharges, sales tax and everything else should be dealt with in the app and I don’t see any reason why I should be bothered with it. I’m sorry to say it here, but the truth is that payments are not that interesting and I don’t really want to be in the loop.

Fade Away

In time, the combination of R2P and biometrics means that the idea of a point of sale will simply fade away. I have fond memories of the old PayPal check in service that would allow you to pay with your presence. I don’t know if you remember this, but they had a nice system whereby you could walk into a coffee shop and your coffee and your face would show up on the server’s terminal so that they could charge it to your PayPal account. You didn’t have to do anything.

I loved it and I look forward to the day in the not too distant future when there is no concept of a point of sale terminals and secure (and private) transaction infrastructure delivers ambient transactions to that retailers can bring back that experience: “Hello, what would you like”/ “Large latte please.”/ “Thank you it will be ready in a moment.” / “Cheers, bye!”.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: