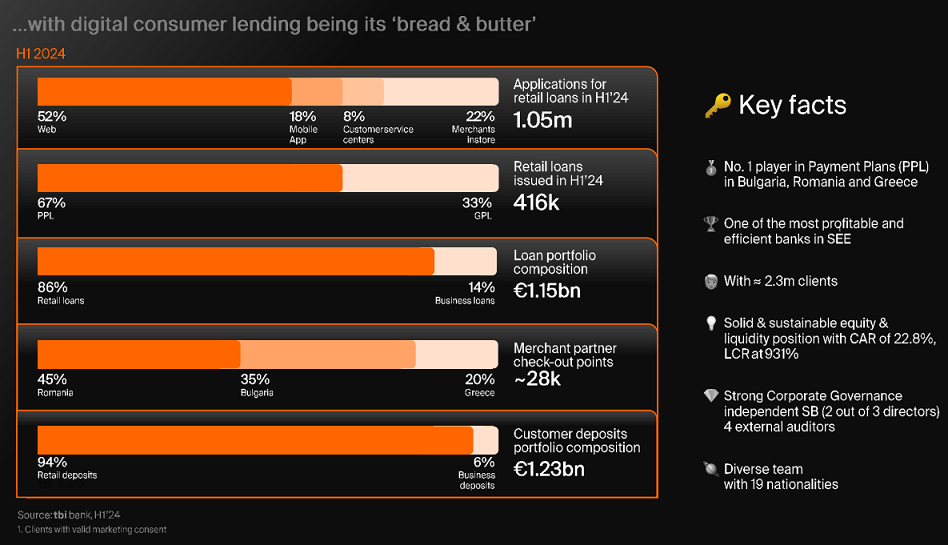

In H1 2024 tbi serviced 1 million loan applications in Bulgaria, Romania, and Greece, nearly 40% more compared to the same period of 2023

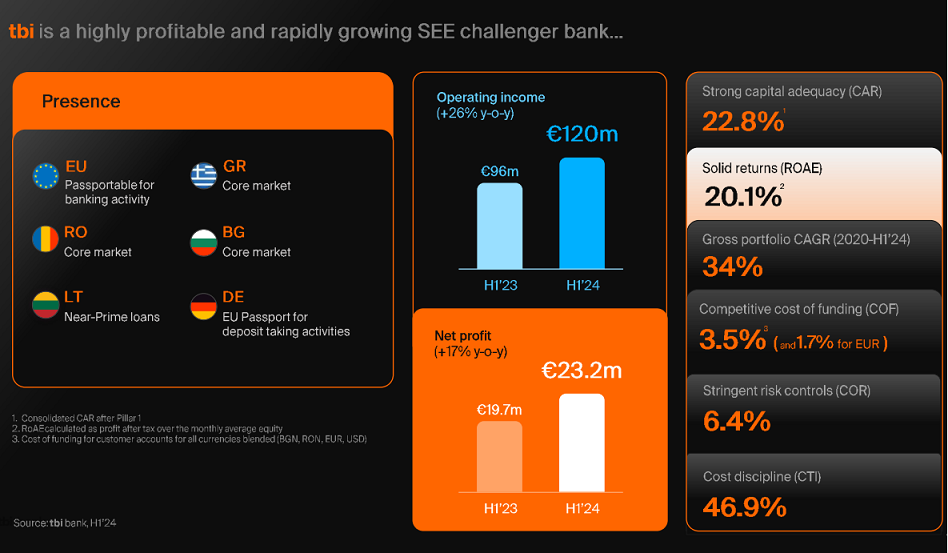

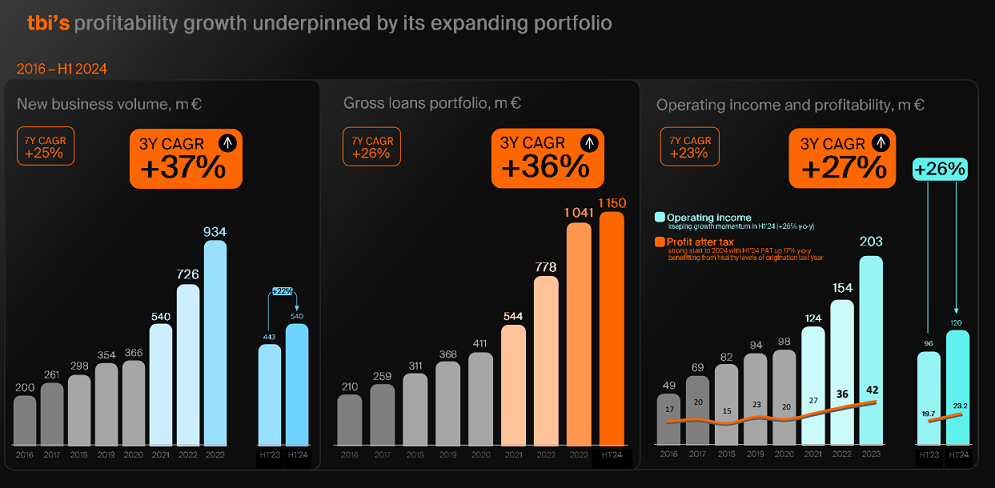

tbi consolidated unaudited financial results for the first half of 2024 show a net profit of EUR 23.2 million – 17% higher than the EUR 19.7 million profit, achieved for the same period of last year, according to the press release.

Throughout the first half of the year, tbi onboarded new merchant partners, including new verticals. The bank is now present in nearly 30.000 merchant partner check-out points in its main markets of operation – Bulgaria, Romania, and Greece.

In H1 2024 tbi serviced 1 million loan applications in Bulgaria, Romania, and Greece, nearly 40% more compared to the same period of 2023. By June the bank disbursed nearly 420.000 payment plans in the amount of EUR 532 million – 22% more compared to the same period of 2023.

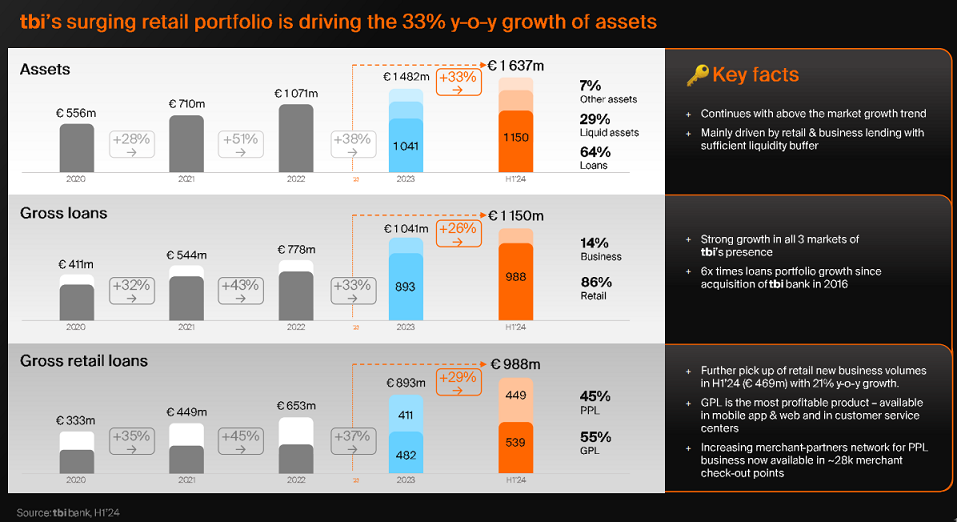

Also, tbi report an impressive 33% growth in total assets as of the end of H1 2024, reaching EUR 1.6 billion (from EUR 1.2 billion at the end of H1 2023). The gross loan portfolio increased to EUR 1.15 billion at the end of June 2024 (26% growth compared to H1 2023), positioning us among the top 10 largest banks on the Bulgarian market.

Based on such positive business performance, tbi revenue grew by 25% to EUR 120 million, mainly driven by 28% increase in net interest income. This allowed operating profit for H1 2024 to reach EUR 85 million.

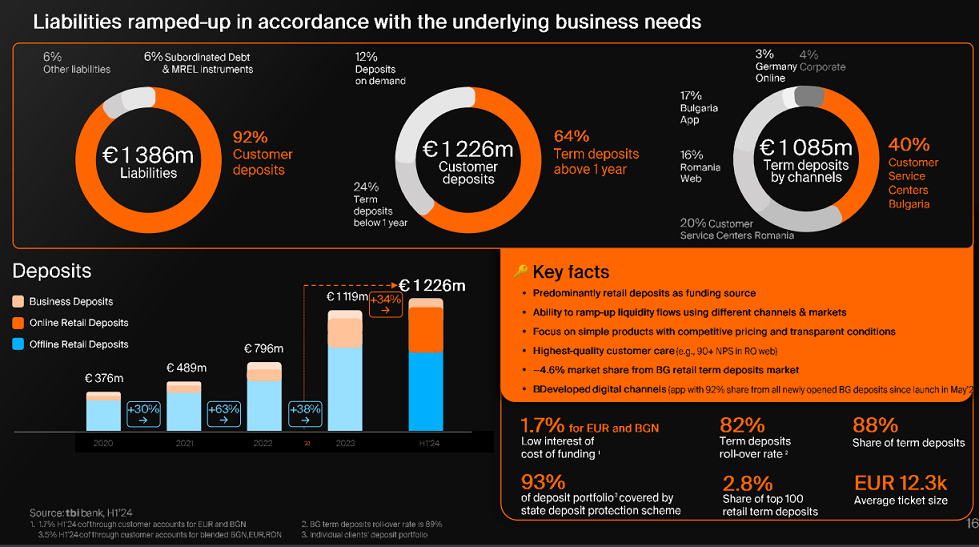

In addition, the bank deposit portfolio reached EUR 1.23 billion at the end of June 2024 – „well outperforming the market and demonstrating a solid growth of 35% compared to June 2023”. The main driver was the retail term deposits portfolio, where the increase was even higher at 40% compared to June 2023.

The increase in the general expenses by 27% to EUR 58 million was mainly driven by continuous investments in technology and AI solutions to support the development of new products in all markets.

According to the press release, „At the end of the period we had a strong and well-secured position from both liquidity and capital sides – on a consolidated basis the liquidity coverage ratio (LCR) being at 929% (much above the regulatory minimum of 100% and one of the highest in the banking sector) and the capital adequacy ratio (CAR) – 22.8%. Our operations are showing improving discipline in terms of cost management (46.9% cost-to-income ratio) and are combined with the return on loan portfolio at 21.3%, allowing the return on assets (ROA) and the return on equity to reach 3.0% and 20%, respectively.”

„In the past 6 months we’ve once again proven that you can be both valuable for your customers by constantly providing new services – and yet very profitable. The backbone for our success remains our team and it is not a coincidence that recently Newsweek magazine named us among the Top 100 Most Loved Workplaces in the world! The team’s dedication directly affects our beloved customers in SEE since they keep receiving great products and great customer experience. Looking towards the second half of 2024 we remain poised for growth, continuing to redefine the banking experience in the region.” – said Petr Baron CEO, tbi fs, Founder-in-Residence

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: