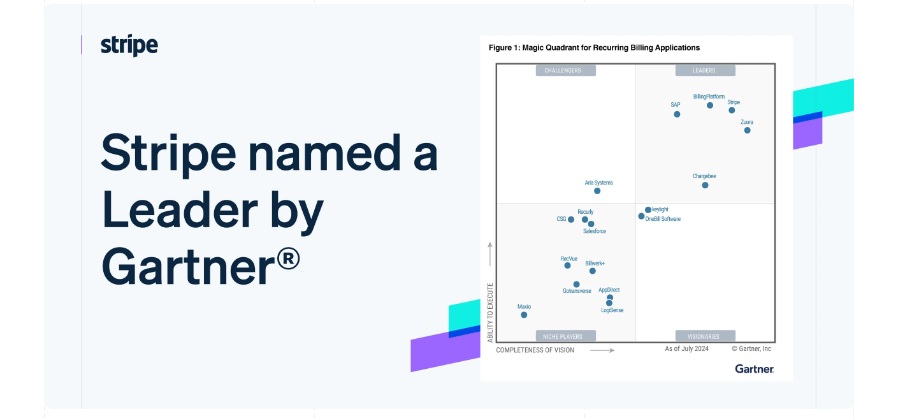

Stripe, a financial infrastructure platform for businesses, announced that Stripe has been named a Leader in the Gartner® Magic Quadrant™ for Recurring Billing Applications. Billing is now Stripe’s second product, alongside its payments suite, to be ranked as a leader by industry analysts.

Launched in 2018, Stripe Billing is software that helps more than 300,000 companies manage how they charge their customers. For most companies a billing system is as crucial as, but distinct from, their ability to accept payments: their billing system manages the intricacies of how much to charge, whom to charge, and when.

Stripe Billing allows businesses to orchestrate their overall financial logic, making it easy to set up billing plans, customize pricing logic, calculate amounts owed, preview upcoming invoices, apply discounts, send payment reminders, track payments, and much more. Stripe Billing supports a wide range of billing models including sales-based contracts, tiered pricing, and usage-based billing. It’s the easiest way to run a modern, global billing system.

This is the first time that Stripe Billing has been reviewed by Gartner as part of its Magic Quadrant for Recurring Billing Applications. Stripe was named a Leader for its Ability to Execute and Completeness of Vision. Billing’s recent momentum includes the release of new enterprise and usage-based billing features and its accelerating adoption by both B2B and B2C companies across a wide range of industries—from technology and healthcare to media and education.

Stripe Billing is experiencing particularly rapid adoption among leading AI companies. These businesses face high early compute costs, incentivizing them to monetize quickly. Many, including OpenAI, Anthropic, Perplexity, and Midjourney, use Billing to accelerate revenue growth and reduce churn.

Historically, companies needed to use Stripe for payments in order to use Billing. To better serve large enterprises with multiprocessor setups, Stripe announced in April that companies can use Billing while processing payments with other providers. In Europe, Stripe users can already manage PayPal-processed subscriptions in Stripe Billing.

„Billing systems should adapt to user needs, not the other way around. Stripe Billing being recognized by Gartner affirms our commitment to helping our users grow revenue by supporting unique, internet-powered business models on Stripe,” said Eileen O’Mara, chief revenue officer at Stripe.

Stripe Billing is part of Stripe’s Revenue and Finance Automation suite, which helps users manage the entire revenue cycle, including invoices, billing, taxes, revenue recognition, and reporting. The software suite is used by hundreds of thousands of companies. Stripe’s Revenue and Finance Automation suite is on track to exceed $500 million in annual revenue run rate in the coming months.

Read the full Gartner report here.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: