UK home to 3m ‘Frankenstein identities, posing multi-billion pound threat

The UK is home to nearly three million „Frankenstein” identities stitched together by fraudsters out of real and made up personal details, according to researchers who warn of a potential multi-billion pound hit to the economy, Finextra reports.

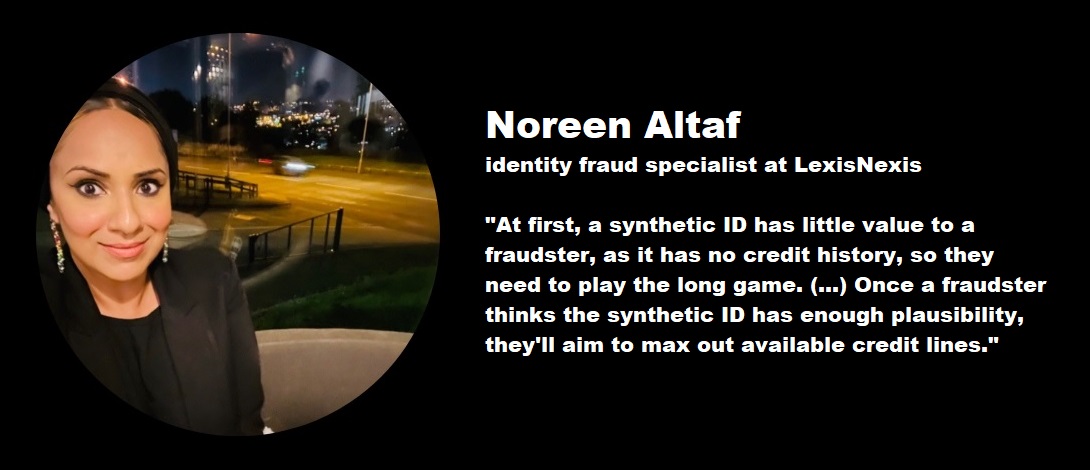

LexisNexis Risk Solutions looked at over 72 million consumer profiles and found 2.8 million showing several signs of ‘Frankenstein cloning’ to create ‘new’ synthetic identities to spoof credit checks and commit high-value fraud against banks and credit providers.

In the US, where synthetic fraud is already a major issue, businesses report an average $15,000 loss to each confirmed synthetic fraud case. Translated to the UK, LexisNexis estimates the problem could cost the economy around £4.2 billion by 2027, unless firms start properly screening for the threat.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: