German regulator BaFin has fined N26 €9.2 million for anti-money laundering failures

BaFin has imposed the fine after concluding that in 2022 N26 systematically submitted suspected money laundering reports late, according to Finextra.

In 2021, BaFin fined the bank €4.25 million and then imposed a temporary cap on the number of new customers the lender was allowed to onboard each month. The limit – set at 50,000 new customers a month – remains in place and has been augmented with an audit presence at the bank to monitor progress.

However, Germany’s financial regulator is considering lifting a cap on the number of new clients that N26 Bank AG can take on after the fintech improved its anti-money laundering controls, according to Bloomberg.

In a statement, N26 says that, since 2022 it has implemented „numerous measures to further improve reporting processes, while investing over €80 million in personnel and technical infrastructure to maintain the highest industry standards in combating financial crime and money laundering”.

„The company already set aside provisions for a potential fine in its 2022 annual financial statements, and the current fine is less than the provision set aside.” – N26 added.

______________

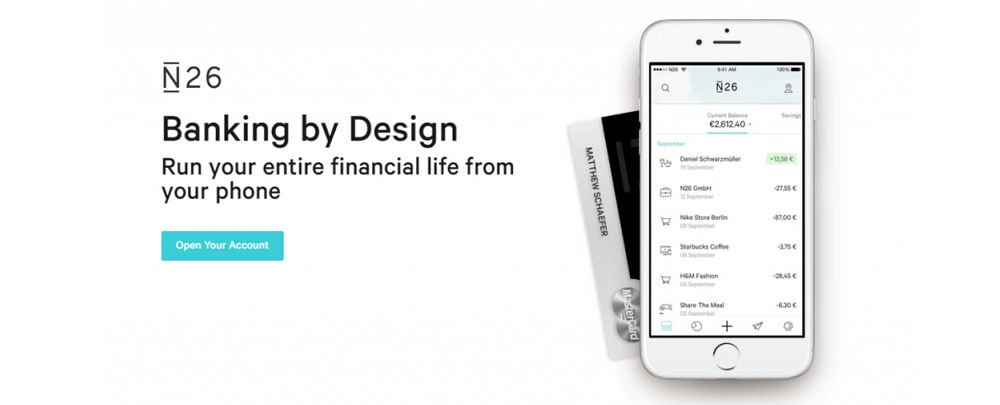

N26 AG is Europe’s leading digital bank with a full German banking licence. Built on the latest technology, N26’s mobile banking experience makes managing money easier, more secure and customer friendly. To date, it has welcomed more than 8 million customers in 24 markets, and processes over 100bn EUR in transactions a year. N26 is headquartered in Berlin with offices in multiple cities across Europe, including Vienna and Barcelona, and a 1,500-strong team of more than 80 nationalities. Founded by Valentin Stalf and Maximilian Tayenthal in 2013, N26 has raised close to US$ 1.8 billion from some of the world’s most renowned investors.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: