Deutche Bank about bitcoin: „A clearer regulatory framework is expected to drive increased corporate adoption and higher liquidity, and ultimately, help address volatility”

an article written by Marion Laboure, Ph.D. – Senior Strategist and Cassidy Ainsworth-Grace, Research Analyst

On March 13, Bitcoin prices reached a new all-time high of $73,157. This remarkable performance has been fuelled by five key factors: the approval of the spot Bitcoin ETF, expectations of future ETF approvals, the upcoming Bitcoin halving (expected April 19th), impending central bank rate cuts, and regulation.

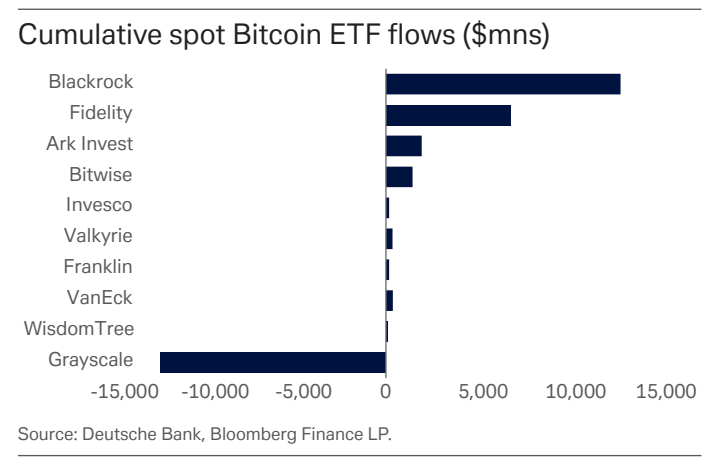

Firstly, demand for the new US spot Bitcoin ETFs has driven recent gains in Bitcoin prices. Since the SEC’s approval on January 10th, there have been $12bn net inflows into the new spot Bitcoin ETFs. To date, Blackrock’s fund alone has received over $13bn in inflows, and Fidelity’s fund has received nearly

$6.9bn.

Following the successful start to the spot Bitcoin ETF, more ETFs are likely coming. A total of seven spot Ethereum ETFs are pending, with the SEC’s first decision expected on the 23rd of May. ProShares has also announced plans to launch five additional ETFs, including one that would provide twice the daily exposure to a Bitcoin-tracking index.

The evolving ETF landscape and participations of institutional players are helping crypto mature into a more established asset class. In addition, Ethereum has also undergone a recent update on March 13, the Dencun upgrade, its most significant upgrade since the Merge in September 2022. This should slash transaction fees, and will enable speeds of up to 100,000 transactions per second.

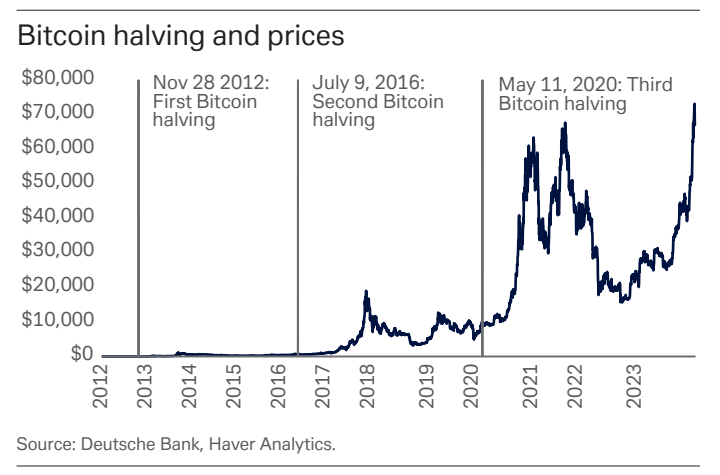

At the same time, the fourth Bitcoin halving event is fast approaching, and is also driving the price increase. Roughly every four years, Bitcoin undergoes a halving where the number of new Bitcoins awarded to miners for verifying transactions is cut in half. As the date draws nearer, much attention will be focused on Bitcoin’s typical price action surrounding previous halving events. In the 30 days prior to the November 2012 halving, prices rose by 5%. A more substantial 13% gain was seen ahead of the July 2016 event. Most recently, there was a sizable 27% price increase in the month before the May 2020 halving.

Alongside this, we seem to be at teetering at a turning point in the global economy. US economic growth has strongly outperformed expectations, supporting a broader rally in risk assets. As inflation pressures continue easing and consumer optimism rises in responses, we also expect central banks in G7 economies to pivot to a more accommodative stance over the coming months. As central banks start cutting rates, this is expected to further fuel rising risk appetite supporting the flow of capital into non-traditional investment classes like cryptocurrencies. This could further support the ongoing rally in digital currency prices.

Last but not least, regulation continues to march on, and we see it as a net positive development for the industry. In the EU, the long-anticipated Markets in Crypto-Assets regulation is slated to take effect in stages through 2024, with all provisions expected to be fully implemented by Q4 2024. A clearer regulatory framework is expected to drive increased corporate adoption and higher liquidity, and ultimately, help address volatility. These factors, in turn, should support Bitcoin prices going forward.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: