NFC Forum has announced the publication of its bi-annual Near Field Communication (NFC) Usage and Adoption Study. The study, conducted by ABI Research highlights the accelerating migration from physical to digital wallets, with more than 80% of those surveyed confirming that they have used a smartphone or smartwatch to make contactless payments. Security, convenience and future digital wallet innovations cement the growing trend towards device first approaches.

Top 5 Takeaways from the 2024 Survey

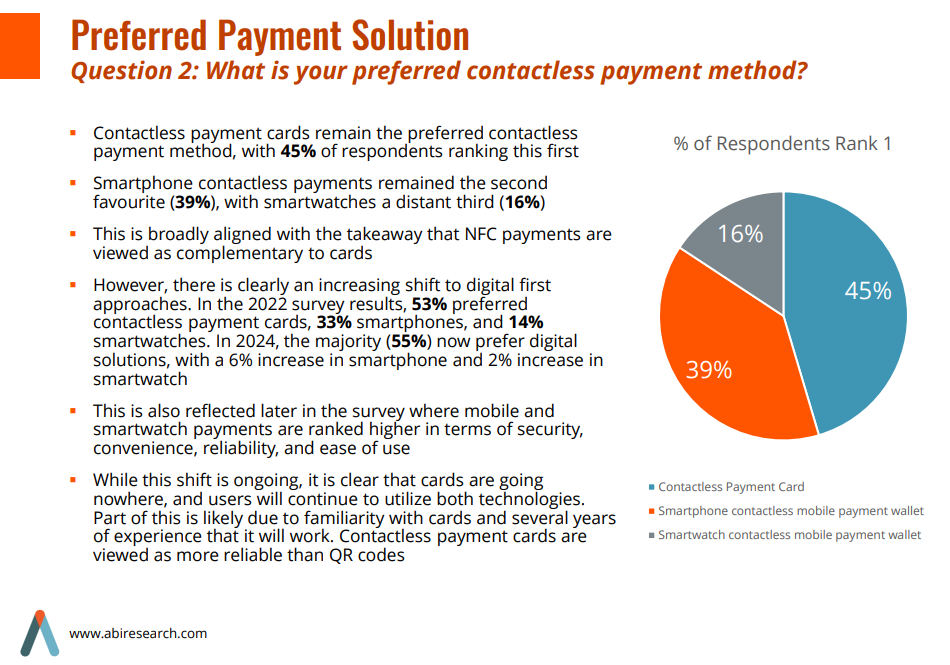

. Contactless has flipped from a card-first to digital-first user experience: 55% of respondents prefer to use their phone or watch to pay over a card. Two years ago this was 47%.

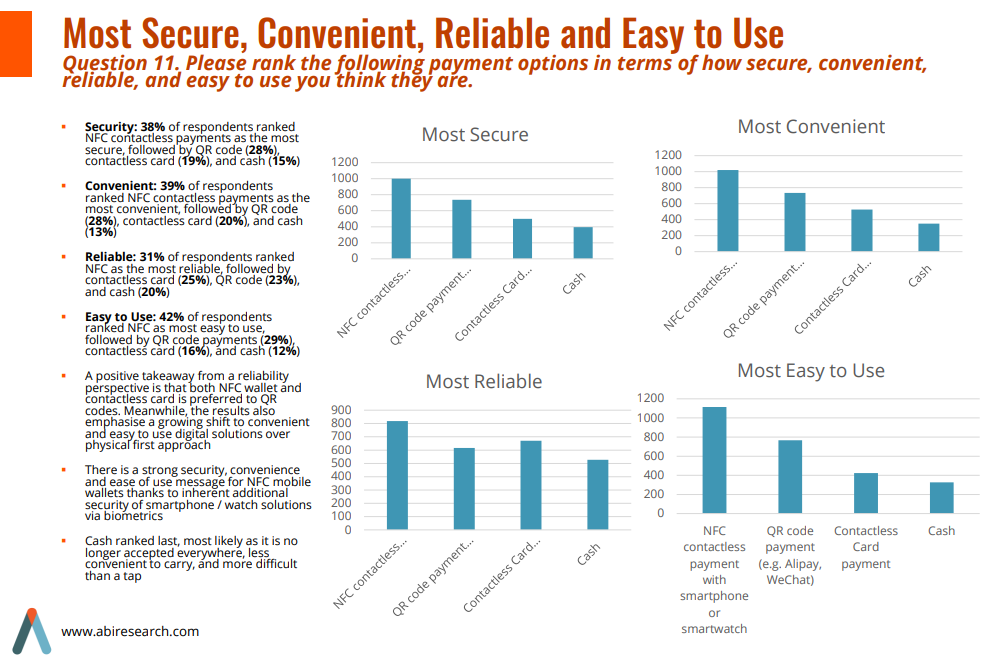

. When compared to QR codes, Contactless Cards, and Cash, NFC Contactless mobile/watch payments was rated the Most Secure, Most Convenient, Most Reliable, and Most Easy to Use way to pay.

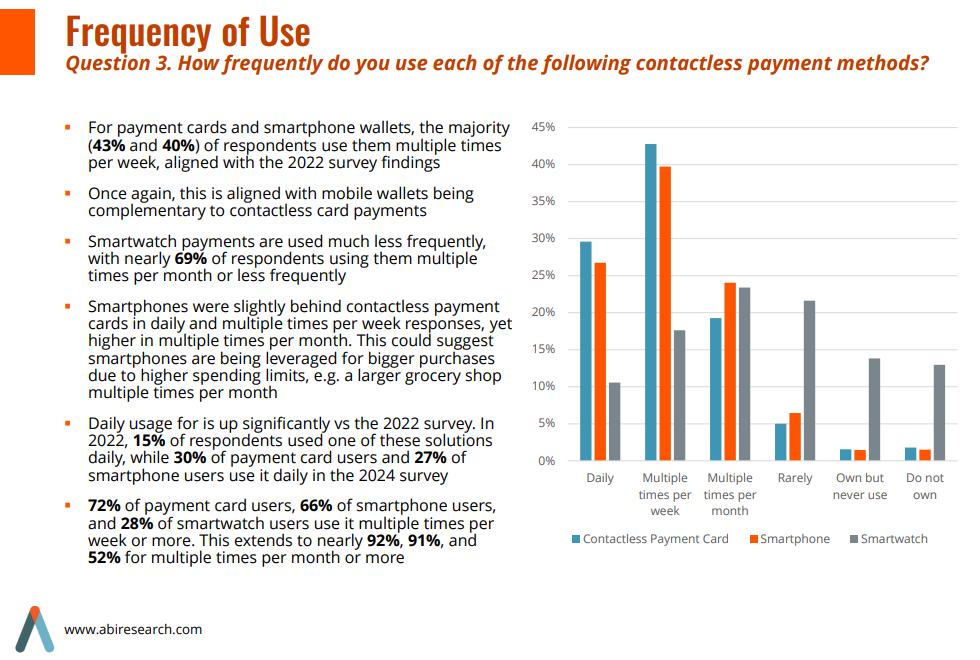

. Daily use of contactless grew drastically from 15% in 2022 survey to 57% of respondents.

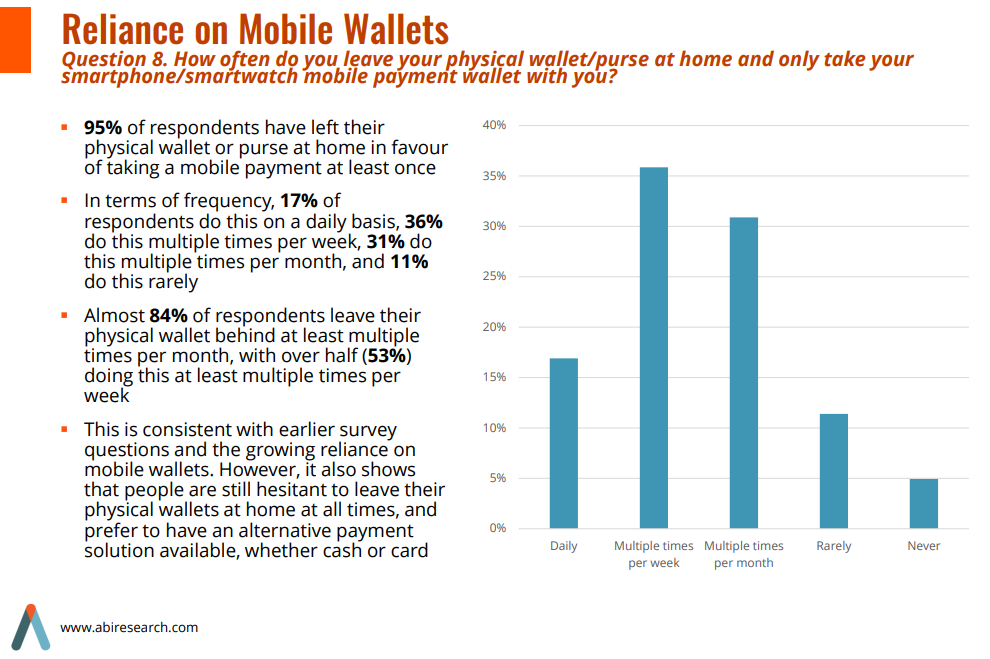

. Consumers are becoming more reliant on digital wallets – 95% of respondents have left their physical wallet or purse at home in favor of taking a mobile payment at least once

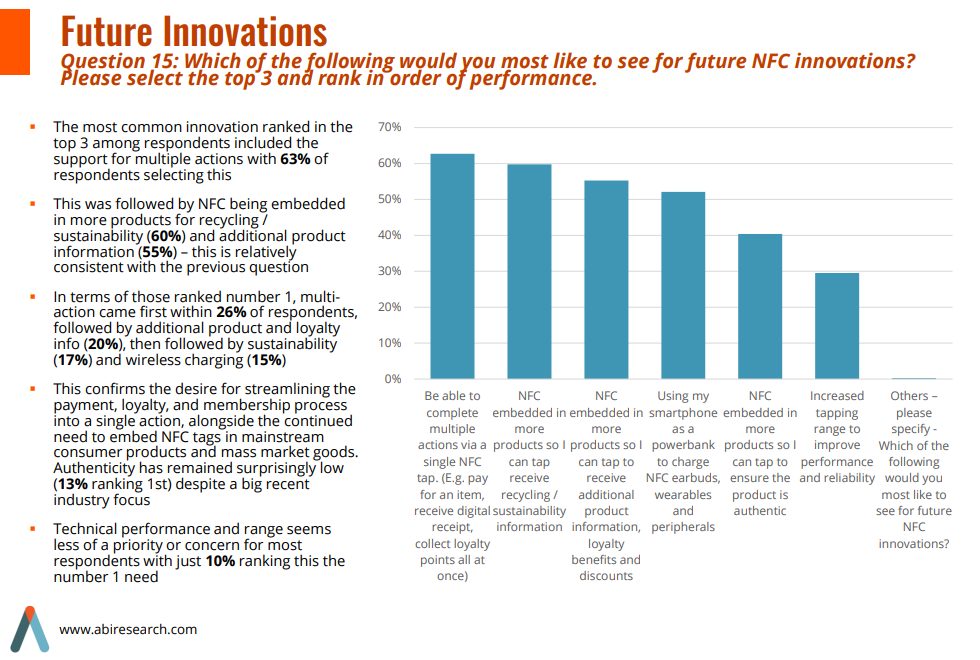

. When looking at „future innovations” of NFC, Multi-purpose tap and support for Sustainability features rated highest.

Have you ever used a smartphone or smartwatch to make a contactless payment?

. For those respondents who had not used either of these options, the survey was terminated. This

meant that only respondents who have used contactless technology were included in the survey

results.

. In total, there were 562 survey terminations, resulting in over 82% of respondents having used a

smartphone or smartwatch to make a contactless payment

. By region, this represented 89% of respondents in the US, 83% in China, 81% in Japan, 80% in Europe,

and 79% in South Korea

For the first time ever, the study found that the majority of consumers prefer to use their mobile phone or wearable to pay over a contactless card. Additionally, when compared to other payment options including contactless cards, QR Codes, and cash, consumers rated NFC contactless as the most secure, most convenient, most reliable, and easiest way to pay in-person.

The study provides a renewed understanding of consumer adoption, familiarity, and experience with NFC technology at both a global and regional level, with 55% of respondents saying they would prefer to use their smartphone or smartwatch to make a payment rather than their card. 95% of those surveyed have left their physical wallet or purse at home on at least one occasion, choosing instead to rely solely on mobile payments. 53% confirmed they do so multiple times each week.

Key Findings from the 2024 Survey

. End users are becoming less reliant on physical wallets. The strong desire for multiple actions to

combine payments and other mobile wallet functionality such as loyalty schemes, discount codes,

receipts, will enable users to be even less reliant on physical solutions over time

. Mobile wallets are more than just NFC – although this is the foundational technology, other

technologies (e.g. QR code, barcodes, one-time passcodes) are now becoming increasingly

complementary. The perception of mobile wallets are now more closely tied to security rather than a

specific contactless technology, enabling multiple use cases beyond payments

. Sustainability is a key consideration for many consumers, and there is broader desire for NFC to be

integrated into more products for additional product information. Combining these two will be very

compelling in accelerating wider NFC usage and tag adoption. However, there is a need to educate

brands on the value proposition and ROI of integrating NFC to further incentivize adoption. This could

be through increased customer engagement and retention, certifying the quality and authenticity of a

product, alongside enabling loyalty schemes and innovative location or AR based interactions

. With people willing to leave cash or physical wallets at home, NFC is becoming fundamental in

enabling various daily activities. This aligns with the need for multi action support and enabling

additional mobile wallet use cases. E.g. users can now leave drivers license, ID, keys, train tickets,

coupons, concert tickets behind or be fully digitized. This shift from physical to digital wallets will

continue to accelerate in the coming years.

“The 2024 Study highlights a significant paradigm shift in the way that people use their contactless devices,” comments Andrew Zignani – Research Director at ABI Research. “Daily use of mobile payment platforms is becoming increasingly common, with users citing the security, reliability and convenience of digital solutions as core driving factors. As familiarity and understanding of NFC continues to grow, so too does demand for additional applications and use cases for the technology. We are now entering an end user perception step change whereby NFC is not just considered a payments technology, but a technology that can underpin a variety of different applications and use cases, such as the ability to tap to receive additional product information, for digital car and/or house key storage, use across brand protection or tap to register a product warranty to name but a few.”

Mike McCamon – Executive Director of NFC Forum, adds: “NFC technology enables the creation of efficient, reliable, secure, environmentally-friendly, and smart solutions. And with emerging concepts such as multi-purpose tap – an evolution of NFC that allows users to complete multiple required actions in a transaction in a single tap – device makers and solution providers are being empowered to create transformative solutions across all manner of vertical industries. Access control, payments, digital identity, transport and even emerging Digital Product Passport requirements for sustainability all stand to benefit from improved usability and security thanks to NFC.”

______________

The survey achieved 2632 total responses across 9 countries, targeting approximately 500 each from the US, Europe, China, Japan, and South Korea

The full version of the Contactless Market and User Trends Study is available to all NFC Forum members with an executive summary for non-members.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: