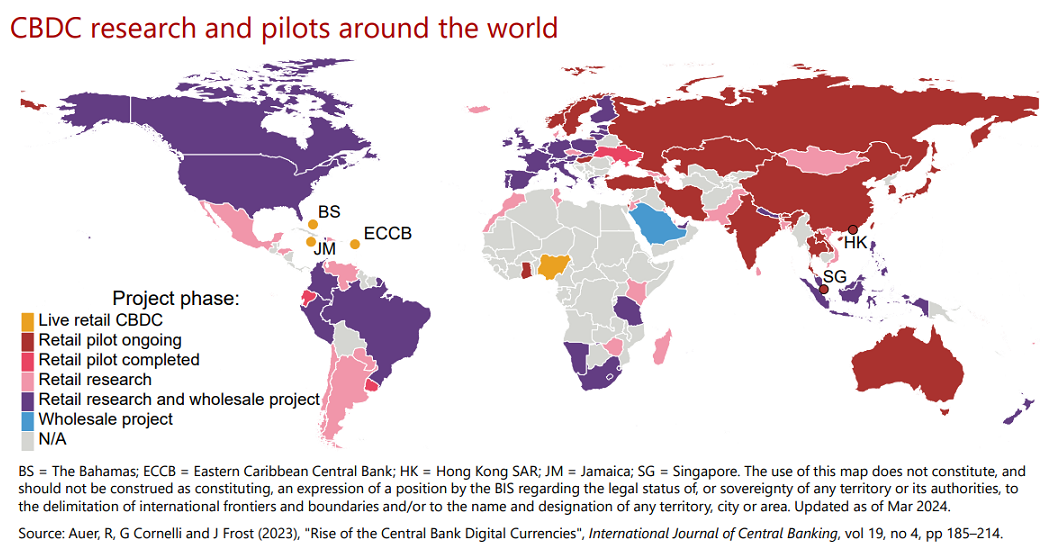

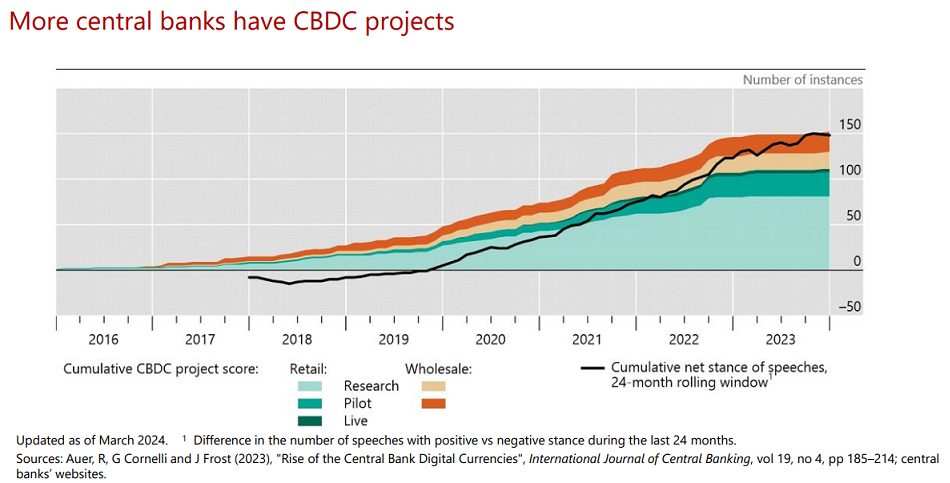

A March 2024 update to the database of central bank digital currencies (CBDCs) shows the addition of one retail CBDC and one wholesale CBDC since June 2023.

There are currently four live retail CBDCs in the world – in The Bahamas, the Eastern Caribbean, Nigeria and Jamaica. Pilots of retail CBDCs are now taking place in 24 jurisdictions and 23 jurisdictions have wholesale CBDC pilots.

We find that higher mobile phone usage (a measure of an economy’s overall digitisation) and higher innovation capacity are positively associated with the likelihood that a country is currently researching or developing a CBDC. Retail CBDCs are more likely where there is a larger informal economy, and wholesale CBDCs are more advanced in economies that have higher financial development.

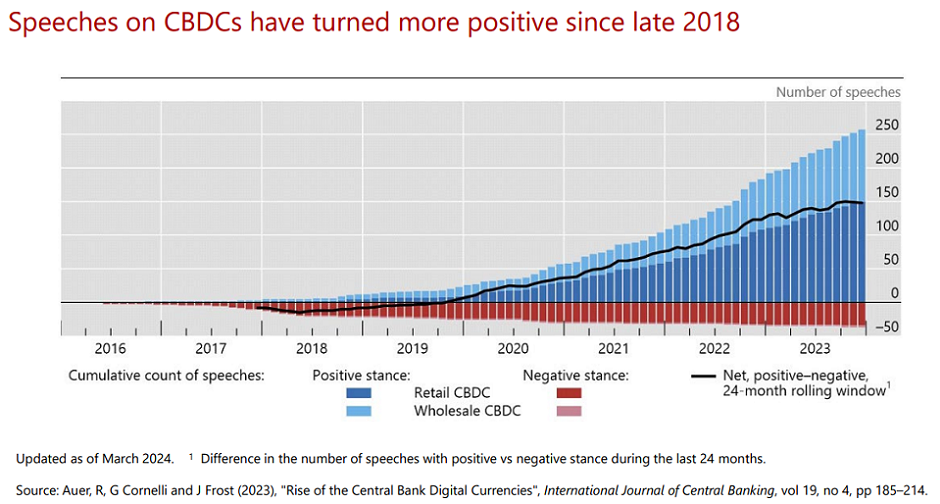

The sentiment of central bankers’ speeches toward CBDCs remains positive.

__________

Over the centuries, wave after wave of new payment technologies has emerged to meet societal demands. Coins, banknotes, cheques and credit cards were each innovations in their own day. Today, there is growing discussion of a new payment technology: central bank digital currencies (CBDCs).

As a digital liability of the central bank, wholesale CBDCs could become a new instrument for

settlement between financial institutions, while retail (or general purpose) CBDCs would be a central bank liability accessible to all. Although the concept of a CBDC was proposed decades ago (ie Tobin (1987), attitudes about whether central banks should issue them have changed noticeably over the past year. Initially, central banks focused on systemic implications that warranted caution. But over time, the need to respond to the declining use of cash in some countries came to the fore, and a number of central banks have warmed to the idea of issuing a CBDC.

A tipping point was the announcement of Facebook’s Libra and the ensuing public sector response. As of late 2019, central banks representing a fifth of the world’s population reported that they were likely to issue CBDCs very soon. Similarly, the share of central banks (by number) that are likely to issue a retail CBDC over the medium term (in one to six years) doubled in 2019, to 20%. Meanwhile, 90% of central banks are engaging in research, experimentation or development of CBDCs.

During the Covid-19 pandemic, social distancing measures, public concerns that cash may transmit the Covid-19 virus and new government-to-person payment schemes have further sped up the shift toward digital payments, and may give a further impetus to CBDC. As a result, CBDCs have seized global attention and feature broadly in central bank communications and public search interest.

Still, many open questions remain.

In the growing literature on CBDCs, discussions centre on several fundamental aspects. One is how central banks should create money and whether CBDCs are desirable in that context. Another area is the systemic implications of CBDCs and how to cope with them. There is also work on policy design frameworks, their implications for cross-country payments, implications for the international role of currencies and legal aspects of their issuance.

The questions this paper aims to answer are: what are the economic and institutional drivers for issuing CBDCs? How do central banks approach the issues? What are the technical solutions sought?

To answer these questions, we first develop a novel CBDC project index based on central bank research and development (R&D) projects. We then empirically investigate common factors in countries that are investigating and piloting CBDCs.

We find that higher mobile phone usage (a measure of an economy’s overall digitisation) and higher innovation capacity are positively associated with the likelihood that a country is currently researching or developing a CBDC. Retail CBDCs are more likely where there is a larger informal economy, and wholesale CBDCs are more advanced in economies that have higher financial development.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: