Issuer processing powerhouse Enfuce today announces it has secured an Electronic Money Institution (EMI) licence from the UK’s Financial Conduct Authority (FCA). „This is a key achievement for Enfuce as it continues to accelerate its expansion across the UK and Europe, where it already holds an EMI licence from the Finnish FSA.” – according to the press release.

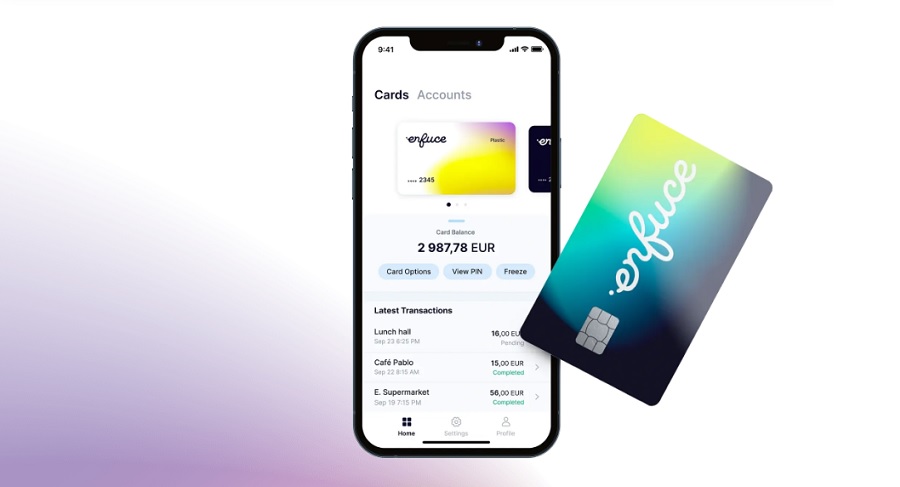

„With the FCA’s EMI licence, Enfuce will be able to provide electronic money services as well as card issuing and payment solutions directly to new and existing UK customers. Enfuce will now have full control over the entire payment process, ensuring a seamless onboarding experience and providing its UK clients a comprehensive and complete Enfuce solution, which is even more secure, efficient and scalable.” the company explains.

This announcement comes less than two years after Enfuce’s first launch in the UK in June 2022 and marks an important milestone for the company’s continued expansion into the country. To date, Enfuce has successfully established key strategic partnerships with prominent UK fintech and financial services companies including the leading small business platform, Funding Circle, and UK neo-banking start-up focused on scientific research, Science Card.

Denise Johansson – co-founder and co-CEO of Enfuce Group, comments: “This is a major step forward for Enfuce. Our ambition from the start has been to expand our presence across Europe and the world. The UK is a key market for us in this endeavour. The FCA’s seal of approval is not only a testament to Enfuce’s commitment to uphold the highest regulatory standards, but will also provide us with the market access, operational ownership and flexibility that are necessary for long-term growth and success in the ever-changing payments landscape.”

Fernley Blackler, CEO of Enfuce UK, who leads the company’s operations in the UK, added: “We are incredibly proud to have received the e-money licence from the FCA, which is renowned for its tough regulatory standards. The authorisation process for EMIs has become more difficult in recent years, so our approval further confirms Enfuce’s compliance with the highest regulatory standards as well as the trust from the regulator in our business model and management team.“

________________

Founded in 2016, Enfuce is one of Finland’s most valuable scaleups, and is the first financial service provider in the world to be PCI-DSS certified while running its service in the public cloud.

Holding an Electronic Money Institution (EMI) licence from the Finnish FSA, enabling operations across Europe, Enfuce’s PCI-DSS certified platform guarantees 99.999% uptime, global scalability, and card scheme connectivity, supporting various card programs and integration with digital wallets. Enfuce has raised €68.5 million in funding rounds.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: