bunq sets its eyes on UK as it reports €53.1 million in net profit in 2023, first full year of profitability. The company becomes the Europe’s second most profitable neobank.

At more than 11 million users in Europe and more than €7 billion in deposits, bunq reapplies for a UK license in global expansion drive.

bunq, the second largest neobank in Europe, reports a net profit of €53.1 million in 2023. „The challenger will direct its net profit to propel its global expansion strategy.” according to the press release.

„In pursuit to step outside the European Union, bunq has now submitted its application for an E-Money Institution (EMI) license in the UK, which will allow bunq to tap into a large market that includes an estimated 2.8 million British digital nomads.” the company says.

Fully licensed in all of the EU and awaiting a banking permit in the US, bunq continues to serve its UK users acquired before Brexit under relevant regimes. „It’s now poised to re-plant its flag and once again let its UK users open a local payment account in just 5 minutes.”

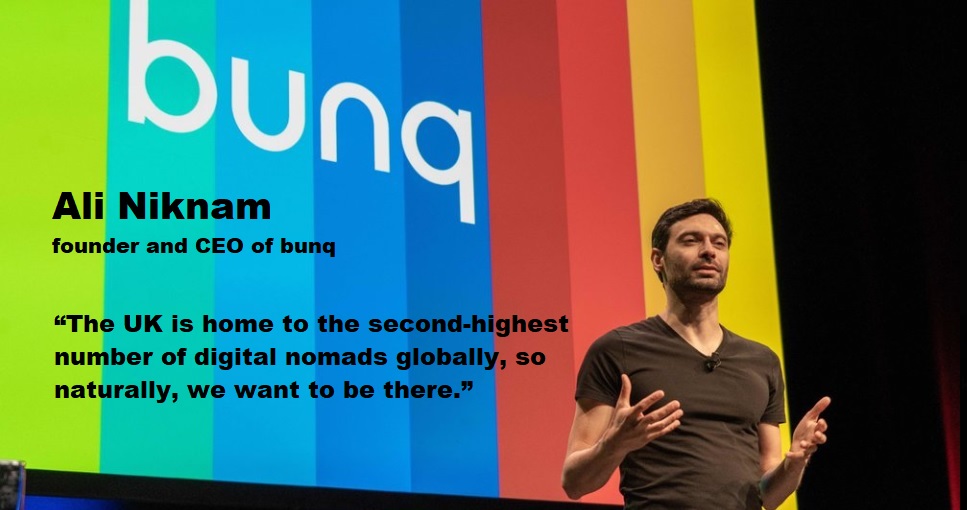

“The UK is home to the second-highest number of digital nomads globally, so naturally, we want to be there”, says Ali Niknam, founder and CEO of bunq. “We want to truly make their life easy, that’s why we’re excited to reintroduce bunq to the Brits and enable them to bank like a local all across Europe.”

Among the first neobanks globally to achieve structural profitability in a highly competitive market, bunq has now reached its first full year of bottom-line profitability. This comes as bunq continues to build momentum globally, with the neobank’s user base reaching 11 million at the end of last year.

“As a bridge between Europe and the rest of the world, the UK is at the forefront of European fintech and a hugely important market for bunq. As a true tech company, it only makes sense for us to pursue this market”, concludes Niknam.

In the last quarter of 2023, bunq’s gross fee income grew by 20%, compared to the last quarter of 2022, and user deposits grew almost fourfold, from €1.8 billion to almost €7 billion at the end of 2023. Gross interest income in the last quarter of 2023 grew by 488%, compared to the same period in 2022.

The news follows bunq’s recent announcement on launching Finn, bunq’s Generative AI platform, that since launch already helped bunq users address nearly half a million queries on budgeting, transactions, and more.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: