The Economist report – Can banks create a true ecosystem with embedded finance?

A new report by Economist Impact for Temenos has shown that 24% of European consumers are likely to switch providers if their bank is not engaged in ESG issues. The report, titled ‘Can banks create a true ecosystem with embedded finance?’, surveyed 300 banking executives globally.

As payments, technology and e-commerce disruptors compete against banks with embedded finance solutions, banks must harness emerging technologies to create their own digital ecosystems and remain at the center of the banking universe.

Key takeaways of the report

. New technologies will have the biggest impact on banks in the next five years—more than customer demands and evolving regulation.

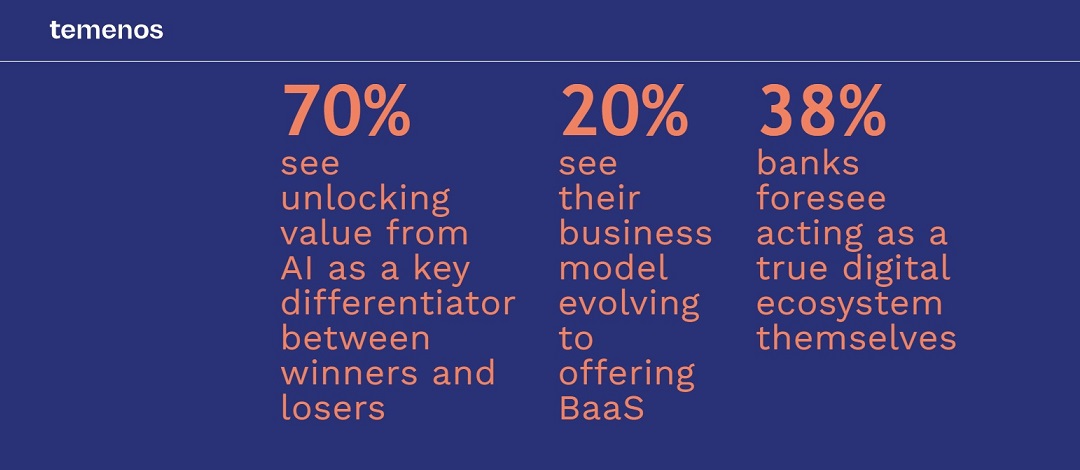

. More than 71% of survey respondents see unlocking value from AI as a key differentiator between winners and losers. While 75% expect generative AI to impact banking.

. Banks see their business model evolving in the next 12-24 months, offering banking-as-a-service to brands and fintechs (20%).

. However, twice as many (38%) banks foresee acting as a true digital ecosystem themselves.

. Customer centricity is driving banks to offer more embedded ESG propositions to their customers (73%).

. With the focus on lowering their carbon footprint, as well as the increasing use of data-intensive AI, banks are inevitably moving to the public cloud—51% of respondents agree that banks will no longer own any private data centers after moving to the public cloud.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: