The number of UK banks investing in technologies such as VR and AR in preparation for entering the Metaverse dropped by nearly a third in the past year. More than half of UK banks were investing in these technologies 12 months ago, compared to just 38% in 2023, according to a survey of 150 UK banking executives conducted by Censuswide for Hexaware Mobiquity.

Asked which emerging technologies and tools they’re engaging with as a priority, almost a quarter cite cybersecurity, with 22% pointing to cloud and 21% highlighting Open Banking APIs.

However, the research shows that UK banks are lagging behind the rest of the world on Generative AI adoption, with just 13% of them engaging with ChatGPT, compared to 19% of global banks.

Meanwhile, 41% of UK banks are developing data visualisation tools to improve stakeholder engagement and understanding of ESG risks and opportunities and 37% are using machine learning and AI to identify and track ESG risks and opportunities.

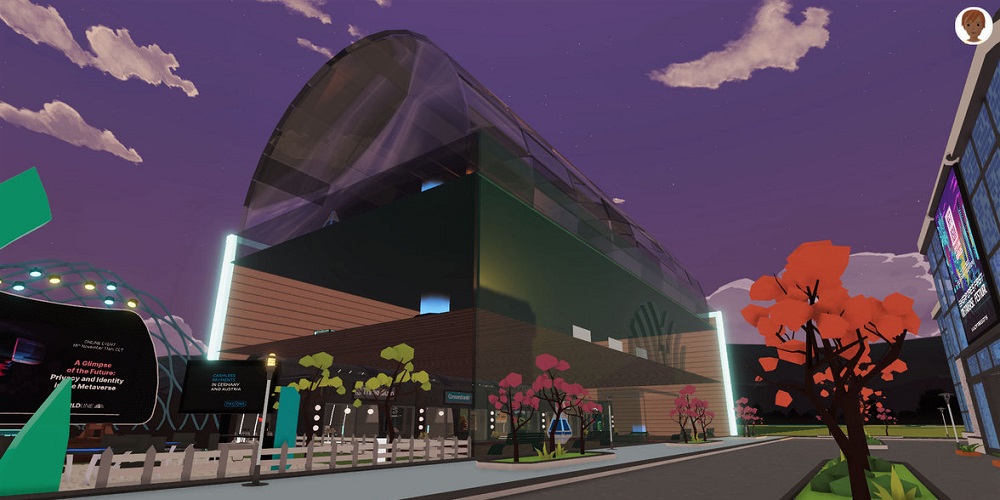

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: