Klarna launches UK’s first credit ‘opt out’ after meeting with UK Economic Secretary to the Treasury

Klarna, the global payments network and shopping destination, has today launched the UK’s first voluntary credit ‘opt out’, an additional tool in the Klarna app to help consumers save time, money and worry.

„The new feature will help consumers achieve their financial goals by providing them with a tool where they can ‘pre-decide’ not to use credit, perhaps while saving for a specific life event or sticking to a very strict budget.” according to the press release.

„Making ‘pre-decisions’ is a well-established way to manage self-control, for example, people who pre-prepare meals for the week are better at sticking to a healthy diet than those who decide what to eat each time they open the fridge.” – the company explains.

The feature was initially suggested by Andrew Griffith MP, UK Economic Secretary to the Treasury in a meeting with Sebastian, Klarna’s CEO and co-founder. Sebastian liked the idea so much he worked with his product teams to implement a first version of the feature less than a month after the meeting.

“As a leader in responsible credit, we always put our customers’ interests first,” commented Sebastian Siemiatkowski, Klarna’s Co-founder and CEO, “Unlike credit card companies, who push you to put all your purchases on credit, we believe that consumers should only use credit when it makes sense for them. That’s why I loved Andrew’s suggestion of a voluntary credit ‘opt out’, so people are in control of their finances.”

Andrew Griffith MP, Economic Secretary to the Treasury, said, “As this government seeks to protect UK borrowers by bringing forward proportionate regulations for Buy-Now-Pay-Later products, I welcome this initiative which shows how a responsible business can use innovation to help protect vulnerable customers.”

In a Twitter thread introducing the new feature, Sebastian called on traditional credit providers to follow Klarna’s lead: “Hey @BcardPayments, @amexUK, @hsbc let’s all agree that consumers should have the tools to switch off from credit if they feel it is not helping their financial goals. We’ve done it. Would love to see you guys follow.”

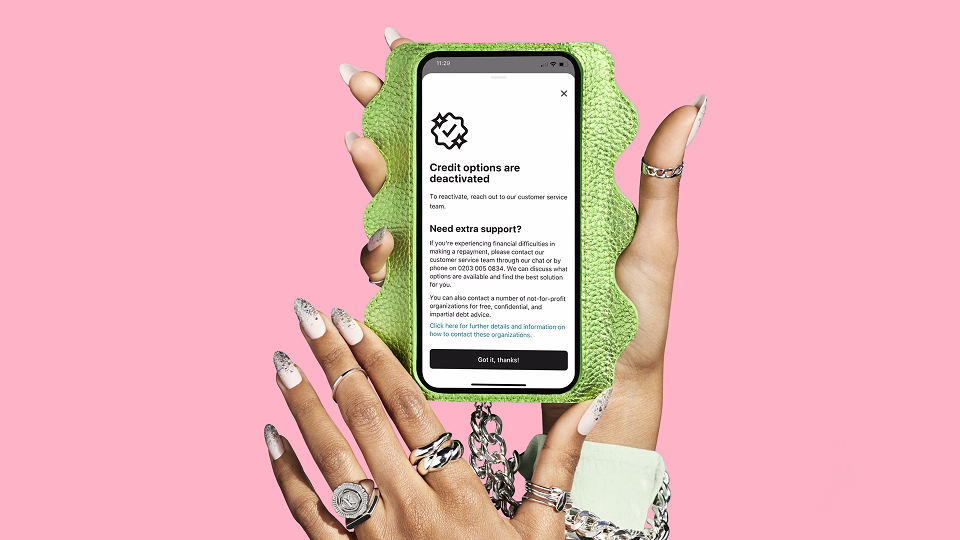

To activate the credit ‘opt out’, consumers enter the ‘settings’ tab in the Klarna app and select, ‘deactivate credit’. Once credit has been deactivated, consumers are taken to a page of resources and support for those dealing with indebtedness and they will no longer be able to use Klarna Pay in 30, Pay in 3 or Financing products. To reactivate credit services, consumers will need to call Klarna’s customer service teams. The opt out is available in the latest version of the Klarna App.

Klarna has not waited for regulation to implement high standards of consumer protection and its credit products are built to prevent people from building up large outstanding balances. The company only lends to those who can afford to repay by conducting strict eligibility checks on each and every transaction, unlike credit cards, which gives a real-time view of a consumer’s financial circumstances. When a customer misses a payment, Klarna will automatically restrict access to credit services to prevent debt building up. All of these measures lead to losses which are less than 1%, 30-40% lower than credit card companies.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: