New feature enables customers to transfer cryptocurrency to friends and family on Venmo or PayPal, and other wallets and exchanges in the crypto ecosystem. Customers will also be able to transfer to a PayPal account and to external wallets and exchanges, delivering more choice and flexibility in how they move and manage their crypto.

„Crypto transfers will be rolling out to Venmo customers over the coming weeks starting in May 2023.” – according to the press release.

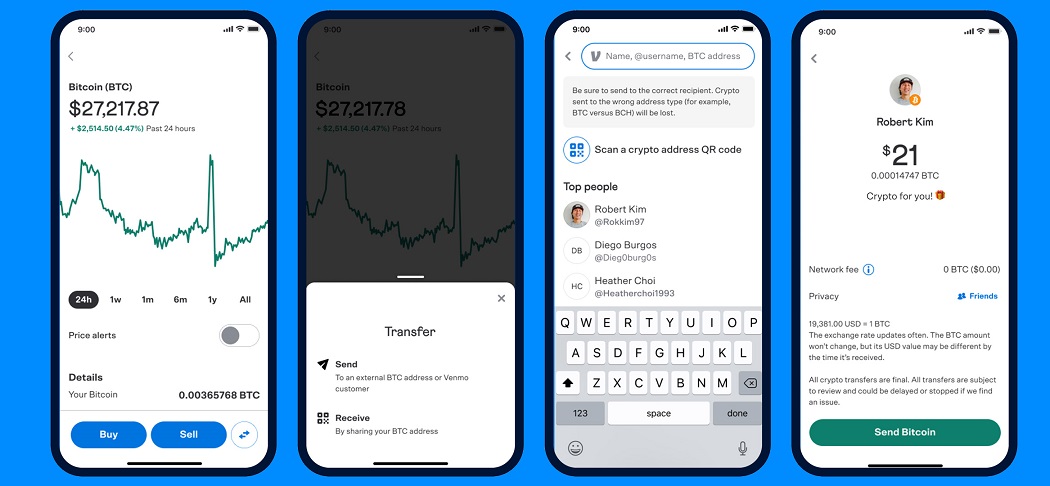

„Transferring crypto on Venmo can be done in a few simple steps. Venmo customers can navigate to the Crypto tab in the Venmo app, view their coins, then tap the Transfer arrows and choose to Send crypto – either to a Venmo account, or by entering in a recipient’s wallet address to send to PayPal or another external wallet. Any customer can also tap Receive to display their unique crypto address QR code, which can be shared with other people.” – the company explains.

With crypto on Venmo, customers can view cryptocurrency trends, buy or sell crypto, and access in-app guides and videos to help answer commonly asked questions and learn more about the world of crypto. Customers using crypto on Venmo can choose from four types of cryptocurrency: Bitcoin, Ethereum, Litecoin and Bitcoin Cash.

„Crypto on Venmo is a new way for the Venmo community to start exploring the world of crypto, within the Venmo environment they trust and rely on as a key component of their everyday financial lives,” said Darrell Esch, SVP and GM, Venmo. „No matter where you are in your cryptocurrency journey, crypto on Venmo will help our community to learn and explore cryptocurrencies on a trusted platform and directly in the app they know and love. Our goal is to provide our customers with an easy-to-use platform that simplifies the process of buying and selling cryptocurrencies and demystifies some of the common questions and misconceptions that consumers may have.”

According to the 2020 Venmo Customer Behavior Study1, more than 30% of Venmo customers have already started purchasing crypto or equities, 20% of which started during the pandemic. With the introduction of crypto on Venmo, the broader Venmo community will now have access to an easy-to-use and intuitive crypto platform to help them take part in the cryptocurrency market. The launch of the feature furthers PayPal’s commitment to educating its customers on the potential of digital currencies as they continue to grow and drives understanding and utility of cryptocurrencies on a mass scale.

Venmo customers can start their crypto journey with as little as $1 by clicking on „Crypto” in the Venmo menu at the top right in the app. Customers will have the ability to buy and sell cryptocurrency using funds from their balance with Venmo, or a linked bank account or debit card. All transactions are managed directly in the Venmo app.

______________

1 In October 2020, the company surveyed 2,217 U.S. Venmo customers to gain a firsthand, real-time account of how their demographic, financial and purchase behaviors have changed over time and how Venmo can help them adapt to the new normal. Survey was administered through Focus Vision. Responses are weighted to ensure representation of the Venmo population by age, income & regional distribution across the U.S.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: