Starting today, Apple Card users can choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high-yield APY of 4.15 percent1 — „a rate that’s more than 10 times the national average.2” – according to the press release.

„With no fees, no minimum deposits, and no minimum balance requirements, users can easily set up and manage their Savings account directly from Apple Card in Wallet.3” – the company explains.

“Savings helps our users get even more value out of their favorite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

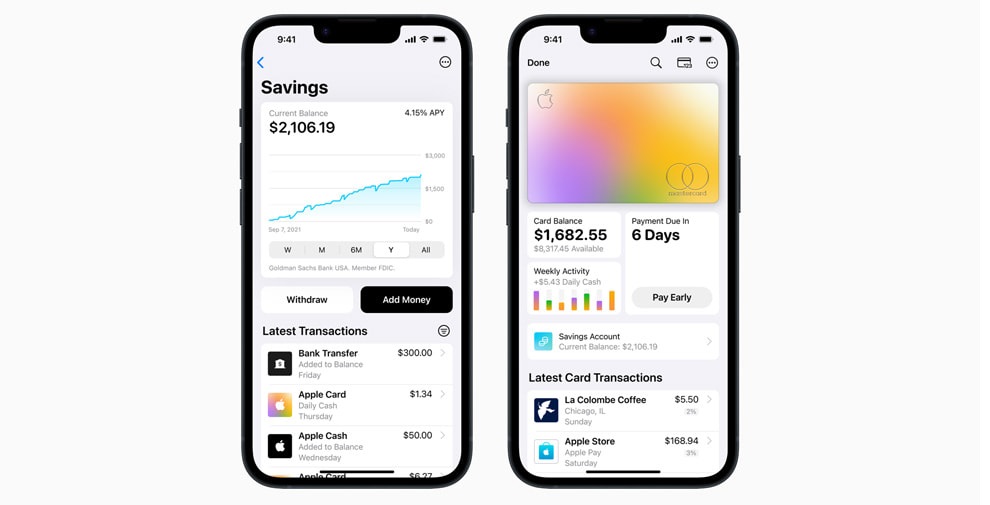

Once a Savings account is set up, all future Daily Cash earned by the user will be automatically deposited into the account. The Daily Cash destination can also be changed at any time, and there’s no limit on how much Daily Cash users can earn. To build on their savings even further, users can deposit additional funds into their Savings account through a linked bank account, or from their Apple Cash balance.

Users will also have access to an easy-to-use Savings dashboard in Wallet, where they can conveniently track their account balance and interest earned over time. Users can also withdraw funds at any time through the Savings dashboard by transferring them to a linked bank account or to their Apple Cash card, with no fees.4

The new Savings account from Goldman Sachs builds upon the financial health benefits that Apple Card already offers, with absolutely no fees,5 Daily Cash on every purchase, and tools that encourage users to pay less Apple Card interest — all, while offering the privacy and security users expect from Apple.

_____________

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: