The Bank for International Settlements (BIS) and the central banks of Israel, Norway and Sweden have concluded Project Icebreaker, which studied the potential benefits and challenges of using retail central bank digital currencies (CBDC) in international payments. The subject will be discussed at Banking 4.0.

A collaboration between the BIS Innovation Hub Nordic Centre, Bank of Israel, Norges Bank, and Sveriges Riksbank, the project tested the technical feasibility of conducting cross-border and cross-currency transactions between different experimental retail CBDC systems.

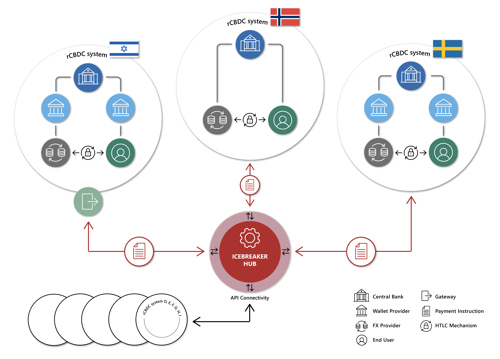

As detailed in the report [link], Project Icebreaker sets out to explore a specific way to interlink domestic systems (a so-called hub-and-spoke solution). A cross-border transaction is broken down into two domestic payments, facilitated by a foreign exchange provider active in both domestic systems. Therefore, retail CBDCs never need to leave their own systems.

In most existing cross-border payment systems, the payer has no choice regarding the exchange rate, as it has no control on who the provider of foreign exchange conversion is. In the model developed by the Icebreaker project, many foreign exchange providers can submit quotes to the system’s hub, which automatically selects the cheaper one for the end user.

This competitive set-up mitigates the risk of insufficient liquidity in the desired currency pair, which can drive fees up and even delay the transaction. The Icebreaker system implements the use of bridge currencies if transactions between two specific end currencies are unavailable, or not favourable, promoting competition among foreign exchange providers.

„The project also demonstrated that the hub-and-spoke model can reduce settlement and counterparty risk by using coordinated payments in central bank money; and complete cross-border transactions within seconds. For countries considering the development of a domestic CBDC, the project provides a model for extending them and innovative services into cross-border transactions.” – according to the press release.

For central banks contemplating the implementation of retail CBDCs, the outcome of Project Icebreaker provides deeper understanding of the technologies that can be used and the technical and policy choices available. The project presupposes very minimum technical requirements so as to be able to integrate domestic systems running on different technologies (as was the case with the proofs-of-concept used by the three central banks), thus promoting scalability, interoperability and simplicity.

Cecilia Skingsley, Head of the BIS Innovation Hub: “Project Icebreaker is really unique in its proposition. It first allows central banks to have almost full autonomy in designing a domestic retail CBDC. Then it provides a model for that same CBDC to be used for international payments.”

Andrew Abir, Deputy Governor, Bank of Israel: “If Israel is to issue a digital shekel, it would be very important that we do it according to the evolving global standards, so that Israelis could use it also for efficient and accessible cross border payments. While there is still much work ahead of us for the Icebreaker model to become a global standard, the learnings from this successful project have been very important for us and for the central banking community.”

Torbjørn Hægeland, Executive director for Financial Stability, Norges Bank: “We are delighted to have been part of one of the first experimental tests of cross-border retail CBDC payments, together with our partners the BIS Innovation Hub, Sveriges Riksbank and Bank of Israel. This project contributes to the important global effort to improve cross-border payments. In addition, it has added significant value to Norges Bank’s experimental test of a domestic system for retail CBDC payments.„

Aino Bunge, Deputy Governor, Sveriges Riksbank: “Although domestic payments have become less expensive, safer and more efficient, payments across currencies are still associated with high costs, slow speed and risk.

When exploring CBDCs it is important to include cross currency opportunities from the start. Project Icebreaker is an interesting project that shows how different CBDC solutions in different countries could enable instant cross currency transactions in a way that would greatly benefit the end users. The project has also been a great example of collaboration and sharing of knowledge between the participating central banks and BIS. Although there are a lot of questions that need to be investigated further, Icebreaker is an interesting initiative and contribution to the discussion on how we can improve cross currency payments.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: