There’s no doubt that ISO 20022 provides financial institutions access to richer and more secure data, but when considering a global adoption of the standard, it’s important to consider how it could impact future innovation in the space.

article written by Peter Klein, co-founder and CTO of FinLync

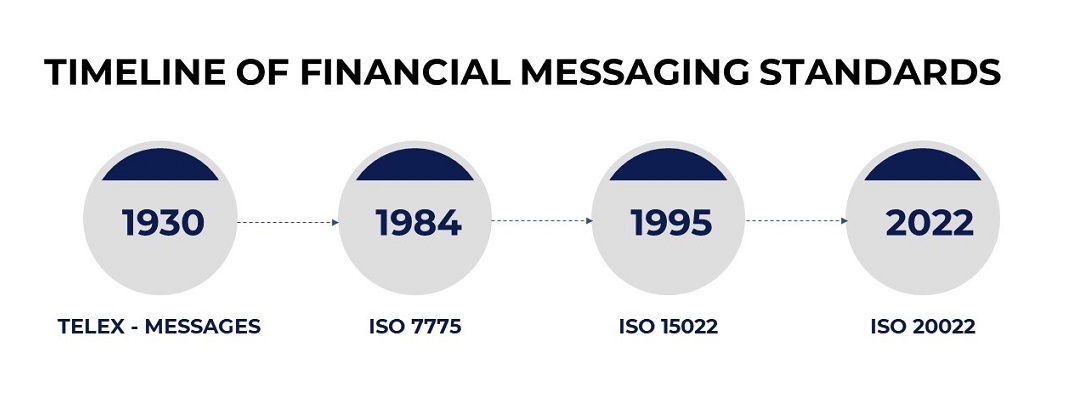

ISO 20022, developed by the International Organization for Standardization (ISO), is the open global standard for financial information. First introduced to financial institutions in 2004, the ISO 20022 standard covers financial information sent back and forth between financial institutions and corporates, including payment transactions, securities trading, credit and debit card transactions and other financial information. This is intended to give financial institutions consistent data that can be used in any kind of financial business transaction.

Although the standard has been around for nearly 20 years, interest in ISO 20022 has picked up in recent months. Financial messaging network provider SWIFT has committed to fully adopting ISO 20022 for some messages by November 2025 and is urging all financial institutions to adopt the standard for cross-border payments. Some analysts estimate that by 2025, 80% of global, high-value payments by volume will be processed through ISO 20022. If, in fact, the standard is broadly adopted on a global scale, ISO 20022 has a chance to radically transform cross-border transactions, which have historically faced security and quality data issues due to an overreliance on legacy technology.

In theory, defining global industry messaging standards should help financial institutions achieve system interoperability across all parties in the value chain. Furthermore, collaboration among participants should also help to drive richer data that improves overall value to the data consumer applications. However, creating a strict industry standard that’s formatted and defined in a way that every party must agree on first has its downsides. It’s also important to consider the full implications of what the payments world would look like if ISO 20022 is universally adopted.

In reality, when looking at a potential global adoption of ISO 20022, it’s important to note that all parties involved must formally agree and comply with political and often complex technology constraints. This means that counterparties will likely need to sacrifice both their time and, more importantly, competitive advantages to comply with adoption. Perhaps the biggest concern facing financial institutions considering adopting ISO 20022 is that it could slow down innovation in the space, ultimately impeding opportunities for new solutions for end corporate users.

One of the most prominent goals of global ISO 20022 adoption is a “harmonization” with international payment systems. However, it’s important to note that these resulting so-called harmonized systems aren’t actually fully harmonized nor optimized due to participants not agreeing and not being able to adapt themselves using their own technology. As a result, unneeded complex messages with duplicated data requirements and structures are created, which are hard to follow and understand. The irony is that in some cases, this can make adoption even more challenging for the data consumer than using the original proprietary standards.

What, then, are the alternatives that financial institutions should consider when debating whether to adopt ISO 20022? In most cases, the latest data aggregators and embedded apps can expedite the process and reduce the initial burden of harmonizing industry standards. Banks would then be able to create their own proprietary messaging standards and have data aggregators take on the labor-intensive work to ensure seamless interoperability with other parties and the consumer applications.

The full article here

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: