The Polish payment landscape is characterised both by traditional practices such as cash, which remains one of the dominant methods of payment, and by innovation and digital payments. The European Payments council interviewed Bartłomiej Nocoń, Head of Digital Banking and Payments at the Polish Bank Association (ZBP) to explore the status quo in more detail.

Blik – the Polish mobile payments system

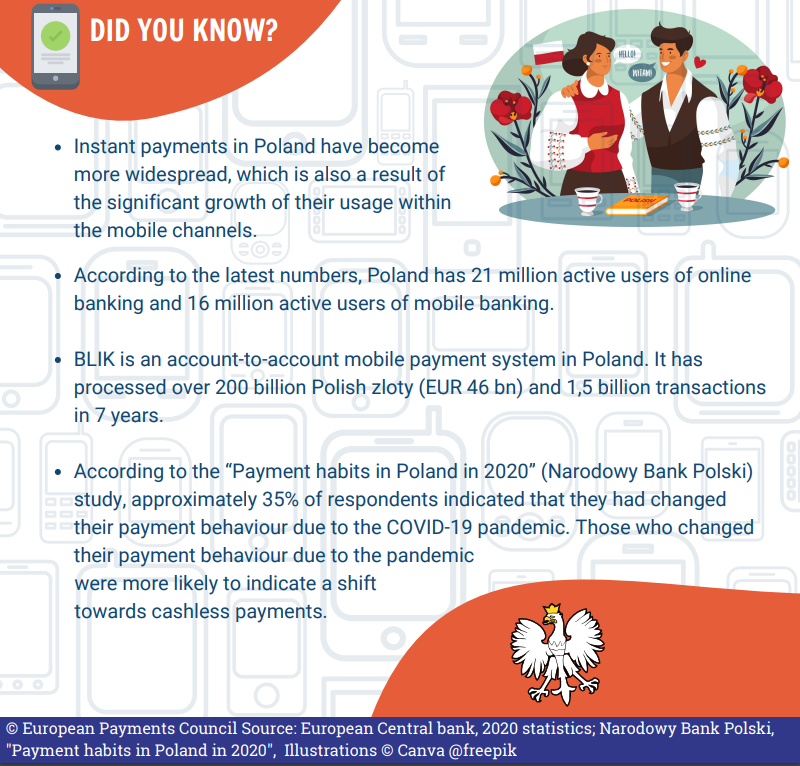

There are 21 million active digital banking users logging into the remote channels, of which 16 million also use mobile apps and ten million use BLIK, the Polish mobile payments system.

BLIK is currently the most popular mobile payment method in Poland. The system is used mostly for e-commerce transactions, but its latest improvement, BLIK Contactless, allows users to pay at point-of-sales.

The idea of creating a mobile payment solution arose from a joint venture between the six largest Polish banks in 2015. Last year, Mastercard joined the initiative as a stakeholder.

„At the very beginning, BLIK was considered an “exotic” payment solution for young and digital users, but thanks to the excellent UX, great communication with the market and the ability to adapt to e-commerce trends that arose in Poland, BLIK has rapidly expanded its portfolio of users. The numbers speak for BLIK: in QI 2022 this payment method was used by over ten million users.

BLIK’s user experience is one of its biggest advantages. The payment initiation process requires the typing of a six-digit one-time password (OTP) on the merchant paywall. This OTP is generated on the user’s bank’s mobile app and expires after two minutes. The whole process is simple, fast, and, most importantly, safe! We expect in the near future that BLIK will “Go Europe” and be ready for mobile payments in euros quite soon.”

Instant payments

At the beginning of 2020, the first Polish payment service provider (PSP) adhered to the SEPA Instant Credit Transfer (SCT Inst) scheme.

Now, instant payments in Poland are becoming more and more popular, which is also a result of the significant growth in their usage within the mobile channels.

PSPs in Poland can send euro payments via a batch-based SEPA-compliant solution called Euro Elixir, which covers many use cases for cross-border euro payments and thus is treated as the main SEPA payments channel in Poland.

„Our domestic (Polish złoty- or PLN-based) instant payments system, Express Elixir, is doubling its transactions each year (roughly a hundred percent growth) and reached 19.5 million transactions in June 2022 (which is 10.73 percent of transactions in the Elixir system – the main retail payment system in Poland – in June).”

Read the article in full here

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: