An ABI Research study sponsored by the Near Field Communication (NFC) Forum revealed that 85% of consumer respondents, who were surveyed across nine countries (United States, China, Japan, South Korea, United Kingdom, Spain, France, Germany and Italy), have used an NFC contactless card or mobile payment wallet, while contactless payment card usage has increased by 30% over the last two years.

View a summary of the study results here.

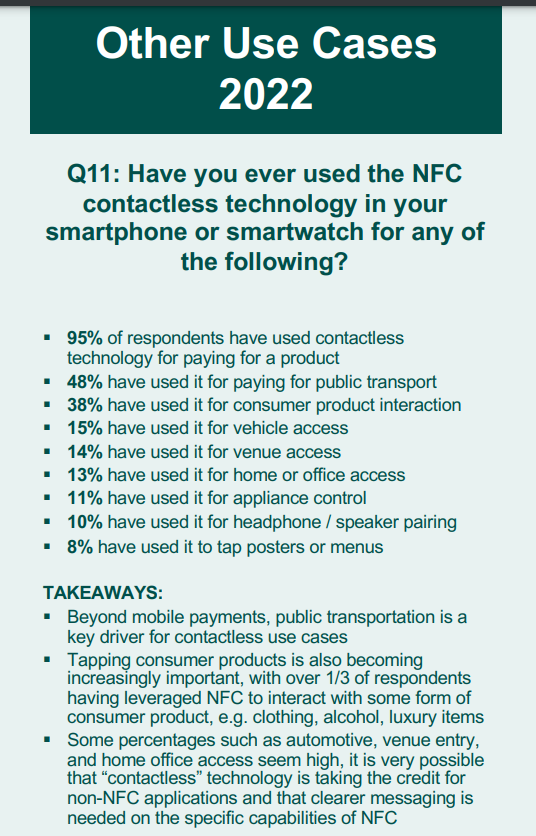

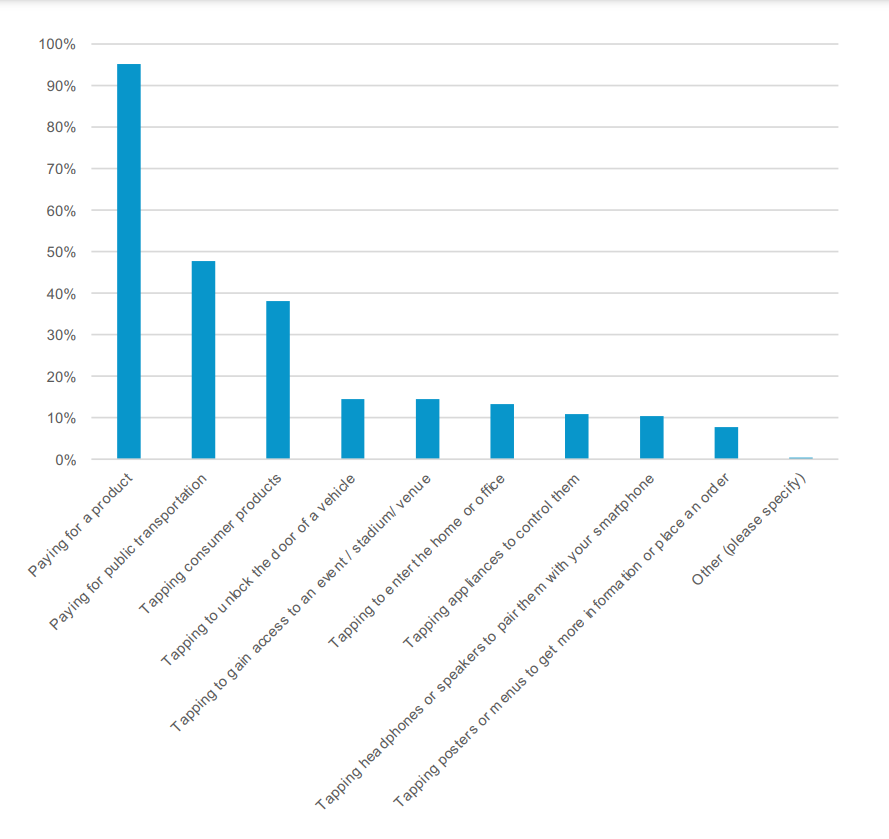

This increase was fueled by NFC’s contactless capability and concerns around the COVID-19 pandemic, along with the continued growth in wearables, smartwatch, and mobile phone users. In addition, the data uncovered a trend, with 95% of respondents having used NFC contactless technology to pay for a product in the last year. This includes data showing nearly halfof consumershaving used NFC to pay for public transport and over a thirdhave used NFC for consumer product interaction on products such as clothing, alcohol or luxury items. One of many interesting regional differences was that virtually every South Korean surveyed used NFC technology every day.

“Impressive NFC wallet usage was complimented by high user satisfaction levels, safety and security confidence, and improved familiarity with NFC,” said Andrew Zignani, Research Director, ABI Research. “On average, 85% of respondents had used contactless technology, representing usage growth of 30% for contactless card usage when compared to 2020 survey results. Apple Pay and Samsung Pay also recorded impressive usage growth, with a 37% and 35% increase in uptake for their respective solutions.”

Metodology

The survey’s first question asked respondents if they had used a contactless payment card or mobile wallet, such as Apple Pay, Google Pay, and Samsung Pay, among others. For those respondents who had not used either of these options, the survey was terminated. This meant that only respondents who have used contactless technology were included in the survey results.

The survey had 2,620 respondents across the following countries and regions, covering a variety of age ranges:

United States: 509, China: 505, Japan: 504, South Korea: 505, United Kingdom: 124, Spain: 116, France: 121, Germany: 118 and Italy: 118.

18 to 24: 366 (14%), 25 to 34: 787 (30%), 35 to 44: 804 (30%), 45 to 54: 429 (16%), 55 to 64: 173 (7%), 65 to 74: 41 (2%), 75 and over: 20 (1%)

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: