Economist Intelligence Unit has now developed a new dataset, along with five-year forecasts, confirming these trends. The new white paper offers an overview of EIU forecasts for digital payments, as well as the accompanying stagnation of ATM numbers and the mixed outlook for card payments. It also looks at the new frontier for disruption: cross-border payments.

Key forecasts

. Following a surge during the pandemic, when lockdowns forced consumers online, growth in digital payments will soften during our five-year forecast period (2022-26).

. The number of ATMs will stagnate or decline, while debit and credit cards will struggle to maintain market share as mobile payment platforms gain more traction.

. While digital disruption to domestic payments continues, the ongoing Russia-Ukraine war will cause parallel disruption to cross-border payment systems.

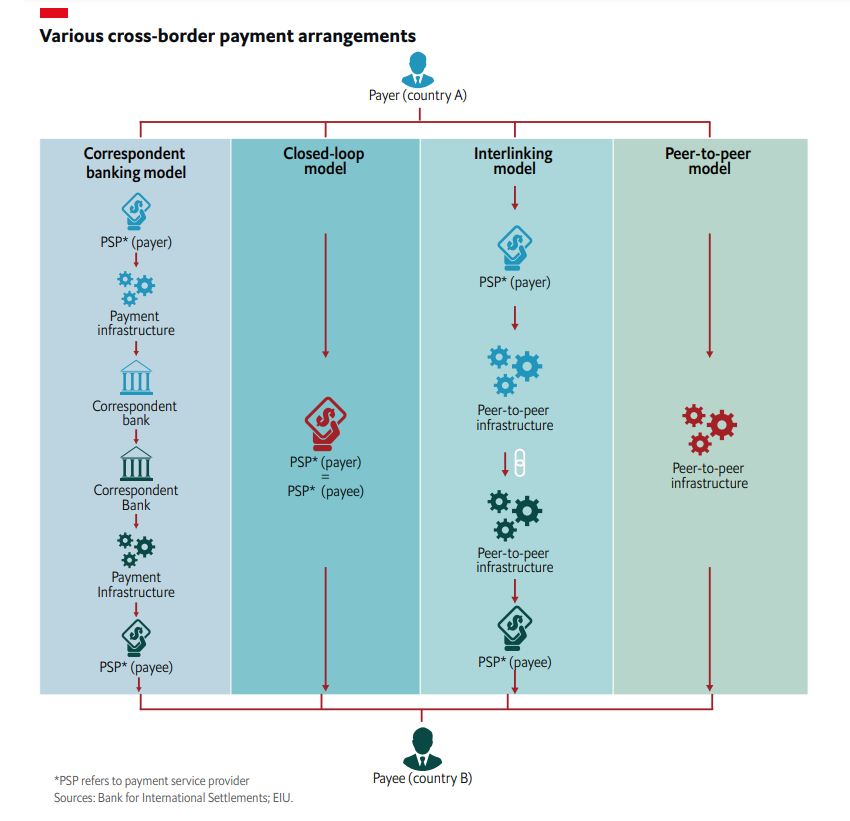

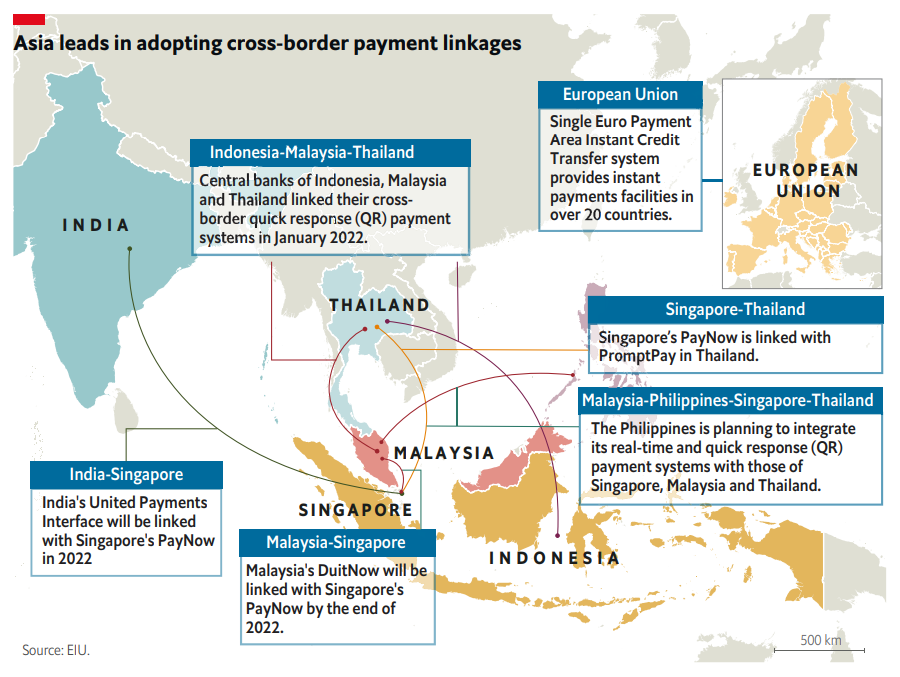

. Countries will seek to interlink their national fast-payments systems, reducing intermediaries and bringing down the cost of sending money abroad.

. Countries across Southeast Asia are in the process of interlinking their fast-payments systems to allow travellers across the region to purchase goods and services by scanning quick-response (QR) codes.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: