More than a decade into the digital revolution, the majority of Britons still feel more comfortable with the option to pay by cash or card, though digital wallets and other “alt” payment methods are making inroads into card and cash use, according to The UK Payments in Transition to Digital survey.

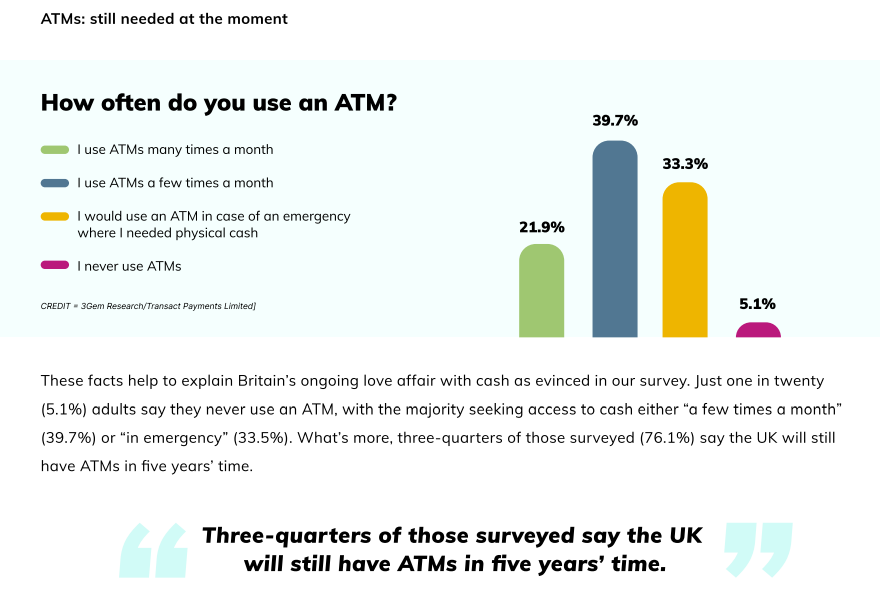

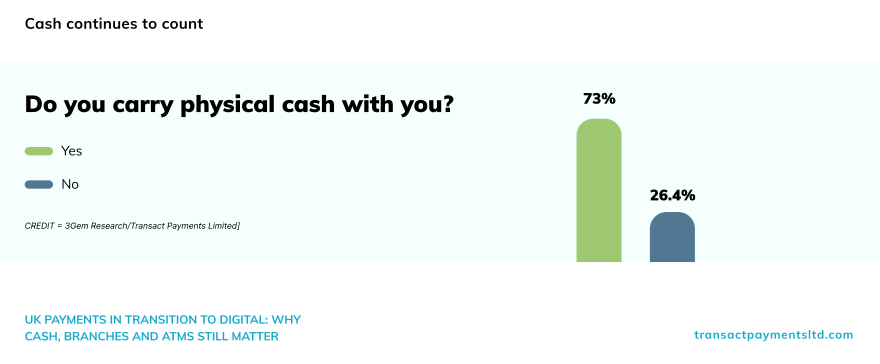

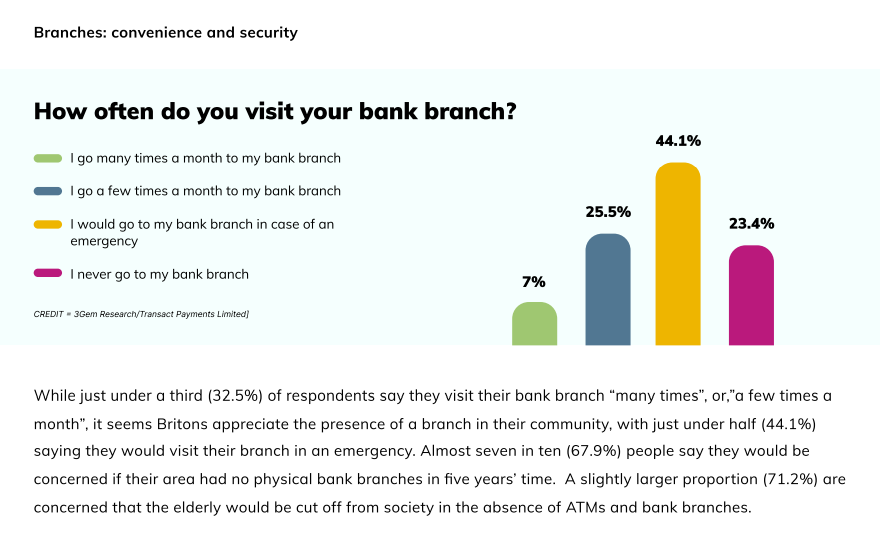

UK consumers still use ATMs and bank branches and want to see them as part of the fabric of society, though in the latter case Britons prefer the option of a branch network for emergencies, occasional use and as security for elderly or vulnerable consumers.

While there are regional differences in these findings, perhaps the most pronounced difference unveiled by the research is the gap between young people’s attitudes and that of older generations. Around two-thirds of the 18-34 generation trust digital wallets and use them, while fewer than one in five of those aged over 55 either trust or use wallets. Proportionally, older consumers are set to form a larger part of the UK population in the decades ahead.

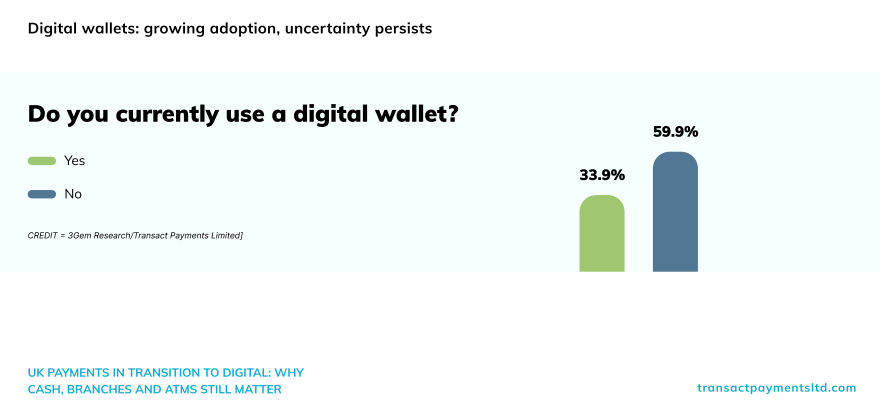

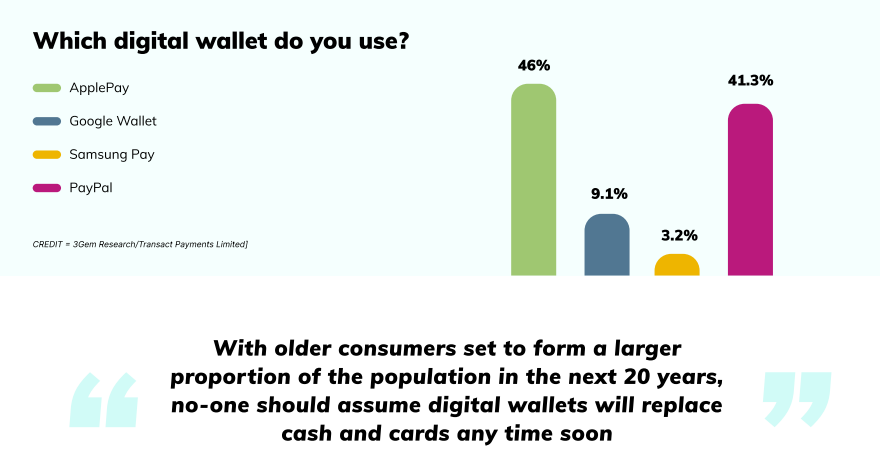

Just over a third of Britons (34%) currently use digital wallets. However, there is a significant generational divide in wallet use, with almost two-thirds (64.3%) of the 18-34 generation using digital wallets, compared to just 18.3% of the 54-65 age bracket and even fewer over 65s. Most users opt either for ApplePay or PayPal as their provider, with ApplePay the most popular solution among younger consumers.

However, only one in five (20%) of respondent said they had either complete, or, “a very high level” of trust in digital wallets, while 34% said they had little or no trust in this payment method. Tellingly, more than a fifth of Britons said they were unsure about digital wallets as a concept.

Again, this result was subject to a generational divide, with around two-thirds of adults under 35 expressing confidence in digital wallets as a payment method – and similar proportions of those aged 55 and above showing low levels of trust. With older consumers set to form a larger proportion of the population across all European markets in the next 20 years, no-one should assume digital wallets will completely replace cash and cards any time soon.

Future will include a significant role for both cash and payment cards

While banks, merchants and payment service providers must prepare for a future with a wide range of payment methods, that future is going to include a significant role for both cash and payment cards.

The authors of the report said: „We anticipate a near-term future (5-10 years, possibly longer) in which cash and cards retain their i:portance in the payments mix. Meanwhile, those engaged in payments should also prepare for a landscape in which digital wallets, account-to-account payments, crypto and other methods also play an important role. Consumers will expect to be able to pay with all of these methods and more, both in-person and online, domestically and across borders, and payments players should be ready for this scenario.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: