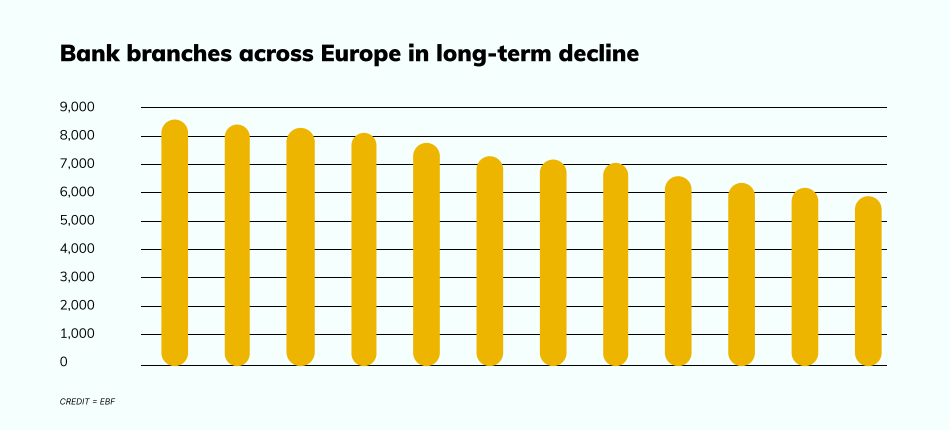

European Banking Federation: some 10,000 bank branches closed during 2021 – the fastest rate of decline since 2007

If ATM use is in decline, then bank branches are disappearing at a faster rate, says Transact Payments in thei latest report called „Why cash, branches and ATMs still matter”. According to the European Banking Federation, the number of bank branches across the continent declined at a faster rate in 2021 than at any time since 2007, with some 10,000 branches closed during the course of the year. The EBF claims some 75,000 branches have been lost since 2008.

While there’s no doubting the many advantages of electronic payment, we are beginning to see a wave of legislative measures across Europe designed to secure access to cash for the elderly and vulnerable populations.

In 2019, Norway became the first country in the world3 to enshrine the right to pay with cash in legislation. In January 2021, Sweden followed suit with legislation specifying the requirement for banks and credit unions to offer cash services through branches and ATMs throughout the country.

Most recently, the May 2022 Queens’ Speech in the UK Parliament5 announced legislation that would guarantee the right to pay in cash and access to ATMs and branches throughout the country.

Banks and Payment Service Providers should expect such legislation to appear across Europe in the years ahead. As we’ll see, the combination of continued cash use and consumer preference for card payment has significant implications for payment strategies over the next 5-10 years.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: