In an interview with The Paypers, Antony Welfare from Ripple highlights the role of key blockchain use cases like payments and DeFi and the token types in transforming the future of money

Some see stablecoins as boosting the settlement function of cross-border payments. How are stablecoins reimagining the banks’ infrastructure?

„From my perspective, stablecoins are a critical part of the new payment system. (…) Once a stablecoin is in use by a country, it can facilitate quick B2B, P2P and other types of payments for business and citizens. It can then be used to quickly settle cross-border payments – assuming the receiving country accepts your stablecoin.„

„Assuming the stablecoin is based on a payment focussed DLT, such are the XRP Ledger, you can then utilise the built-in speed and near-instant settlement that these ledgers bring. No current system is anywhere close to settling transactions – WITH finality – in the seconds it takes on the XRP ledger. This is where the transformation and innovation begin. Once you can use stablecoins and CBDCs to make quick and small transactions, you open the country to significant new opportunities and innovations.„

Lack of clarity on the Central Bank’s digital currency

Ripple has several pilots in the progress for CBDCs, including the Royal Monetary Authority (RMA) of Bhutan and the Republic of Palau. And it could be much more, but „there is no consensus on what a CBDC is and what it will / can be used for.”

„To me, the whole concept of a CBDC is still ‘under-defined’ – after working with Central Banks and the financial sector for a while, my personal view is that there is a lot of misunderstanding of what a CBDC is – which makes sense as CBDCs are not really defined yet – what I mean is there is no consensus of what a CBDC is and what it will/can be used for.„

„In my view, a CBDC is ‘a digital currency, issued by a central bank/sovereign nation’ – its use is to simplify the payments systems for a country. This means it should be able to be used by all people and have the same access and value for all. It should be used for all types of transactions (commercial and retail – using existing terminology).

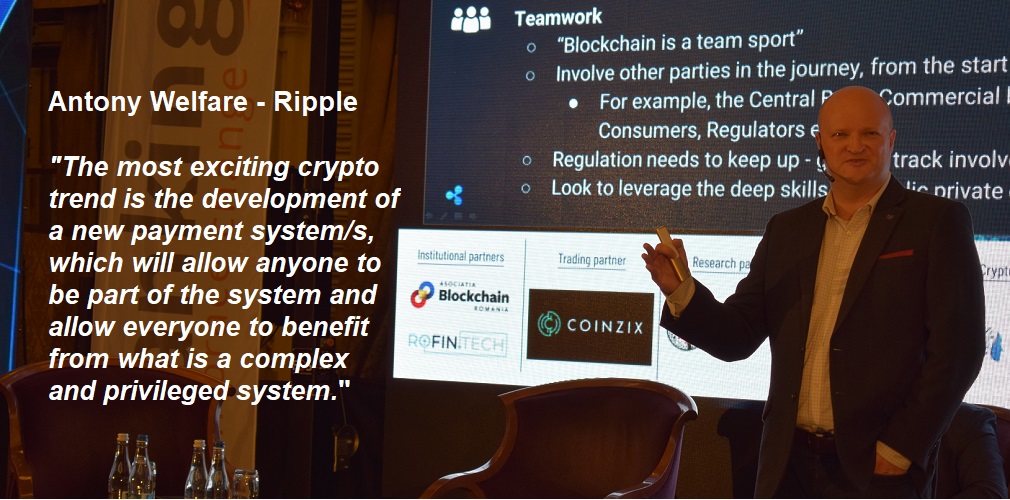

What are the trends in crypto that you are personally excited about?

„The most exciting crypto trend is the development of a new payment system/s, which will allow anyone to be part of the system and allow everyone to benefit from what is a complex and privileged system. Once we enable micro-payments, we can pay fractions of money to creative people, to authors to artists – small amounts for one person becomes a worthwhile career for a budding artist.

Imagine, your favourite athlete with NFTs of them training, or competing, and sold to you as a fan and student of theirs – they can continue to build their career, and you can enjoy their career and learn from it, whilst owning an asset from them.„

The full interview here

____________

Antony Welfare is Senior Advisor, CBDC Europe and Global Partnerships, at Ripple. Antony has over 25 years’ experience in Retail and Consumer tech, followed by nearly a decade in blockchain technology. He is dedicated to building a world-class partner ecosystem to support the growth of Ripple’s connected CBDC platform through CBDC engagements in Europe and developing global partnerships.

Antony co-founded the Retail Blockchain Consortium alongside University College London’s (UCL) Centre for Blockchain Technology, Oracle and MonoChain, to drive blockchain adoption across the retail value chain, and is the author of ‘Commercializing Blockchain: Strategic Applications in the Real World’, which was published in 2019 by Wiley.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: