Baltic fintech Paysera is to halt transfers to and from Russia and close accounts of Russian clients in a show of solidarity with Ukraine as it comes under siege from Russian armed forces. The company encourages other financial institutions to stand in solidarity with Ukraine and suspend operations related to Russia.

Paysera, one of the largest and longest-running financial technology companies in the Baltic States, shows solidarity with Ukraine while also reducing risks in the Russian market. The company will no longer process transactions in Russian roubles, close its Russian clients’ accounts, and restrict money transfers to and from Russian banks.

The restrictions on financial transactions will mostly affect Russian residents since the accounts of legal entities will be closed. Accounts of private individuals will be closed if the individual does not have the right to reside in another country deemed acceptable by the company’s policy.

In addition, transactions in Russian roubles will be terminated. Furthermore, transfers to all Russian or Belarusian banks have been terminated for all customers if the recipient is a Russian or Belarusian company.

Companies that are registered outside Russia but whose main shareholders are Russian citizens (without the right to reside in one of the countries acceptable to the company) will not be able to stay as the company’s clients.

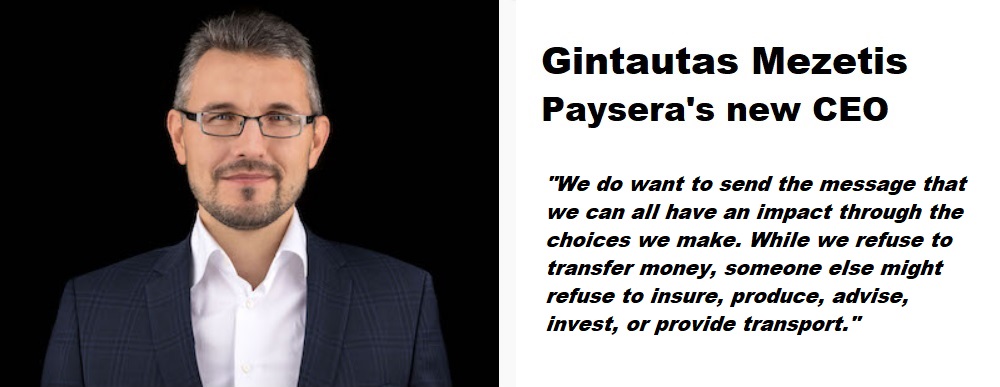

„The EU sanctions imposed on Russian banks on February 22 are a compromise, intended to be approved by all EU member states. We stand in solidarity with the Ukrainians and will no longer process nearly all transactions related to Russia. While we understand that we are not a giant in the financial market, we do want to send the message that we can all have an impact through the choices we make. While we refuse to transfer money, someone else might refuse to insure, produce, advise, invest, or provide transport,” says Gintautas Mežetis, CEO of Paysera.

He explains that by imposing restrictions on Russia-related operations, the company is also reducing operational risk.

„Although we cannot impose sanctions, we do have the right to choose which clients we find acceptable and the extent of services we want to provide to them. It is not enough to impose sanctions only on the decision-makers. There are many people driving tanks and contributing to the occupation of Ukraine who we are unable to identify. Russian citizens are partly responsible for the existing government and its decisions, just as Belarusian citizens are partly responsible for the Belarusian government and its decisions,” says the CEO of Paysera.

Clients will be notified of the restrictions on transactions in the coming days. Under the company’s agreement with its clients, a 60-day notice period is required before implementing the restrictions.

According to G. Mežetis, it is possible that in the next month or two, the EU and the US will impose stricter sanctions on Russia’s financial sector than those introduced on February 22. In this case, Paysera would implement the EU or US sanctions immediately instead of having to comply with the notice period, in line with the applicable legal requirements.

Paysera restrictions on money transactions linked to Russia:

1. Russian citizens will no longer be able to use Paysera accounts (the restriction does not apply to Russian citizens who have a residence permit in another country acceptable to the company). Existing accounts will be closed following the contractual notice period.

2. Russian and Belarusian companies will not be able to use Paysera accounts. All existing accounts will be closed.

3. All Paysera clients will not be able to transfer money in all currencies to Russian and Belarusian banks if the recipient is a legal entity. Nor will they be able to receive transfers from them (transfers between natural persons who are not sanctioned will not be restricted for the time being but will be subject to more frequent and thorough checks on their origin and destination).

4. Currency exchange to Russian Roubles (RUB) will no longer be available for Paysera clients. However, it will be possible to exchange (sell) existing roubles.

5. Money transfers to and from WebMoney (a Russian-owned electronic payment system) have already been suspended.

6. No new accounts will be opened for legal clients whose main shareholders do not have a residence permit in a country accepted by the company.

_____________

Paysera LT is a Lithuanian fintech company founded in 2004 in Vilnius. Last year, customers transferred 6.5 billion EUR via the Paysera app and online banking, 38% more than the previous year. The company is one of the largest non-banking payment operators in the Baltics, providing payment gateway services to 13,000 e-shops in different countries.

Paysera offers payment collection by cards, through banks, fintech companies, and international payment systems in 20 European countries. Historically, the company is the first e-money institution in Lithuania, having received its license in 2012.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: